YupThey don’t go out. The good ones are taken, the crazy ones are depressed and the rest are in ESTL or butch.

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High School

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

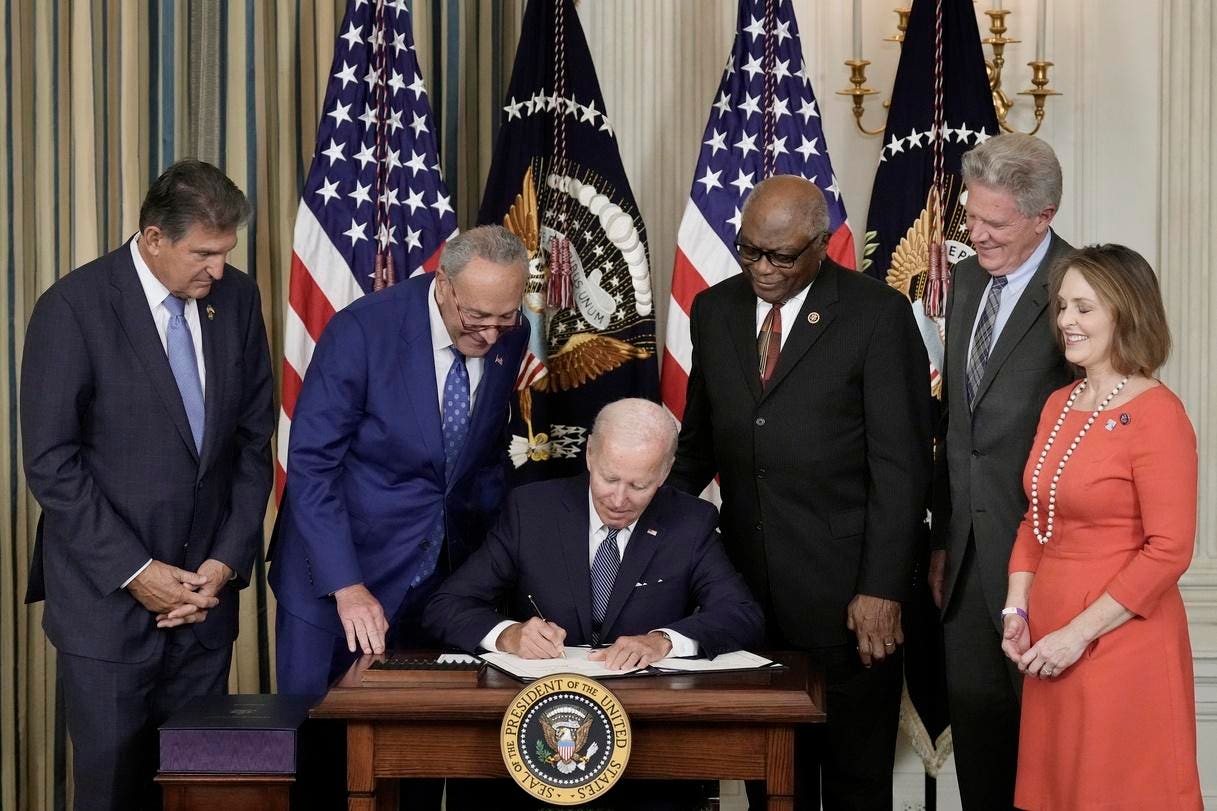

The Great Wealth Transfer

- Thread starter mcmurtry66

- Start date

'greatest economic boom' my ass. You need to look at actual history, instead of looking at how people live today.

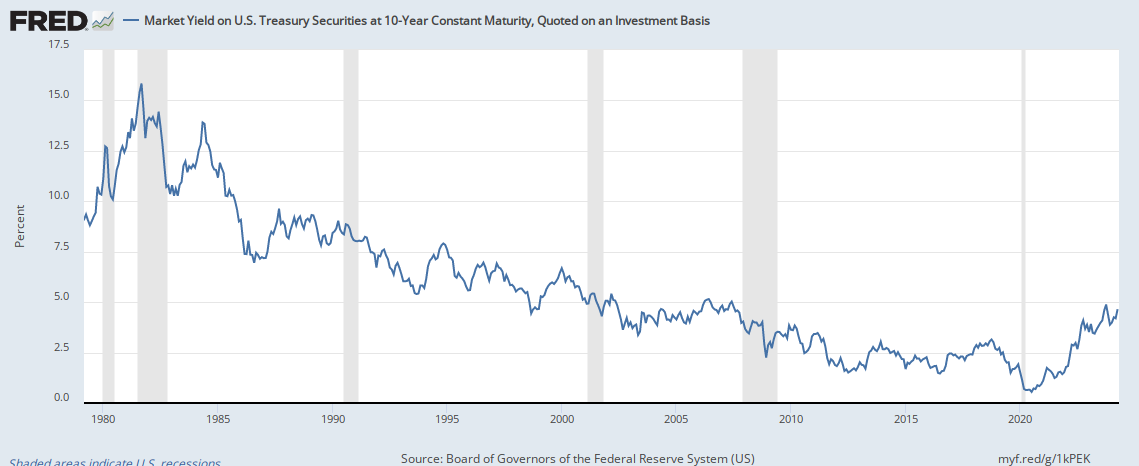

You cannot be serious. Yes, you started at a time with high inflation and mortgage rates and over the time as Boomers increased their income, they were also able to invest that income into assets that generated unprecedented returns. Guys like Bill Gross get worshipped - you couldn't lose money in the long-run if you tried from 1980 to present. It doesn't matter what asset class.

Inflation came down, real wages grew nicely, etc.

So, did the guy end up advocating massive government spending cuts and far less inflating of the money supply? So that young people could be better off?

He just said people are pissed off. But didn't point out that young people vote even more for what he seems to be saying they are mad about.

Inflation in 21-22 topped out around 16% based on how they measured it in the 80s. Inflation is a lot higher than the government reported CPI.lmao You guys would shit your pants at 10% unemployment, 10% inflation, and 15% interest rates.

'greatest economic boom' my ass. You need to look at actual history, instead of looking at how people live today.

And I guarantee your dad didn't pay his own way through school by bagging groceries at 15-20 hours per week. If he had scholarships, great, but you couldn't pay for shit at 20 hours of a minimum wage job.

The result of worship of the false god of material wealth is hollow,'angry' people with no connection to family, history and varied communities.

Conservatives Against Capitalism: From the Industrial Revolution to Globalization Hardcover – August 8, 2017

by Peter Kolozi (Author)Few beliefs seem more fundamental to American conservatism than faith in the free market. Yet throughout American history, many of the major conservative intellectual and political figures have harbored deep misgivings about the unfettered market and its disruption of traditional values, hierarchies, and communities. In Conservatives Against Capitalism, Peter Kolozi traces the history of conservative skepticism about the influence of capitalism on politics, culture, and society.

Kolozi discusses conservative critiques of capitalism―from its threat to the Southern way of life to its emasculating effects on American society to the dangers of free trade―considering the positions of a wide-ranging set of individuals, including John Calhoun, Theodore Roosevelt, Russell Kirk, Irving Kristol, and Patrick J. Buchanan. He examines the ways in which conservative thought went from outright opposition to capitalism to more muted critiques, ultimately reconciling itself to the workings and ethos of the market. By analyzing the unaddressed historical and present-day tensions between capitalism and conservative values, Kolozi shows that figures regarded as iconoclasts belong to a coherent tradition, and he creates a vital new understanding of the American conservative pantheon.

Editorial Reviews

We’ve long known that European conservatives have been ambivalent about, if not hostile to, capitalism. What Peter Kolozi has uncovered is an entirely American tradition of conservative ambivalence about capitalism. Although most people assume that American conservatives have always been committed to laissez-faire capitalism, Kolozi shows that up until recently, many conservatives in the United States were deeply uneasy about the Ayn Rand/Paul Ryan view of the world. The result is an astonishing and exhilarating feat of intellectual recovery―and a sense of just how peculiar and unprecedented is the current embrace of the free market on the right. -- Corey Robin, Brooklyn College and the CUNY Graduate Center, author of The Reactionary Mind: Conservatism from Edmund Burke to Sarah Palin

Conservatives Against Capitalism provides a rich, thorough, and thoughtful treatment of an understudied strain of American intellectual life, namely that of self-defined conservatives who are critical of capitalism and of market relationships. Kolozi argues that these conservative thinkers have often been far more sympathetic toward the state than the stereotypical idea of the Republican Right would suggest. Recognizing this tradition gives a much fuller sense of conservatism’s role in American politics and illuminates tensions on the right today. An important contribution to the field. -- Kimberly Phillips-Fein, NYU-Gallatin, author of Invisible Hands: The Making of the Conservative Movement from the New Deal to Reagan

Right. So where are the crazy ones now?They don’t go out. The good ones are taken, the crazy ones are depressed and the rest are in ESTL or butch.

Right. So where are the crazy ones now?

Hopped up on SSRIs and crying over Bravo shows. Who knew McM’s vice would be the limiter of his fish in the sea…

My dad came from absolutely nothing and literally paid his paid through 4 years of ISU bagging groceries for 15-20 hours a week. That probably wouldn't pay for your books these days.

That would have been from a time when the state of Indiana paid roughly 40% of the cost of a college education at a state school. That's down around 10% now. Trickle down, bitches.

My son recently read the David Goggins memoir (he grew up in Brazil, IN). He told me "maybe I'll join the Army, dad" out of the blue the other day. I told him what a great option it was to pay for college. But he was turned off at the notion of having to work in the armed services for 4 years in his early 20s when he could be living in some beach house with his bros making bank (kid thinks his life is going to be grand; I hope it is).That would have been from a time when the state of Indiana paid roughly 40% of the cost of a college education at a state school. That's down around 10% now. Trickle down, bitches.

But I'm glad the seed has been planted. It would be a great option for him, although I would push for him to go into the Air Force or Navy (so he could do engineering).

About Goggins:

David Goggins - Wikipedia

I don't agree at all that Mitch would not be competitive. He would have had a history of accomplishment in actually governing successfully in Indiana. He was able to recruit effective managers to drive efficiencies in State Departments.. BMV is only one example..You say that as though it is a fact. However that is about the same thing I said about Trump when the started running so I don't buy your statement. People amaze/confuse me all the time in what they do.

Your daughter loves Ayn Rand and now your son loves Goggs? You’re doing a great job as a parent. I read the book and love Goggs. Very intense individual.My son recently read the David Goggins memoir (he grew up in Brazil, IN). He told me "maybe I'll join the Army, dad" out of the blue the other day. I told him what a great option it was to pay for college. But he was turned off at the notion of having to work in the armed services for 4 years in his early 20s when he could be living in some beach house with his bros making bank (kid thinks his life is going to be grand; I hope it is).

But I'm glad the seed has been planted. It would be a great option for him, although I would push for him to go into the Air Force or Navy (so he could do engineering).

About Goggins:

David Goggins - Wikipedia

en.wikipedia.org

@Willdog7Your daughter loves Ayn Rand and now your son loves Goggs? You’re doing a great job as a parent. I read the book and love Goggs. Very intense individual.

Dude, interest rates and unemployment were way higher from the 70s through the first decade of the 2000s. You think interest rates were way down after 1980? I built a house in 1988 with a 7% mortgage, amid a housing crunch.You cannot be serious. Yes, you started at a time with high inflation and mortgage rates and over the time as Boomers increased their income, they were also able to invest that income into assets that generated unprecedented returns. Guys like Bill Gross get worshipped - you couldn't lose money in the long-run if you tried from 1980 to present. It doesn't matter what asset class.

Inflation came down, real wages grew nicely, etc.

Everyone makes money in the long run - everyone. There has never been a 44 year run, as in your example, where people lost money if they stayed invested. And, of course, you forget the Stagflation decade when we came of age. You guys graduate from college now with ridiculous offers. Be greatful unemployment is so low and that the Boomers are retiring. The wealth transfer from Boomers to your generation is going to be much more than we had (zero for me).

You need to stay among your own group and cry about how bad you have it, because to old-timers like me, you sound like such a victim.

Here's a hint: if you want to buy a house, stop looking at houses in popular areas, where prices have run up. Work to find a motivated seller and jump on it. When we looked for a house in Ft. Wayne in 1985, there were very few houses for sale in our price range. GM workers were moving from Wisconsin to work at the new GM truck plant. I didn't rely on a real estate agent only - I drove around neighborhoods at night, looking for 'for sale' signs. I found one, schedule a walk-thru the next day, and put a bid on it, even though my wife was in Detroit for business. I was the first of 4 offers that day.

When times are difficult, you've got to hustle. You might have to lower your wants and go more with your needs.

That's 1 1/2 years. Check the inflation rates from the 70s to 2009.Inflation in 21-22 topped out around 16% based on how they measured it in the 80s. Inflation is a lot higher than the government reported CPI.

I don't know if it's still available, but the military used to have a deal to pay off your student loans if you joined up. Of course, those could have been for the hard-to-fill military jobs.My son recently read the David Goggins memoir (he grew up in Brazil, IN). He told me "maybe I'll join the Army, dad" out of the blue the other day. I told him what a great option it was to pay for college. But he was turned off at the notion of having to work in the armed services for 4 years in his early 20s when he could be living in some beach house with his bros making bank (kid thinks his life is going to be grand; I hope it is).

But I'm glad the seed has been planted. It would be a great option for him, although I would push for him to go into the Air Force or Navy (so he could do engineering).

About Goggins:

David Goggins - Wikipedia

en.wikipedia.org

My barracks roommate, from Indianapolis, in Germany, got out, went to IU and joined ROTC. Still got his GI Bill and joined the Reserves. So, he was triple-dipping and got out of IU an officer. Last I heard of him he was a Colonel working as a laison to the Russian embassy. Pretty good gig.

The military is a really good option if you don't have a plan after high school. You are trained and given a lot of responsibility 18 to 21 years olds never experience in civilian life. It's not for everybody and I was homesick as hell. But I'm glad I did it.

I think doing ROTC is a great idea for anyone. Get a liberal arts degree for free, work for four years as an officer doing something meaningful, and then apply to grad/professional school.I don't know if it's still available, but the military used to have a deal to pay off your student loans if you joined up. Of course, those could have been for the hard-to-fill military jobs.

My barracks roommate, from Indianapolis, in Germany, got out, went to IU and joined ROTC. Still got his GI Bill and joined the Reserves. So, he was triple-dipping and got out of IU an officer. Last I heard of him he was a Colonel working as a laison to the Russian embassy. Pretty good gig.

The military is a really good option if you don't have a plan after high school. You are trained and given a lot of responsibility 18 to 21 years olds never experience in civilian life. It's not for everybody and I was homesick as hell. But I'm glad I did it.

I agree, though, the military isn’t for everyone. My daughter, for example, could not do it.

I don't know how it is now, but when my daughter graduated from HS in 2011, getting a ROTC scholarship was very competitive. A couple guys in her class got them and they were really good athletes. I'm not sure what they're looking for, but being in sports would probably be a plus. Academically, of course, you have to be pretty good.I think doing ROTC is a great idea for anyone. Get a liberal arts degree for free, work for four years as an officer doing something meaningful, and then apply to grad/professional school.

I agree, though, the military isn’t for everyone. My daughter, for example, could not do it.

Purdue used to have a nuclear program the Navy sent their officers to. I think it was a grad school program. Again, I don't know if they still do, but I imagine they probably have a ROTC engineering program for some engineering - my guess is aeronautical, since PU is big on that.

If he has an interest, he should probably talk to someone who's been in the Air Force and Navy. I'm sure Aloha could give a few tips. I'd stay away from recruiters right now, because they're mainly interested in filling a quota and many (not all) will tell you anything to get you to sign up.

I didn’t think it was that competitive. My buddy’s son got in at Illinois State and it wasn’t an ordeal.I don't know how it is now, but when my daughter graduated from HS in 2011, getting a ROTC scholarship was very competitive. A couple guys in her class got them and they were really good athletes. I'm not sure what they're looking for, but being in sports would probably be a plus. Academically, of course, you have to be pretty good.

Purdue used to have a nuclear program the Navy sent their officers to. I think it was a grad school program. Again, I don't know if they still do, but I imagine they probably have a ROTC engineering program for some engineering - my guess is aeronautical, since PU is big on that.

If he has an interest, he should probably talk to someone who's been in the Air Force and Navy. I'm sure Aloha could give a few tips. I'd stay away from recruiters right now, because they're mainly interested in filling a quota and many (not all) will tell you anything to get you to sign up.

He did it, too, at IU. I always joke with him that the army must have no standards.

Dude, interest rates and unemployment were way higher from the 70s through the first decade of the 2000s. You think interest rates were way down after 1980? I built a house in 1988 with a 7% mortgage, amid a housing crunch.

Everyone makes money in the long run - everyone. There has never been a 44 year run, as in your example, where people lost money if they stayed invested. And, of course, you forget the Stagflation decade when we came of age. You guys graduate from college now with ridiculous offers. Be greatful unemployment is so low and that the Boomers are retiring. The wealth transfer from Boomers to your generation is going to be much more than we had (zero for me).

You need to stay among your own group and cry about how bad you have it, because to old-timers like me, you sound like such a victim.

Here's a hint: if you want to buy a house, stop looking at houses in popular areas, where prices have run up. Work to find a motivated seller and jump on it. When we looked for a house in Ft. Wayne in 1985, there were very few houses for sale in our price range. GM workers were moving from Wisconsin to work at the new GM truck plant. I didn't rely on a real estate agent only - I drove around neighborhoods at night, looking for 'for sale' signs. I found one, schedule a walk-thru the next day, and put a bid on it, even though my wife was in Detroit for business. I was the first of 4 offers that day.

When times are difficult, you've got to hustle. You might have to lower your wants and go more with your needs.

Do you have any understanding of basic economics and finance? Have you ever looked at data to support your theory? Milton Friedman is rolling in his grave.

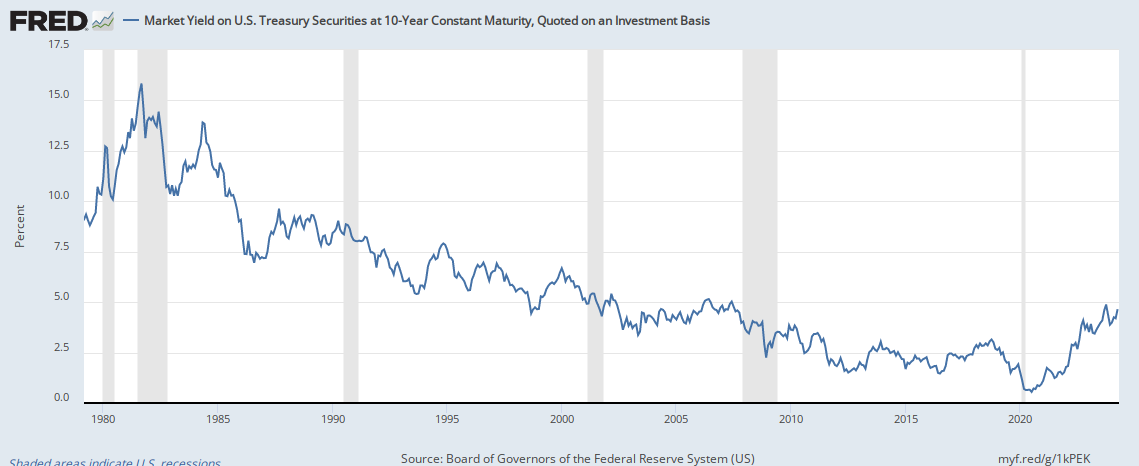

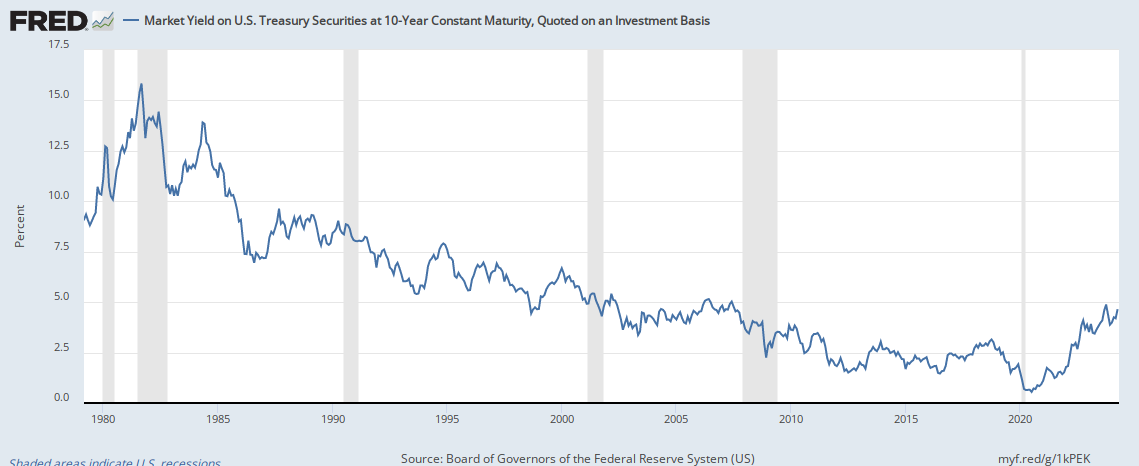

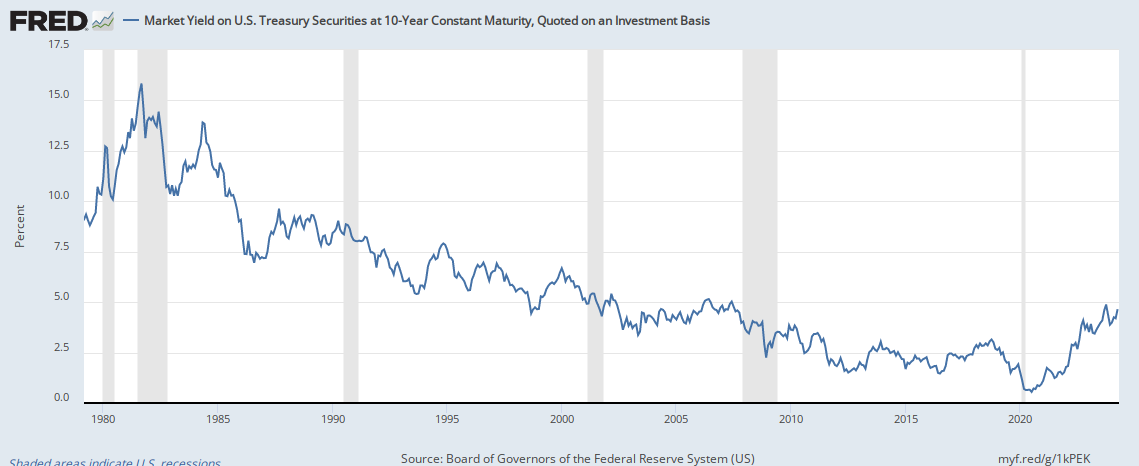

First off, asset prices and interest rates are inversely correlated. That's not debatable. It's proven by financial theory and is accepted as fact. If you have a 40 years stretch where interest rates have come down, asset values are conversely going to increase for a massive amount of time.

Between 1965 and 1980, bonds outpaced stocks in returns only three years (70, 71, 76). Between 1981 and 1996, bonds outpaced stocks eight times, despite materially higher stock market returns (903% vs. 165% for S&P 500).

That trend continued far beyond 1996, but you get the point. It was literally impossible to not make boatloads of money. People made money over time in the 60s and 70s, but nowhere near what they did in the 80s, 90s, 00s, and 10s, which was when Boomers were in their prime.

Secondly, you are sorely mistaken if you think I am the one impacted right now. I bought a house, by choice, last November, in an area that I wanted, because I could. Many of my peers do not have the same earnings power nor ability to do so.

That being said, I WILL BE impacted because of your stupid generation Dan. You haven't saved enough for retirement, you have run up the largest debt in our history and you did all of that on the back of the lowest tax rates among any generation. That means my ass has to bail your poor, obese ass out because you selfish losers were unable to leave this world better than you came into it.

We should have let COVID do its job.

LOL. Dayum. JDB is big mad.Do you have any understanding of basic economics and finance? Have you ever looked at data to support your theory? Milton Friedman is rolling in his grave.

First off, asset prices and interest rates are inversely correlated. That's not debatable. It's proven by financial theory and is accepted as fact. If you have a 40 years stretch where interest rates have come down, asset values are conversely going to increase for a massive amount of time.

Between 1965 and 1980, bonds outpaced stocks in returns only three years (70, 71, 76). Between 1981 and 1996, bonds outpaced stocks eight times, despite materially higher stock market returns (903% vs. 165% for S&P 500).

That trend continued far beyond 1996, but you get the point. It was literally impossible to not make boatloads of money. People made money over time in the 60s and 70s, but nowhere near what they did in the 80s, 90s, 00s, and 10s, which was when Boomers were in their prime.

Secondly, you are sorely mistaken if you think I am the one impacted right now. I bought a house, by choice, last November, in an area that I wanted, because I could. Many of my peers do not have the same earnings power nor ability to do so.

That being said, I WILL BE impacted because of your stupid generation Dan. You haven't saved enough for retirement, you have run up the largest debt in our history and you did all of that on the back of the lowest tax rates among any generation. That means my ass has to bail your poor, obese ass out because you selfish losers were unable to leave this world better than you came into it.

We should have let COVID do its job.

Now thats bringing the smoke. I was just going to tell Boomers to say they’re sorry and buy Bitcoin.Do you have any understanding of basic economics and finance? Have you ever looked at data to support your theory? Milton Friedman is rolling in his grave.

First off, asset prices and interest rates are inversely correlated. That's not debatable. It's proven by financial theory and is accepted as fact. If you have a 40 years stretch where interest rates have come down, asset values are conversely going to increase for a massive amount of time.

Between 1965 and 1980, bonds outpaced stocks in returns only three years (70, 71, 76). Between 1981 and 1996, bonds outpaced stocks eight times, despite materially higher stock market returns (903% vs. 165% for S&P 500).

That trend continued far beyond 1996, but you get the point. It was literally impossible to not make boatloads of money. People made money over time in the 60s and 70s, but nowhere near what they did in the 80s, 90s, 00s, and 10s, which was when Boomers were in their prime.

Secondly, you are sorely mistaken if you think I am the one impacted right now. I bought a house, by choice, last November, in an area that I wanted, because I could. Many of my peers do not have the same earnings power nor ability to do so.

That being said, I WILL BE impacted because of your stupid generation Dan. You haven't saved enough for retirement, you have run up the largest debt in our history and you did all of that on the back of the lowest tax rates among any generation. That means my ass has to bail your poor, obese ass out because you selfish losers were unable to leave this world better than you came into it.

We should have let COVID do its job.

Our first mortgage wasn't that bad but I remember my older brother saying they had to pay 17%. On the other hand, our first house cost $31,000. It was a very nice small 2 bedroom house.And my first mortgage was 15% WITH a VA guaranteed loan - many mortgages were 18%.

I can remember thinking that if I EVER make $1000/month I'm gonna be rolling in money. 🤣

He does have some good points. However I disagree that it was just the Boomer generation. I think the next couple generations were just as guilty as the Boomer generation.LOL. Dayum. JDB is big mad.

The problem with the boomers is that they all believe it was just hard work and intelligence that got them what they have. It wasn't. It was mostly pure luck of being born at the most opportune time.He does have some good points. However I disagree that it was just the Boomer generation. I think the next couple generations were just as guilty as the Boomer generation.

What’s the divorce rate for Boomers compared to your generation?The problem with the boomers is that they all believe it was just hard work and intelligence that got them what they have. It wasn't. It was mostly pure luck of being born at the most opportune time.

What’s the percentage of kids born to unwed mothers for Boomers compared to your generation?

I think we started seeing these things happen more frequently with the Boomer generation but I’m not sure of the actual numbers

What’s the divorce rate for Boomers compared to your generation?

More winning from the losers…

According to Washington University, baby boomers have the highest divorce rate of any generation, with the divorce rate for people age 65 and older tripling since 1990. However, the divorce rate has decreased slightly over the past two decades, and the divorce rate for millennials has dropped dramatically since 2008.

And

- 1965: 24% of black infants and 3.1% of white infants were born to single mothers

- 1990: 64% of black infants and 18% of whites were born to single mothers

It's funny because I do think that people have a tendency to get tired/bored with each other and go their own separate ways. It would be interesting to see what the divorce rate was when the boomers were in their 20s thru their 40s. I'm just guessing that it would be a lot lower. I think it's sad to see a couple to stay together until they're in their 60s and then get divorced.More winning from the losers…

According to Washington University, baby boomers have the highest divorce rate of any generation, with the divorce rate for people age 65 and older tripling since 1990. However, the divorce rate has decreased slightly over the past two decades, and the divorce rate for millennials has dropped dramatically since 2008.

And

- 1965: 24% of black infants and 3.1% of white infants were born to single mothers

- 1990: 64% of black infants and 18% of whites were born to single mothers

He does have some good points. However I disagree that it was just the Boomer generation. I think the next couple generations were just as guilty as the Boomer generation.

The Greatest and the Silent generations paved the way.

It's funny because I do think that people have a tendency to get tired/bored with each other and go their own separate ways. It would be interesting to see what the divorce rate was when the boomers were in their 20s thru their 40s. I'm just guessing that it would be a lot lower. I think it's sad to see a couple to stay together until they're in their 60s and then get divorced.

@stollcpa might want to have a word with you.

There’s no comps like the present because of social media and tech. I’m one hundred percent certain my ex stoker would be unhappily with me absent instagram and keeping contacts etc. easy to monkeybranchIt's funny because I do think that people have a tendency to get tired/bored with each other and go their own separate ways. It would be interesting to see what the divorce rate was when the boomers were in their 20s thru their 40s. I'm just guessing that it would be a lot lower. I think it's sad to see a couple to stay together until they're in their 60s and then get divorced.

Conservatives Against Capitalism: From the Industrial Revolution to Globalization Hardcover – August 8, 2017

by Peter Kolozi (Author)

Few beliefs seem more fundamental to American conservatism than faith in the free market. Yet throughout American history, many of the major conservative intellectual and political figures have harbored deep misgivings about the unfettered market and its disruption of traditional values, hierarchies, and communities. In Conservatives Against Capitalism, Peter Kolozi traces the history of conservative skepticism about the influence of capitalism on politics, culture, and society.

Kolozi discusses conservative critiques of capitalism―from its threat to the Southern way of life to its emasculating effects on American society to the dangers of free trade―considering the positions of a wide-ranging set of individuals, including John Calhoun, Theodore Roosevelt, Russell Kirk, Irving Kristol, and Patrick J. Buchanan. He examines the ways in which conservative thought went from outright opposition to capitalism to more muted critiques, ultimately reconciling itself to the workings and ethos of the market. By analyzing the unaddressed historical and present-day tensions between capitalism and conservative values, Kolozi shows that figures regarded as iconoclasts belong to a coherent tradition, and he creates a vital new understanding of the American conservative pantheon.

Editorial Reviews

We’ve long known that European conservatives have been ambivalent about, if not hostile to, capitalism. What Peter Kolozi has uncovered is an entirely American tradition of conservative ambivalence about capitalism. Although most people assume that American conservatives have always been committed to laissez-faire capitalism, Kolozi shows that up until recently, many conservatives in the United States were deeply uneasy about the Ayn Rand/Paul Ryan view of the world. The result is an astonishing and exhilarating feat of intellectual recovery―and a sense of just how peculiar and unprecedented is the current embrace of the free market on the right. -- Corey Robin, Brooklyn College and the CUNY Graduate Center, author of The Reactionary Mind: Conservatism from Edmund Burke to Sarah Palin

Conservatives Against Capitalism provides a rich, thorough, and thoughtful treatment of an understudied strain of American intellectual life, namely that of self-defined conservatives who are critical of capitalism and of market relationships. Kolozi argues that these conservative thinkers have often been far more sympathetic toward the state than the stereotypical idea of the Republican Right would suggest. Recognizing this tradition gives a much fuller sense of conservatism’s role in American politics and illuminates tensions on the right today. An important contribution to the field. -- Kimberly Phillips-Fein, NYU-Gallatin, author of Invisible Hands: The Making of the Conservative Movement from the New Deal to Reagan

Of course they don't have standards - they let me in!I didn’t think it was that competitive. My buddy’s son got in at Illinois State and it wasn’t an ordeal.

He did it, too, at IU. I always joke with him that the army must have no standards.

I think - not sure - there are at least a couple type 'scholarships' available. One used to be just for books that anyone could qualify for if they signed up for ROTC classes, but no commitment after graduation. The other is a full scholarship, where you're committed to 6 years of service (a couple of which may be Reserve) after you graduate.

Of course, things change and I could be completely off base about how it is today.

You want to present charts instead of admitting your naivete about what you wrote. Your claim that Boomers generated unrealistic gains from 1980 to present is ridiculous. EVERY 44 year period, there have been gains in wealth. That's not a 'theory' - that's a fact.Do you have any understanding of basic economics and finance? Have you ever looked at data to support your theory? Milton Friedman is rolling in his grave.

First off, asset prices and interest rates are inversely correlated. That's not debatable. It's proven by financial theory and is accepted as fact. If you have a 40 years stretch where interest rates have come down, asset values are conversely going to increase for a massive amount of time.

Between 1965 and 1980, bonds outpaced stocks in returns only three years (70, 71, 76). Between 1981 and 1996, bonds outpaced stocks eight times, despite materially higher stock market returns (903% vs. 165% for S&P 500).

That trend continued far beyond 1996, but you get the point. It was literally impossible to not make boatloads of money. People made money over time in the 60s and 70s, but nowhere near what they did in the 80s, 90s, 00s, and 10s, which was when Boomers were in their prime.

Secondly, you are sorely mistaken if you think I am the one impacted right now. I bought a house, by choice, last November, in an area that I wanted, because I could. Many of my peers do not have the same earnings power nor ability to do so.

That being said, I WILL BE impacted because of your stupid generation Dan. You haven't saved enough for retirement, you have run up the largest debt in our history and you did all of that on the back of the lowest tax rates among any generation. That means my ass has to bail your poor, obese ass out because you selfish losers were unable to leave this world better than you came into it.

We should have let COVID do its job.

By the way, the stock market took a 25% dump in 1987 - the largest since the Depression, again took a dump in 2000, and again in 2008. It wasn't the wonderful bed of roses you'd like to think. Most of the reason wealth increased was due to the internet. That's not a 'Boomer' issue - it's technology. Maybe you should learn a little history instead of theories.

Yes, I do have a 'basic' understand of economics and finance - one of my degrees is in Economics and History, and I am quite comfortable in retirement due to hard work, long-term investment, and not wallowing in the self-pity your generation is involved in.

Last edited:

Speaking of wealth transfers. Biden wants to tax capital gains to the point where investing is basically worthless.

This shouldn’t have any negative repercussions.

Here's detail

Biden Capital Gains Rate Proposal: 44.6%?

The number being bandied about is 44.6%, which would be the highest formal federal capital gains rate since its inception.

www.forbes.com

www.forbes.com

Our first house was $39k, 3 small BR and 1 Bathroom. Basic. But we also weren't making half of that. Add in the 15% mortgage and we were sweating making the payment. And, contrary to what JDB claims, I actually took a loss on it when I sold it 6 years later because the housing market still sucked.Our first mortgage wasn't that bad but I remember my older brother saying they had to pay 17%. On the other hand, our first house cost $31,000. It was a very nice small 2 bedroom house.

I can remember thinking that if I EVER make $1000/month I'm gonna be rolling in money. 🤣

You want to present charts instead of admitting your naivete about what you wrote. Your claim that Boomers generated unrealistic gains from 1980 to present is ridiculous. EVERY 44 year period, there have been gains in wealth. That's not a 'theory' - that's a fact.

I'm not sure you're even capable of reading charts, graphs or data. You seem like the type of guy that excelled at bullshitting his way through life as an insurance broker.

No, I don't believe it's all hard work. Some luck is involved, but work was instilled in most of us at an early age and we didn't expect to live like our parents right out of college.The problem with the boomers is that they all believe it was just hard work and intelligence that got them what they have. It wasn't. It was mostly pure luck of being born at the most opportune time.

The Boomer generation monetized the internet and developed greater technology. Be grateful that we had such entrepreneurs and risk-takers and geniuses in our generation.

And music - it's by far better than anything your generation calls music today.

*spit*

Last edited:

@JamieDimonsBalls @DANC im going to go ahead and pull the plug on this back and forth. That’s enough. We are on the same team. Move onI'm not sure you're even capable of reading charts, graphs or data. You seem like the type of guy that excelled at bullshitting his way through life as an insurance broker.

Similar threads

- Replies

- 37

- Views

- 616

- Replies

- 20

- Views

- 567

- Replies

- 3

- Views

- 463

- Replies

- 49

- Views

- 2K

ADVERTISEMENT

ADVERTISEMENT