Nice post: My point is this. During the negotiations opponents of the plan said that there would not be any benefits for average people. Of course everyone knew that was not the case but that was the rhetoric. Now there are some examples of pay increases and bonuses. Any entry level accountant can look at an income statement and determine the impact of the tax reduction on prior year's performance....and it is significant. Are some of the bonuses politically motivated ? Yes! Does that matter to the people getting the bonuses? No! Read their posts here. Was the basis for doing the tax reductions to repatriate offshore money? Repatriation was ONE of the expected outcomes. The bottom line is that businesses are getting huge tax cuts and have no excuse not to respond. Is the labor market tightening and pushing up demand for labor? Absolutely! It’s good to see the beginning of it. Even the most liberal news people are reporting they anticipate a huge impact:

https://www.cnbc.com/2017/12/20/this-is-just-the-start-of-companies-increasing-spending.html

So...are,most people going to see some benefit? Yes, and it is just beginning and that is my point.

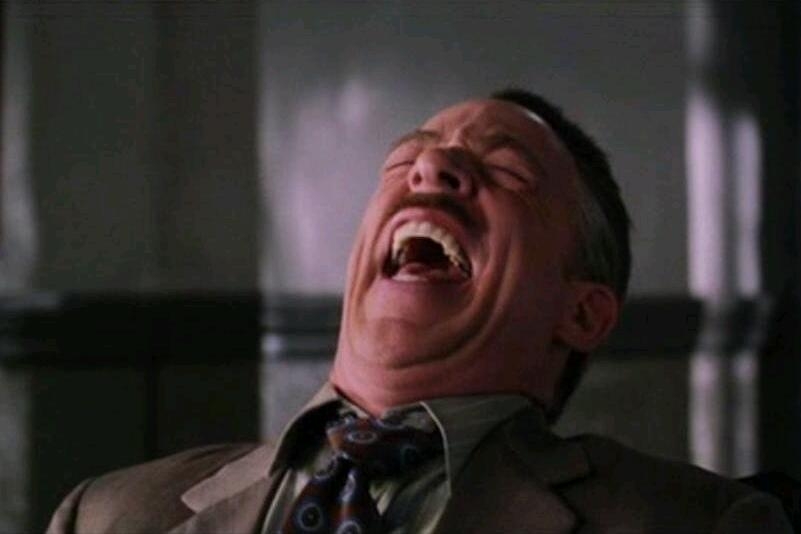

Thanks for letting me know that only the GOP rich will get tax breaks. I didn’t realize there were no rich Dems but Oh! I bet Nancy and George are laughing all the way to the bank with their tax cuts while blaming the Reps for catering to the rich.