The taxation began in the in 1983. It was part of the recommendation of the Reagan (and Skip O'Neil ) bipartisan social security reform, not a democrat proposal. The democrat minority recommended ss tax increases that would have carried the ss trust fund well beyond its exhaustion date.The Democrats significantly cut Social Security benefits in the early 90’s. Except they didn’t call it a cut, they taxed the benefits. The end result was moving Social Security trust funds into the general fund of the US treasury through our individual tax returns. The Social Security trust fund saved no money with this cut. Given our progressive rates, and income floor where no taxes are levied, the taxes on Social Security benefits introduces means testing into the system. Of course, the politicians were and are dishonest about what they have done with Social Security.

Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2/3+ of Americans favor 2% wealth tax!

- Thread starter toastedbread

- Start date

Those IOUs are US government bon ds, the world gold standard for investments. To call them IOUs is silly.So true since we really don't have any SS funds.... nothing to transfer except a bunch of IOUs.

The question is would it be better for low income workers. SSs goal is to lessen poverty in old age. To do so it transfers funds from the middle class to the poor. It is not designed to be a good retirement plan for high income groups, and for them--me included--it is a fairly burdensome tax. I was happy to pay it to benefit the less fortunate in our society. Note too that it is inflation indexed. This is a very important feature for the poor. And while you downplay market risks, exchange trade funds took a grave hit in the last downturn. A worker w/ an annual income (for social security calculation) of $25000 would receive circa $15,000 (probably closer tp $13000) in her 1st year. I have not checked the calculation break points recently so I cannot give an exact number. I would like to see numbers that taking into account inflation and market risk that would put such a worker in as good a situation.Not that much of a risk if they let everyone into the Thrift Savings Plan that federal government workers and military invest in. Everyone should read up on it as I’ve recommended many times. A SS system built around that would be good for nearly everyone.

Last edited:

You were tipped off on those penny stocks? Otherwise geesh man.

Are you really a CPA? Everyone knows that real CPAs only drive used corollas!

I received a tip. First one worked and second didn’t.

Couldn’t be typical CPA when I started my business at 25. Had to have personality to get out and grow business. My junior partner right now is one of those quite guys. When this rainmaker retires, he’s going to have rude awakening.

As for cars I was dirt poor most of my youth. When I could I wanted nice cars. Now a Ford Explorer is fine. Lol. They all have to be IU red.

Last edited:

That's not quite true.... they were downgraded a few years ago. And just think about it like this.... you paid a SS tax so people could get social security in the future and since they've spent all the money that we paid in they eventually they will have to raise taxes to pay off those IOUs (or cut benefits) so you'll be paying for your SS again. They already cut benefits when they started taxing benefits.Those IOUs are US government bon ds, the world gold standard for investments. To call them IOUs is silly.

End now between paying taxes on my SS and my Medicare premium I won't get more than 60% of my benefit next year.

"NPT, post: 2821991, member: 410"]That's not quite true.... they were downgraded a few years ago. And just think about it like this.... you paid a SS tax so people could get social security in the future and since they've spent all the money that we paid in they eventually they will have to raise taxes to pay off those IOUs (or cut benefits) so you'll be paying for your SS again. They already cut benefits when they started taxing benefits.That's not quite true.... they were downgraded a few years ago. And just think about it like this.... you paid a SS tax so people could get social security in the future and since they've spent all the money that we paid in they eventually they will have to raise taxes to pay off those IOUs (or cut benefits) so you'll be paying for your SS again. They already cut benefits when they started taxing benefits.

End now between paying taxes on my SS and my Medicare premium I won't get more than 60% of my benefit next year.

End now between paying taxes on my SS and my Medicare premium I won't get more than 60% of my benefit next year.[/QUOTE]

That's not quite true.... they were downgraded a few years ago. And just think about it like this.... you paid a SS tax so people could get social security in the future and since they've spent all the money that we paid in they eventually they will have to raise taxes to pay off those IOUs (or cut benefits) so you'll be paying for your SS again. They already cut benefits when they started taxing benefits.

End now between paying taxes on my SS and my Medicare premium I won't get more than 60% of my benefit next year.

Last edited:

That's not quite true.... they were downgraded a few years ago. And just think about it like this.... you paid a SS tax so people could get social security in the future and since they've spent all the money that we paid in they eventually they will have to raise taxes to pay off those IOUs (or cut benefits) so you'll be paying for your SS again. They already cut benefits when they started taxing benefits.

End now between paying taxes on my SS and my Medicare premium I won't get more than 60% of my benefit next year.

That's not quite true.... they were downgraded a few years ago. And just think about it like this.... you paid a SS tax so people could get social security in the future and since they've spent all the money that we paid in they eventually they will have to raise taxes to pay off those IOUs (or cut benefits) so you'll be paying for your SS again. They already cut benefits when they started taxing benefits.

End now between paying taxes on my SS and my Medicare premium I won't get more than 60% of my benefit next year.

Last edited:

While I agree with you regarding farm land being a very good investment. You have a couple of Boyd's that have artificially inflated the price of farm ground in your county.I made couple really stupid mistakes in my early 30s. I hit really big on couple tech stocks and a penny stock that went from $10,000 to $145,000 in less than 20 days. Only played 2 penny stocks my entire life. Second one wasn’t good. My wife got new pool and Escalade out of my hits. She didn’t have to give them back when I got my ass kicked with Enron and a few others. LOL. Learned my lesson and stayed mostly in mutual funds except for few individual stocks since then. Have done really well with Apple but rest hit and miss. Wish I would diversified into farm land and didn’t. Farm Land now selling for $10,000-$15,000 per acre in our county. If I had followed my fathers 8th grade educated advice I wouldn’t be here at the office today.

While I agree with you regarding farm land being a very good investment. You have a couple of Boyd's that have artificially inflated the price of farm ground in your county.

More than the Boyd’s. The Amish in our area inflated prices long before the Boyd’s. It’s really gotten crazy. The numbers don’t support much more than $3,000 to maybe $5,000 per acre. People like the Boyds are starting to get their average price of Land way too high IMO. I tell my landlords they’re crazy to accept $200-$300 per acre cash rent when their property is worth $10,000-$15,000 per acre.

Back when my dad was pushing me to buy land, I would have had to borrow the money and farming didn’t necessarily make the mortgage payment. I was just starting in business and I wasn’t exactly sure when my next paycheck might come. Turns out, business was good and I could have made the payments. At the time I wasn’t willing to take the risk.

The income from SS taxes are not enough to pay benefits now. The money I and everyone else paid in that was invested in us bonds is now being used to pay benefits as the bonds bough by SS payment (and the interest on the bonds) are redeemed.

[/QUOTE]"NPT, post: 2821991, member: 410"]That's not quite true.... they were downgraded a few years ago. And just think about it like this.... you paid a SS tax so people could get social security in the future and since they've spent all the money that we paid in they eventually they will have to raise taxes to pay off those IOUs (or cut benefits) so you'll be paying for your SS again. They already cut benefits when they started taxing benefits.

End now between paying taxes on my SS and my Medicare premium I won't get more than 60% of my benefit next year.

While your statement that SS taxes were spent is true, in your context it is misleading. 100% of SS taxes are spent on SS: (a) for administrative expenses, (b) for benefits (70-75% retirement, the balance disability and survivor benefits) and to purchases US government bonds held in the SS trust fund. Those bonds are now being redeemed, and the proceeds used to pay benefits. I do not think this has any effect on taxes. Those bonds are part of the national debt, and the maturing debt is routinely refinanced, including of course the debt to the SS trust fund. The funds from redeeming SS trust fund bonds have been used since circa 2012-13 to pay benefits. This was projected to be so in the report. on the 1983 SS reforms. Circa 2039-40 the SS trust fund will be exhausted and SS will no longer be able to pay full benefits. The SS statute provides for reductions' in benefits.

There are clear solutions. 1st all salaries w/o a maximum should be subject to SS taxes. There is no defense for taxing the middle class to benefit the poor, and not taxing the more affluent and rich. All should bare this burden. (I am personally uncertain about taxing other income for SS purpose, but it is a viable option). 2nd the SS retirement age must be raised, probably to 70. Note that under this solution neither you nor I will pay again., but congress does need to act now.

When you say they cut benefits when they started taxing them, you are correct. It was, however part of the solution adopted in 1983 in response to the then SS crisis' Something like this could recur. As I said waiting to deal w/ the actual problems of SS is a very bad idea, but the ideological barriers to facing all our national problems are overwhelming.

As to your complaint about paying taxes on SS income and on premiums for health insurance. I have little sympathy. If your retirement income were all from sources other than SS you would pay higher taxes, and a lot more for health insurance w/o medicare. That said, we have the same general tax profile and I think I should pay a bit more taxes, so I assume I think you should, too We have national needs that ought to be meet and paid for. Waiting to address them is a bad idea just as not responding to future SS problems is.

I see Yangs' UBI as different. It props up your 'capitalism the force'. Bernie and Liz's M4A is more the political thing. With Yangs' UBI, Capitalism never reaches the point where Marx predicted revolution.

everything is political, as is Yang's UBI just as much so as MFA.

not sure what you're getting at with UBI propping up capitalism the force.

that said, capitalism the force needs no more reinforcing than gravity the force.

that said, UBI only staves off discontent and distention as long as the proceeds are realized by the recipient as incremental gain.

capitalism the force will instantly try to transfer that entire $1,000 mo from the recipient to any non competitive market capitalistic entity that has the power to do so.

ie the electric co, cable/internet co, healthcare, where there is not market competition, and housing, where regardless of how much money is chasing it, the near future inventory of both rental and ownership units remains stagnant, so you would have more money chasing the same inventory, and capitalism the force in housing would instantly try and eat as much of that incremental $1,000 mo as it could.

as would healthcare, all for profit utilities including cable/internet, even non profit utilities, education, and anything else that is essentially a must have, but doesn't face real market competition or isn't scalable to accommodate increased demand, thus you just have more dollars chasing the existing inventory.

on things that aren't scalable or are monopolies, or are duopolies/oligopolies that behave as monopolies, and are essentials for everyone, consumers need protections from capitalism the force, just as we protect ourselves from gravity, as neither force stops exerting itself, ever.

by protections, think price regulation on healthcare, (which requires single negotiator as in Medicare), price regulation on utilities, rent control, increased taxes on non primary homes, etc.

and any and all such controls need protected from capitalism the force purchasing govt for the express reason of usurping any and all consumer protections.

MFA would need the same protections, to keep the healthcare/pharma industry from just buying MFA policy, and upping MFA reimbursement rates to what private insurance rates now are, or more, thus totally undermining any attempt to lower costs.

in the end, all consumer protections and solutions start with eliminating money from govt and term limits. (1 term).

which brings us back to a voter revolt, as an already bought govt can't/won't do so otherwise. (due to capitalism the force).

Farmland is overpriced everywhere. Of course, there aren't many investments that are underpriced, for the reasons we've examined.More than the Boyd’s. The Amish in our area inflated prices long before the Boyd’s. It’s really gotten crazy. The numbers don’t support much more than $3,000 to maybe $5,000 per acre. People like the Boyds are starting to get their average price of Land way too high IMO. I tell my landlords they’re crazy to accept $200-$300 per acre cash rent when their property is worth $10,000-$15,000 per acre.

Back when my dad was pushing me to buy land, I would have had to borrow the money and farming didn’t necessarily make the mortgage payment. I was just starting in business and I wasn’t exactly sure when my next paycheck might come. Turns out, business was good and I could have made the payments. At the time I wasn’t willing to take the risk.

More than the Boyd’s. The Amish in our area inflated prices long before the Boyd’s. It’s really gotten crazy. The numbers don’t support much more than $3,000 to maybe $5,000 per acre. People like the Boyds are starting to get their average price of Land way too high IMO. I tell my landlords they’re crazy to accept $200-$300 per acre cash rent when their property is worth $10,000-$15,000 per acre.

Back when my dad was pushing me to buy land, I would have had to borrow the money and farming didn’t necessarily make the mortgage payment. I was just starting in business and I wasn’t exactly sure when my next paycheck might come. Turns out, business was good and I could have made the payments. At the time I wasn’t willing to take the risk.

That's just pure land speculation then, if the value is not close to being supported by the income it produces.... basically the greater fool theory... not sound investment. The greater fool theory can make one a lot of money, as long as they aren't the last fool.

That's just pure land speculation then, if the value is not close to being supported by the income it produces.... basically the greater fool theory... not sound investment. The greater fool theory can make one a lot of money, as long as they aren't the last fool.

Farmers are notorious for paying crazy prices for land. There’s no economic reason to pay these prices. It’s purely “I want it”. Most banks won’t loan more than $5,000-$6,000 per acre. If you borrow the money to buy at these prices you have to have other collateral.

When I first graduated from IU in early 80s the prices in our county spiked from $1,000-$1,200 per acre to $3,000-$3,500. Banks and Farm Credit Services made money available like candy. Farmers got in financial trouble and land prices crashed. Lending institutions got hammered repossessing land and auctioning off. It remained low for years but now it’s crazy again.

Maybe they could grow tulips.That's just pure land speculation then, if the value is not close to being supported by the income it produces.... basically the greater fool theory... not sound investment. The greater fool theory can make one a lot of money, as long as they aren't the last fool.

Interest rate decreases were a huge variable that made buying farmland such a winner today but who foresaw that coming 30 years ago? Farmland has always been a bit of a boom and bust type of investment. Farmland after WWI in Indiana was over $500 per acre and by the time of the Great Depression it was around $40 per acre if that in some cases. Your decision was sound it’s just that farmland is not the safe investment people believe it to be.More than the Boyd’s. The Amish in our area inflated prices long before the Boyd’s. It’s really gotten crazy. The numbers don’t support much more than $3,000 to maybe $5,000 per acre. People like the Boyds are starting to get their average price of Land way too high IMO. I tell my landlords they’re crazy to accept $200-$300 per acre cash rent when their property is worth $10,000-$15,000 per acre.

Back when my dad was pushing me to buy land, I would have had to borrow the money and farming didn’t necessarily make the mortgage payment. I was just starting in business and I wasn’t exactly sure when my next paycheck might come. Turns out, business was good and I could have made the payments. At the time I wasn’t willing to take the risk.

This is the kind of thinking that drives me crazy. No, I didn't pay SS taxes so people could get SS in the future, I paid it so they could get it in the present. The balance in the trust fund is an anomaly was set up to take care of the bulge that the Boomer generation has/will cause in benefits paid (think of the snake swallowing the mouse), but the architecture of Social Security has no real aspect of "pay now, receive" later for anyone -- it's a scheme for real time, generational wealth transfer.And just think about it like this.... you paid a SS tax so people could get social security in the future and since they've spent all the money...

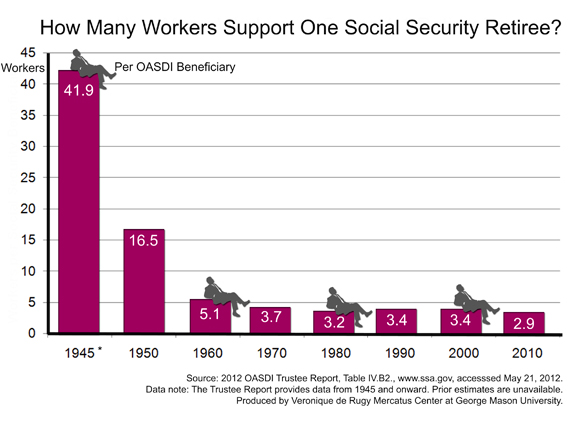

Once us Boomers die off and the system comes back to "equilibrium" (for lack of a better term), the pressure should come off. The trick is going to be getting through until that happens. The Greatest Generation got theirs and made sure they birthed enough babies to pay for it. Us Boomers screwed up by not producing enough workers to support the benefits we have coming.

You're correct, especially if you only take into account current prices and/or people just entering the market. This is an interesting example of many things we have recently discussed, i.e. excessive wealth, low interest rates, and the subjectivity of wealth.That's just pure land speculation then, if the value is not close to being supported by the income it produces.... basically the greater fool theory... not sound investment. The greater fool theory can make one a lot of money, as long as they aren't the last fool.

As Bill pointed out, low interest rates made farmland great investments. Compare what a person received for their money in the early 2000's. You could buy bonds or bank notes with little risk and little return, or you could have bought land that gave you a little better return, but had the added value of appreciation of principal.

Most of the farmland that is being bought today, is being bought by the same people that started buying back then. The farms are paying for themselves and they just keep rolling them over. So while it doesn't seem to be a great investment now, they're playing with the house's money. And so what if it's a little steep? That just increases the value of all the acres they've purchased since 2000. The market could retrace 75% and they still will have come out ahead. (This touches on the subjectivity topic. It only takes two people to raise farm prices for an entire area.)

On a side note: one thing that hasn't been mentioned, is GMO's. That was a little bit of luck with the timing. Seed advancements have allowed a lot of these acres to be more productive than they otherwise would have. Also, the growth in the Chinese markets helped with demand. So several factors lined up just right.

No you pay SS taxes now so you can get SS in the future (I agree that when I was working I paid in SS taxes so other people could get it then). I understand what you're saying but what you get in the future is based on what you pay in when you're working.This is the kind of thinking that drives me crazy. No, I didn't pay SS taxes so people could get SS in the future, I paid it so they could get it in the present.

"Once us Boomers die off and the system comes back to "equilibrium" (for lack of a better term), the pressure should come off."

Have you seen stats supporting this. I've never seen any but I've never looked because I'd just never thought of it that way. Interesting thought.

Farmland is overpriced everywhere. Of course, there aren't many investments that are underpriced, for the reasons we've examined.

How is that possible? Everything cannot be overpriced for long periods of time because pricing (AKA valuation) is what someone is willing to pay for an asset. People have been complaining that equities and bonds have been overpriced for decades. Without a triggering mechanism that causes a dramatic reset (see 2008 Recession), it's hard to buy into that argument.

Valuation is simply a function of supply and demand for assets coupled with future expectations of underlying factors (e.g. inflation). Everything is relative.

Last edited:

That's just pure land speculation then, if the value is not close to being supported by the income it produces.... basically the greater fool theory... not sound investment. The greater fool theory can make one a lot of money, as long as they aren't the last fool.

That's the biggest difference between farmland and single or multi-family housing... farmland produces cash flow. For the majority of those property owners, there are no cash flows, so the greater flow theory is more applicable.

No you pay SS taxes now so you can get SS in the future (I agree that when I was working I paid in SS taxes so other people could get it then). I understand what you're saying but what you get in the future is based on what you pay in when you're working.

"Once us Boomers die off and the system comes back to "equilibrium" (for lack of a better term), the pressure should come off."

Have you seen stats supporting this. I've never seen any but I've never looked because I'd just never thought of it that way. Interesting thought.

Last edited:

That's the biggest difference between farmland and single or multi-family housing... farmland produces cash flow. For the majority of those property owners, there are no cash flows, so the greater flow theory is more applicable.

Yes, farmland generates cash flow but it doesn’t produce cash flow to support $10,000-$15,000 per acre.

Again, it's been sold as a "pay now, receive later" scheme, which implies that it's some kind of investment. That's not the reality. The fact that my benefits are based to an extent on my contributions is just part of the pitch. At its core, at the macro level, it's still nothing more than a generational transfer of wealth.No you pay SS taxes now so you can get SS in the future (I agree that when I was working I paid in SS taxes so other people could get it then). I understand what you're saying but what you get in the future is based on what you pay in when you're working.

No, I don't. And I might be totally off base. It just makes sense to me based on the demographics."Once us Boomers die off and the system comes back to "equilibrium" (for lack of a better term), the pressure should come off."

Have you seen stats supporting this. I've never seen any but I've never looked because I'd just never thought of it that way. Interesting thought.

I agree that everything is relative, but valuations are subjective. For example, the rule of thumb for farmland is that its value is 20 years income. You may not agree that 10k an acre is too much, but you certainly must agree that 20k is, or 30k is. IOW, there must be a point at which the valuation won't cashflow. If your line of thought is true, how can that be?How is that possible? Everything cannot be overpriced for long periods of time because pricing (AKA valuation) is what someone is willing to pay for an asset. People have been complaining that equities and bonds have been overpriced for decades. Without a triggering mechanism that causes a dramatic reset (see 2008 Recession).

Valuation is simply a function of supply and demand for assets coupled with future expectations of underlying factors (e.g. inflation). Everything is relative.

The last person that bought a piece of farmland around here, said he didn't have anywhere to put is money. He thought farmland was his best option. Whether he's right or wrong, it's not hard to imagine that if there is excessive investment(wealth), bubbles can be formed, due to the lack of realized value of the underlying assets. There needs to be balance between investments and consumption. Right now our economy is weighted too heavily towards investments.

Basically I'm defining the bubble. You seem to be saying everything is fine, if you don't count the bubbles???

Yes, farmland generates cash flow but it doesn’t produce cash flow to support $10,000-$15,000 per acre.

I don't know anything about the specific economics and you could be right, but at the very least, it has the potential too (crop price increases, substantial yield improvements, crop switches, etc.).

There is literally no cash flow for a primary residence so you have to bank on an exit being higher than your entry.

I agree that everything is relative, but valuations are subjective. For example, the rule of thumb for farmland is that its value is 20 years income. You may not agree that 10k an acre is too much, but you certainly must agree that 20k is, or 30k is. IOW, there must be a point at which the valuation won't cashflow. If your line of thought is true, how can that be?

The last person that bought a piece of farmland around here, said he didn't have anywhere to put is money. He thought farmland was his best option. Whether he's right or wrong, it's not hard to imagine that if there is excessive investment(wealth), bubbles can be formed, due to the lack of realized value of the underlying assets. There needs to be balance between investments and consumption. Right now our economy is weighted too heavily towards investments.

Basically I'm defining the bubble. You seem to be saying everything is fine, if you don't count the bubbles???

See above. If you accept that there are overvaluations, as some have for several years, you would in theory, short those assets or buy other assets that are underpriced/valued. Short sellers haven't been doing so hot over the past decade because asset prices have been steadily increasing, as you pointed out.

There is certainly an issue too low of a supply of quality, cash flow generating assets and too much demand for those assets, which has caused what you would perceive as mispricings (and I would perceive as market-based valuations) across asset classes. What will change this? Triggers that affect the underlying assumptions of perceived value (interest rates, inflation, growth rates, tax rates and treatment, etc.).

See above. If you accept that there are overvaluations, as some have for several years, you would in theory, short those assets or buy other assets that are underpriced/valued. Short sellers haven't been doing so hot over the past decade because asset prices have been steadily increasing, as you pointed out.

There is certainly an issue too low of a supply of quality, cash flow generating assets and too much demand for those assets, which has caused what you would perceive as mispricings (and I would perceive as market-based valuations) across asset classes. What will change this? Triggers that affect the underlying assumptions of perceived value (interest rates, inflation, growth rates, tax rates and treatment, etc.).

Don't they say that you will run out of money shorting long before the market adjust to accurate reality?

See above. If you accept that there are overvaluations, as some have for several years, you would in theory, short those assets or buy other assets that are underpriced/valued. Short sellers haven't been doing so hot over the past decade because asset prices have been steadily increasing, as you pointed out.

There is certainly an issue too low of a supply of quality, cash flow generating assets and too much demand for those assets, which has caused what you would perceive as mispricings (and I would perceive as market-based valuations) across asset classes. What will change this? Triggers that affect the underlying assumptions of perceived value (interest rates, inflation, growth rates, tax rates and treatment, etc.).

Corn and Soybean futures have been record short for a couple of years now. Farmland has been going through the roof. Both could be right, but it will be hard to thread that needle.

I don't think, "put your money where your mouth is", is a viable argument for the precise reason we're discussing now- which is, "what is the nature of wealth?" If the land across the road sales for 10k an acre, then my land is worth 10k an acre, and I can value it as such on my Income Statement and Balance Sheet. I could use that wealth as collateral, but should I? What happens to that wealth if at the next auction land sells for 4k an acre?

On the other hand I can take that land grow corn, and sell it. That's a form of wealth that's been created, correct? But in this instance, it's realized. I can buy more land, or a combine, or groceries.

Both are wealth, one is concrete and realized, the other is a subjective value placed on something by a couple individuals. Excessive wealth leads to too much of the latter. And it comes at the expense of the former.

Would you bet the farm on how Lindsay Graham feels about Donald Trump in 6 months? I wouldn't either. That's the reason, "put your money where your mouth is" doesn't work. It's too subjective. Knowing there is a bubble is different, than knowing when it will burst.

Well I will agree that it's not a reality now but it could have been if the government had actually put the money away and not spent it because for a long time there was a LOT more going in than was going out. Look at this table do see how we could be sitting on a big pile of money if they had done what they were suppose to..... and those numbers do even allow for what they would have gained if invested even in government bonds.Again, it's been sold as a "pay now, receive later" scheme, which implies that it's some kind of investment. That's not the reality. The fact that my benefits are based to an extent on my contributions is just part of the pitch. At its core, at the macro level, it's still nothing more than a generational transfer of wealth.

Well I will agree that it's not a reality now but it could have been if the government had actually put the money away and not spent it because for a long time there was a LOT more going in than was going out. Look at this table do see how we could be sitting on a big pile of money if they had done what they were suppose to..... and those numbers do even allow for what they would have gained if invested even in government bonds.[

What are you talking about? We have done what we are supposed to do. We have done the same things since the SS act, albeit w/ some possible statotory changes. You talk as if the SS surplus disappeared. It has not. The SS trust fund has over two trillion dollars in US (special issue) government bonds earning 2.3% interest. Since 2010 current receipt from SS taxes have not been enough to pay old age pensions in totaL. The balance of money required to pay full benefits came, and comes, from the SS trust fund. The interest earned by the SS trust on these "IOUs" has been sufficient to meet the shortfall, and add to the trust fund. The table you link is updated yearly, and the two trillion plus dollar balance etc comes a more current report, The suggestion that the two trillion dollars in assets does not exist is ludicrous. Indeed, it will be drawn down starting in 2020. Again, I have no idea how you get such erroneous information, but your post has nothing to do w/ the actual situation of social security todayWell I will agree that it's not a reality now but it could have been if the government had actually put the money away and not spent it because for a long time there was a LOT more going in than was going out. Look at this table do see how we could be sitting on a big pile of money if they had done what they were suppose to..... and those numbers do even allow for what they would have gained if invested even in government bonds.

Would you bet the farm on how Lindsay Graham feels about Donald Trump in 6 months? I wouldn't either. That's the reason, "put your money where your mouth is" doesn't work. It's too subjective. Knowing there is a bubble is different, than knowing when it will burst.

How long have you known there is a bubble? One cannot simply suggest that things are in a bubble for five years and then if a downturn occurs, claim victory. Timing, as you say, is everything and also validates the underlying statement itself.

Point taken. A stopped watch... However that goes both ways. That was a real 17 trillion dollars worth of wealth destroyed in '08. Most of it unrealized, but real nonetheless. Very little has changed since then. What makes you believe it won't happen again? I remember a lot of people bragging about the economy in '07.

My overall point is that our economy is not as efficient as it could or should be. And that hurts everyone.

Also, different markets have different "timings", so five years in corn futures, is much different than stocks, is much different than real estate. I know you know that, I'm just putting it out there.

My overall point is that our economy is not as efficient as it could or should be. And that hurts everyone.

Also, different markets have different "timings", so five years in corn futures, is much different than stocks, is much different than real estate. I know you know that, I'm just putting it out there.

Last edited:

What are you talking about? The SS trust fund now has over two trillion dollars in assets, ie special issue us bonds . The assets cited in the table you link are still held in the SS trust fund as are asset accumulated since. The table you link come from the annual SS report which gives a broad range of information on SS. To repeat, The SS trust fund now has over two trillion dollars in assets.This comes from the current form of the table you link in the most current SS report. Since 2010 the amount received from social security taxes has not been enough to pay 100% of benefits. The money required to pay the full amount comes from the interest on the funds you seem to say do not exist, and a small continuing surplus from interest received is added to the SS trust, To repeat the law requires that 100% of SS funds be spent on SS, including funding trust bonds , and the law is followed.. The surplus is there today, just as it was in 2008 and its is still reflected in the same table you link... The only difference is the sum is larger and the date on the table is 2019. I have no idea where you get the idea the SS surplus has been spent. It is counter factual, and totally incorrect .Well I will agree that it's not a reality now but it could have been if the government had actually put the money away and not spent it because for a long time there was a LOT more going in than was going out. Look at this table do see how we could be sitting on a big pile of money if they had done what they were suppose to..... and those numbers do even allow for what they would have gained if invested even in government bonds.

The assets are nothing more than government bonds (treasuries). How does the government pay the interest and principle on those bonds? It can only do it by increasing the national debt with more debt. The SS trust fund is nothing but IOUs from the government to the government.What are you talking about? The SS trust fund now has over two trillion dollars in assets, ie special issue us bonds . The assets cited in the table you link are still held in the SS trust fund as are asset accumulated since. The table you link come from the annual SS report which gives a broad range of information on SS. To repeat, The SS trust fund now has over two trillion dollars in assets.This comes from the current form of the table you link in the most current SS report. Since 2010 the amount received from social security taxes has not been enough to pay 100% of benefits. The money required to pay the full amount comes from the interest on the funds you seem to say do not exist, and a small continuing surplus from interest received is added to the SS trust, To repeat the law requires that 100% of SS funds be spent on SS, including funding trust bonds , and the law is followed.. The surplus is there today, just as it was in 2008 and its is still reflected in the same table you link... The only difference is the sum is larger and the date on the table is 2019. I have no idea where you get the idea the SS surplus has been spent. It is counter factual, and totally incorrect .

The assets are nothing more than government bonds (treasuries). How does the government pay the interest and principle on those bonds? It can only do it by increasing the national debt with more debt. The SS trust fund is nothing but IOUs from the government to the government.

I regret that I cannot describe the details. Perhaps they carry bundles of dollar from treasury to the SS offices. I can tell you the SS folk then transfer the self same dollars to retirees. This is done by bank transfers It is happening now,. however it is done, and the money. ends in the hands of ss pensioners. In time all the the funds in the SS trust fund will end up in the hands of retirees -all two trillion. No matter how much you call governmentThe assets are nothing more than government bonds (treasuries). How does the government pay the interest and principle on those bonds? It can only do it by increasing the national debt with more debt. The SS trust fund is nothing but IOUs from the government to the government.

bonds IOUs or assert that what is happening cannot happen, it will happen--indeed has been happening since 2010--and distorting fats will not change that.

The government of course maintains different accounts, and transfers funds between them. In the end the money including interest ends up in SS retires hands.

The redemption of the SS bonds does not increase the national debt. You claim to understand personal finances, but don,'t seem to know how debt is routinely re-financed. A 100 bond is redeemed. this reduces debt by 100. but the government is then short 100 dollars, So it issues another 100 dollar bond, and the debt is the same, (There is some debate among authorities on how the debt to SS should be treated for accounting ;purposes, but I have not attempted to follow it.) i

By stating that what is true is not true because it does not reflect. your view is not admirable. It does not change the fact that because you do not want it to be true nor does your desire to hae truth not be trurh change things.. I want to learn. I read about at the federal thrift plan. It is exceptional good.

There is much that is wrong w/ ss. Denying reality does nothing to address them.

Not even close.... the trust funds contain (for the lack of a better word) mortgages/loans made to the general fund. How do you think those are gonna be paid back? They'll pay those loans off by increasing your taxes and my taxes. So in other words you'll get to pay more taxes that will go from the general fund into the SS fund to pay off the loans whereas if they hadn't spent the SS funds there would be plenty there.What are you talking about? The SS trust fund now has over two trillion dollars in assets, ie special issue us bonds . The assets cited in the table you link are still held in the SS trust fund as are asset accumulated since. The table you link come from the annual SS report which gives a broad range of information on SS. To repeat, The SS trust fund now has over two trillion dollars in assets.This comes from the current form of the table you link in the most current SS report. Since 2010 the amount received from social security taxes has not been enough to pay 100% of benefits. The money required to pay the full amount comes from the interest on the funds you seem to say do not exist, and a small continuing surplus from interest received is added to the SS trust, To repeat the law requires that 100% of SS funds be spent on SS, including funding trust bonds , and the law is followed.. The surplus is there today, just as it was in 2008 and its is still reflected in the same table you link... The only difference is the sum is larger and the date on the table is 2019. I have no idea where you get the idea the SS surplus has been spent. It is counter factual, and totally incorrect .

You wrote, "what happens when the spigot gets turned off," AMONG 10 TRILLION OTHER TOPICS!!good points, but we're comparing a rigged system for the plus side with one that's been sabotaged for the negative.

what would the market be at today were it not for the 08 bailout, quantitative easing, capital gains tax inequities, 40 yrs of political policies that are directly geared for the purpose of benefitting Wall St and raising the Dow, and then again throwing another billion in tax cuts for Wall St and the investor class at the market with Trump's/GOP tax cut.

that trillion didn't go under investor's mattresses, it got plowed into the market, benefiting the small minority investor class because of an extra trillion chasing the same stocks..

even a pyramid scheme will keep showing gains, if someone keeps throwing money at it.

on the other side, 40 yrs of DC engineered stagnant to regressing working class wages has drastically hurt the SS revenue pool, especially with the ceiling on FICA taxable incomes.

literally every cent that has been shifted from the working class to the investor class over the decades, and literally every cent of increased wealth disparity, has been removed from FICA generated revenues.

and how much has just been raided from the fund?

all that said, plowing FICA revenues into the market would again drastically drive up the market, regardless of not improving the actual earnings or multiples of the business entities that comprise it.

it would also even further affect public economic policy coming out of DC.

lowering the min wage to $6.50 hr, open immigration, corp tax benefits to offshore even more, and any other such policy decisions that drive up the market, could be sold as in the interests of the SS fund.

fact is, the market isn't driven by earnings or multiples, it's driven by the amount of money chasing the stocks.

so when the market keeps going up due to more and more money chasing it, and the metrics of the publicly traded stocks that comprise the market don't keep up with higher and higher stock value, how does that not become a ponzi scheme, and what happens when the spigot gets turned off.

and what happens when raising the retirement age higher and higher and higher, becomes the mechanism to keep the spigot from being turned off.

plowing FICA money into the market sounds great even to me just looking at the grossly manipulated market today in hindsight, and not taking into consideration it's impact on future short term economic policy out of DC, and not taking into consideration the sabotage to the FICA revenues on the other side, but what about for whatever generation doesn't time it right.

and what about all the other generations starting today, that have to work into their mid seventies to retire, then 80, then mid 80s, to keep the spigot open and the pyramid from collapsing.

If you'd use some punctuation and write about one matter at a time I think people could understand you a lot better.

Nonetheless, here's an article that may answer

https://www.investopedia.com/news/recession-2020-economists-see-high-chances/

That's called the "trickle down" theory of economics. Here's what that looks like in reality:This is one of my biggest issues with a wealth tax. It seems to indicate that the money would be more efficiently or equitably distributed and I am not confident of that.

And remember -- it's always better to be pissed off than pissed on.

Similar threads

- Replies

- 6

- Views

- 393

- Replies

- 9

- Views

- 297

A

Normalizing the idea of ignoring or throwing out the Constitution

- anon_6hv78pr714xta

- The Water Cooler 3 4 5

- Replies

- 176

- Views

- 3K

A

- Replies

- 140

- Views

- 2K

ADVERTISEMENT

ADVERTISEMENT