https://www.cnbc.com/2018/06/14/tru...rue-as-americans-spend-tax-bill-proceeds.html

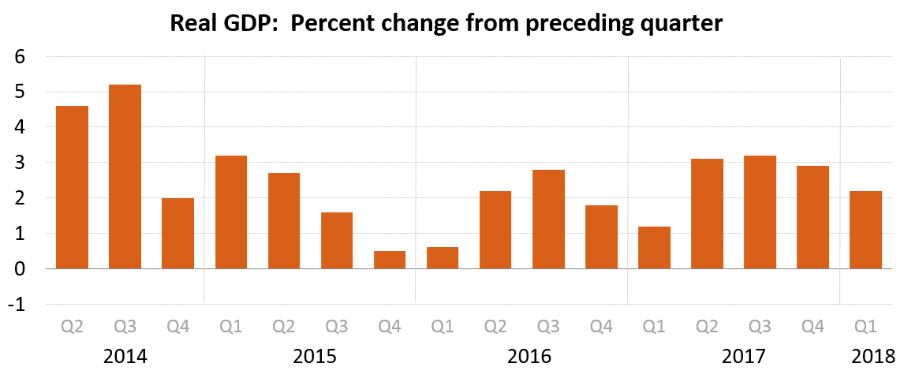

Notice this is CNBC and not Fox. Just saying. Now let me ask you folks a question. Are you happy about this? Are you happy that our economy is growing at a rate where we were told would not happen again? Obama said those days were over. Also with the unemployment rate at record lows, does this make you happy? Tell me why or why not.

Notice this is CNBC and not Fox. Just saying. Now let me ask you folks a question. Are you happy about this? Are you happy that our economy is growing at a rate where we were told would not happen again? Obama said those days were over. Also with the unemployment rate at record lows, does this make you happy? Tell me why or why not.