Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

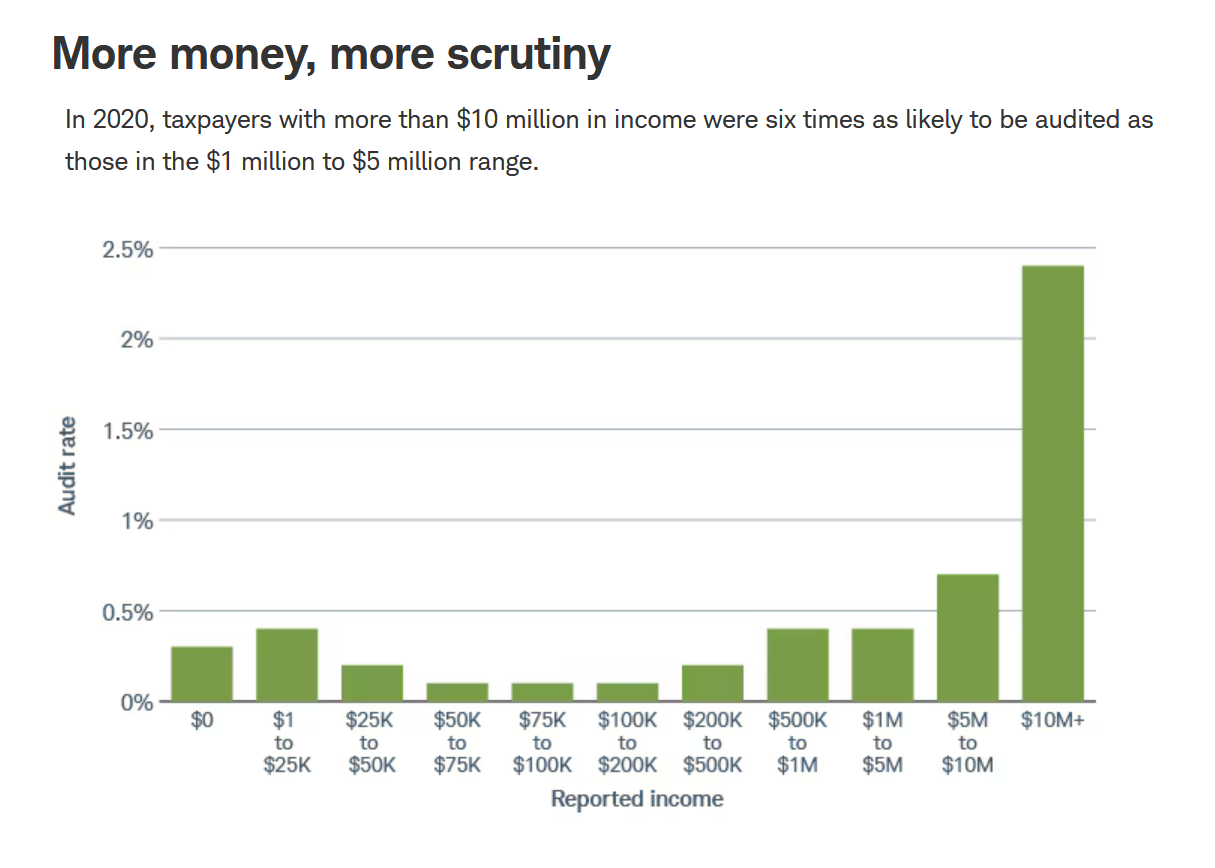

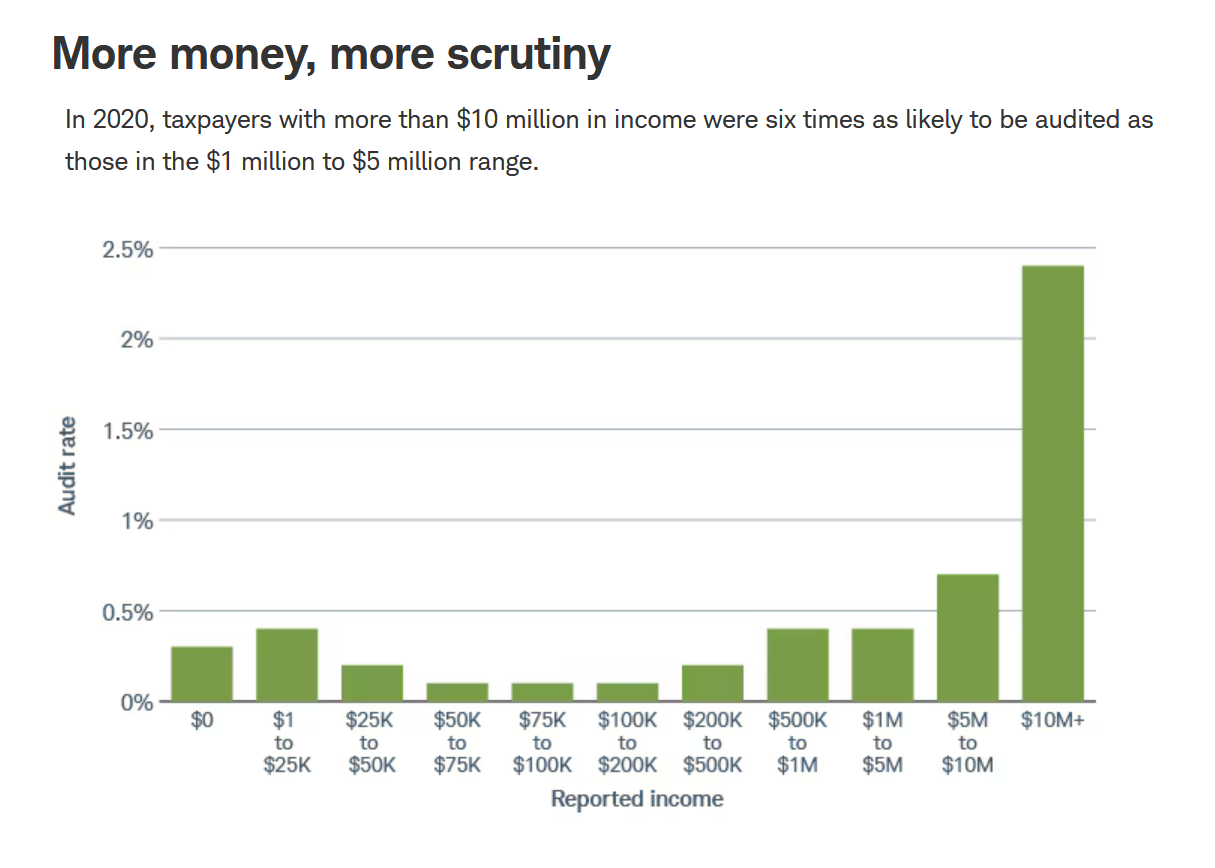

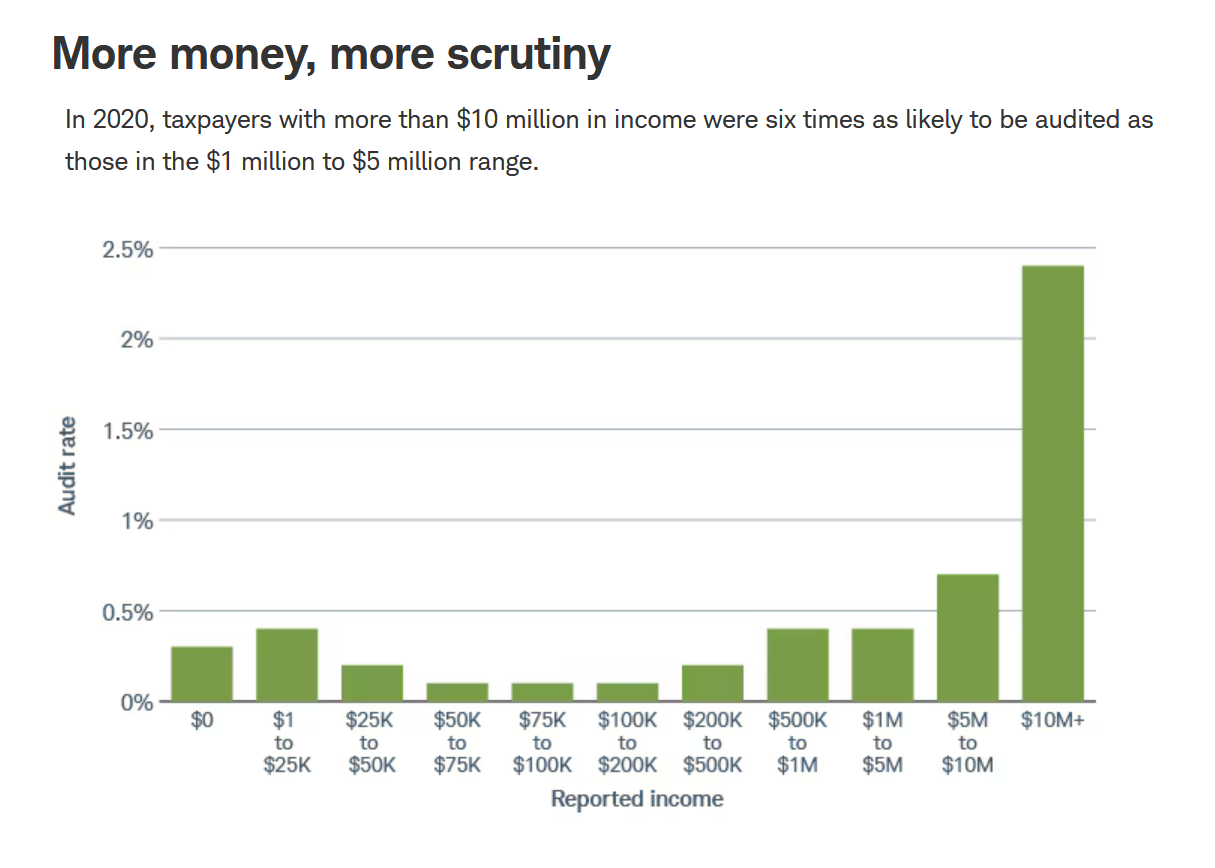

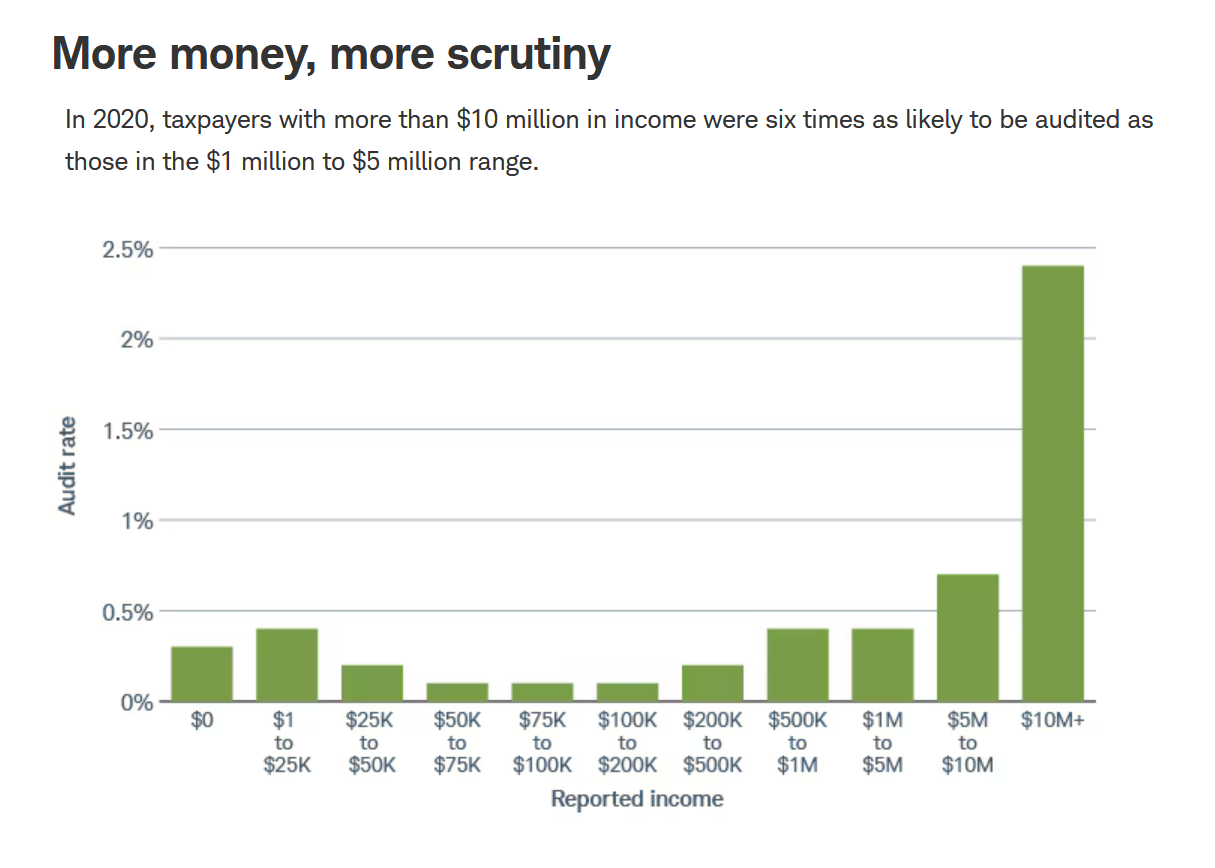

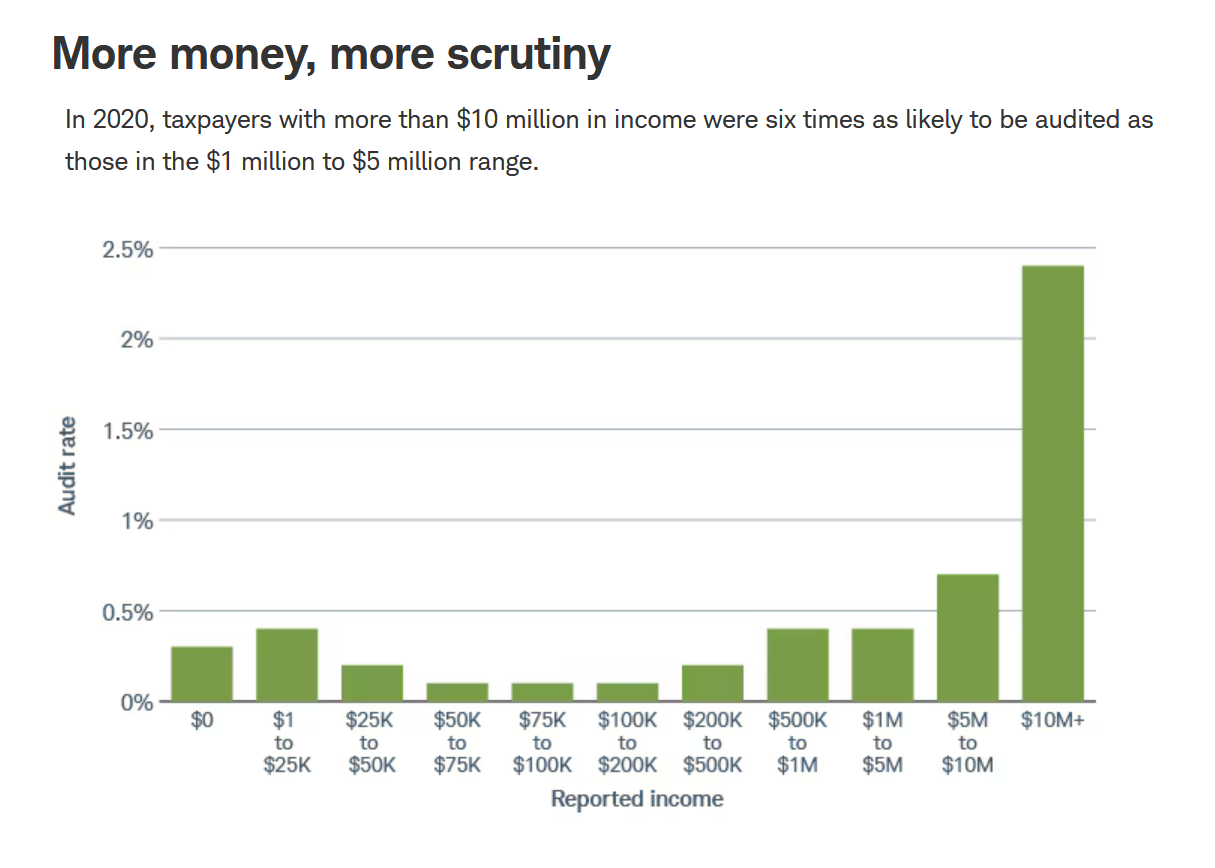

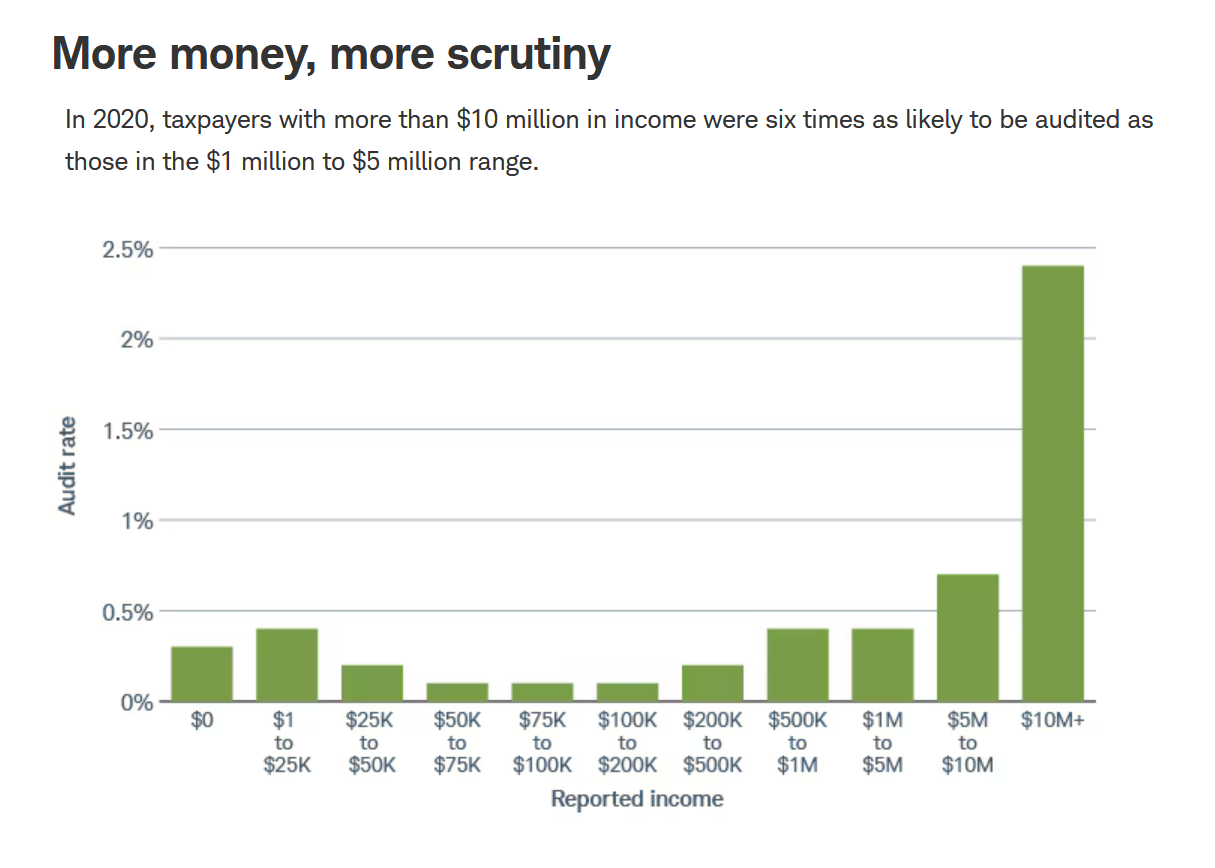

IRS audits

- Thread starter NPT

- Start date

This kind of surprised me. Why would the low income people be audited more than the ones a little higher? Is it just a case of a lot more people being in the 50k to 200k so it makes the percentage lower?

I forget the exact details, but there are deductions or credits available to low income filers that have a lot of potential for abuse. I want to say it's child tax credits or something of that nature.

The low income folks are more likely to be receiving benefits based on low income & should be verified? Purely conjecture…This kind of surprised me. Why would the low income people be audited more than the ones a little higher? Is it just a case of a lot more people being in the 50k to 200k so it makes the percentage lower?

I forget the exact details, but there are deductions or credits available to low income filers that have a lot of potential for abuse. I want to say it's child tax credits or something of that nature.

Earned Income Tax Credit.

The IRS Continues To Focus Its Audits On Poor People, Not Millionaires

If you’re interested in seeing greater fairness, this is why you want the IRS to have more agents so they can audit those who might really have something to pay up.

www.forbes.com

www.forbes.com

The IRS is not responsible for verifying income for such purposes.The low income folks are more likely to be receiving benefits based on low income & should be verified? Purely conjecture…

This kind of surprised me. Why would the low income people be audited more than the ones a little higher? Is it just a case of a lot more people being in the 50k to 200k so it makes the percentage lower?

A few years ago, one of my buddies got audited because his baby mama filed her taxes first and claimed their kid even though it was his year to do it.

He said he had to provide the court ruling that it was his year to file with the kid.

I have no idea what happened to her. I assume she had to pay some hefty penalty.

A few years ago, one of my buddies got audited because his baby mama filed her taxes first and claimed their kid even though it was his year to do it.

He said he had to provide the court ruling that it was his year to file with the kid.

I have no idea what happened to her. I assume she had to pay some hefty penalty.

Hopefully she had to take care of any legal fees he had.

This kind of surprised me. Why would the low income people be audited more than the ones a little higher? Is it just a case of a lot more people being in the 50k to 200k so it makes the percentage lower?

The majority of the people being audited in the $0 reported income group are more than likely non-filers who the IRS believes (or knows) have reportable income. They also audit a higher percentage of people claiming an EITC (earned income tax credit). That system is ripe for abuse since it's a refundable credit (meaning you can get a "refund" even if you owe no tax).

I also suspect these figures are for formal audits (the kind where you have to show up in person with your shoe box of receipts, etc.) as well as the type where everything is handled by mail - where the IRS sends out the "hey, we know you made more $ than you reported because we have this 1099" letter. Many people consider an "audit" to only mean the former and not the latter. I've gotten one of those letters before, where we did not receive (or discarded) an end-of-year tax report for a bank account, stating we earned $20 in interest. In those situations the IRS will typically just reduce your refund or send you a bill for the discrepancy.

Last edited:

I've never been audited but did get a letter from the IRS one year saying that I owed money because I had made a mistake on one of two forms. I called them and after waiting for 30 minutes got a lady who was really nice. I told her about the letter and told her I may have made a mistake but wanted her to point it out so we went thru both forms and when we got done she said that I didn't owe anything. I asked her to send me a letter stating that I didn't owe anything and several days later the letter came in the mail.A few years ago, one of my buddies got audited because his baby mama filed her taxes first and claimed their kid even though it was his year to do it.

He said he had to provide the court ruling that it was his year to file with the kid.

I have no idea what happened to her. I assume she had to pay some hefty penalty.

I don't want an audit but don't fear one because I try to do the taxes correctly and I don't think the IRS is out to get me. If I make a mistake it's not to defraud the government... it's an honest mistake. My biggest fear is forgetting something or a typo error... I always get my wife to go over them to check for at least typo errors.

Over the years I've worked alongside some very successful people in the millionaire class who share a common thread. The thread being acutely aware of how the tax codes affect their bottom line. In addition to being tax aware themselves they hire the best tax consultants. Often these consultants were former IRS agents. The typical IRS agent conducting an examination (audit) is no match for these pros.

Consequently, the IRS agents and the mailings go after the low hanging fruit which statistics show aren't the richest among us.

P.S. The more affluent had to laugh at the way I conducted my business when they would drop by my expensive office space so they could send me off on a bird dog mission on their behalf. Gotta love the rich.

Consequently, the IRS agents and the mailings go after the low hanging fruit which statistics show aren't the richest among us.

P.S. The more affluent had to laugh at the way I conducted my business when they would drop by my expensive office space so they could send me off on a bird dog mission on their behalf. Gotta love the rich.

EITCI forget the exact details, but there are deductions or credits available to low income filers that have a lot of potential for abuse. I want to say it's child tax credits or something of that nature.

This kind of surprised me. Why would the low income people be audited more than the ones a little higher? Is it just a case of a lot more people being in the 50k to 200k so it makes the percentage lower?

It's mostly EITC and child tax credits via automated computer audits. IRS doesn't have the manpower to do a lot of legit audits with revenue agents. But very easy for them to catch via computers a situation where the same child SSN is used on multiple tax returns. Could be a case where both parents are attempting to claim same child as a dependent, for example.

I was reading something a while back that said the IRS were outgunned when going against the pros that big companies hire.The typical IRS agent conducting an examination (audit) is no match for these pros.

irs sees less resistance to fight from low income earners?This kind of surprised me. Why would the low income people be audited more than the ones a little higher? Is it just a case of a lot more people being in the 50k to 200k so it makes the percentage lower?

enough money, influence and connections can get away with almost anything these days

Last edited:

I've always wondered if that's part of it. Easy pickin's with no resistance. Most people would just pay (if they could) what the IRS says they owe without even checking to see if the IRS was right.irs sees less resistance to fight from low income earners?

I've done it before (and knew I was in the right)I've always wondered if that's part of it. Easy pickin's with no resistance. Most people would just pay (if they could) what the IRS says they owe without even checking to see if the IRS was right.

unless it's big $, it's not worth the time and aggravation

I was reading something a while back that said the IRS were outgunned when going against the pros that big companies hire.

That's why they've asked for additional IRS funding and staffing, so they can go after more of the big boys. Of course, the Republicans say the money would be used to go after working class heroes.

That's why they've asked for additional IRS funding and staffing, so they can go after more of the big boys. Of course, the Republicans say the money would be used to go after working class heroes.

Some argue the money spent for agents would actually raise revenues and provide a more equitable tax system.

Those who oppose what they call intrusive big government disagree. Leaving the paying of income taxes on the honor system is an individual and corporate right. Similar to corporations making political donations as a right to free speech as decided in Citizens United by the Supreme Court.

I think what Noodle was saying is what you went through counts as an "audit" for the purposes of the numbers posted.I've never been audited but did get a letter from the IRS one year saying that I owed money because I had made a mistake on one of two forms. I called them and after waiting for 30 minutes got a lady who was really nice. I told her about the letter and told her I may have made a mistake but wanted her to point it out so we went thru both forms and when we got done she said that I didn't owe anything. I asked her to send me a letter stating that I didn't owe anything and several days later the letter came in the mail.

I don't want an audit but don't fear one because I try to do the taxes correctly and I don't think the IRS is out to get me. If I make a mistake it's not to defraud the government... it's an honest mistake. My biggest fear is forgetting something or a typo error... I always get my wife to go over them to check for at least typo errors.

I was reading something a while back that said the IRS were outgunned when going against the pros that big companies hire.

Of course - between tax attorneys and accountants, the private sector pays better and maintains superior talent

I wondered about that.... in a way I guess it is but it was more of audit of themselves than me because they had entered some numbers incorrectly. That was before I started e-filing.I think what Noodle was saying is what you went through counts as an "audit" for the purposes of the numbers posted.

On a side note I know a couple people that will not e file because they don't trust it. My standard answer is that I trust e-filing more than I trust them typing everything in correctly.

Similar threads

- Replies

- 59

- Views

- 1K

- Replies

- 1

- Views

- 123

- Replies

- 25

- Views

- 522

- Replies

- 212

- Views

- 3K

- Replies

- 179

- Views

- 3K

ADVERTISEMENT

Latest posts

-

-

-

-

What the hell are schools supposed to do to stop the war in Gaza

- Latest: NewGuyToTheBoard

ADVERTISEMENT