I'm leaning back toward renting after my last year. Stupidity has cost me 100k plus on an 'as is' purchase. Did I say it was stupid? Then, right after I purchased early last year the interest rates begin to climb. I'm hoping someone is as stupid as me and buys it. At least they'll get damn near a brand new house and I just might get my money back.Sure. Of course that's always the main financial argument for owning vs renting. Fixed housing cost that should theoretically get cheaper each year as inflation eats away.

Congrats on the payoff

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High School

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Has anyone here stretched for their primary residence?

- Thread starter JamieDimonsBalls

- Start date

Sure. Of course that's always the main financial argument for owning vs renting. Fixed housing cost that should theoretically get cheaper each year as inflation eats away.

Congrats on the payoff

I wonder how taxes figured into that? One could look into simple tax rates, but I suspect the full tax picture with all ancillary fees that are tacked on for phones, TV, internet, gas, etc would render a much lower take home amount today than in 1983.

Might be some studies on it but I am too lazy.

That’s a great point. But I think the add-on fees are typically optional to a point. Even if they are modern necessities, they certainly allow for a higher standard of living so it’s not exactly apples to apples.I wonder how taxes figured into that? One could look into simple tax rates, but I suspect the full tax picture with all ancillary fees that are tacked on for phones, TV, internet, gas, etc would render a much lower take home amount today than in 1983.

Might be some studies on it but I am too lazy.

But yeah, I can’t imagine not having a cell phone or cable tv or internet in this day and age.

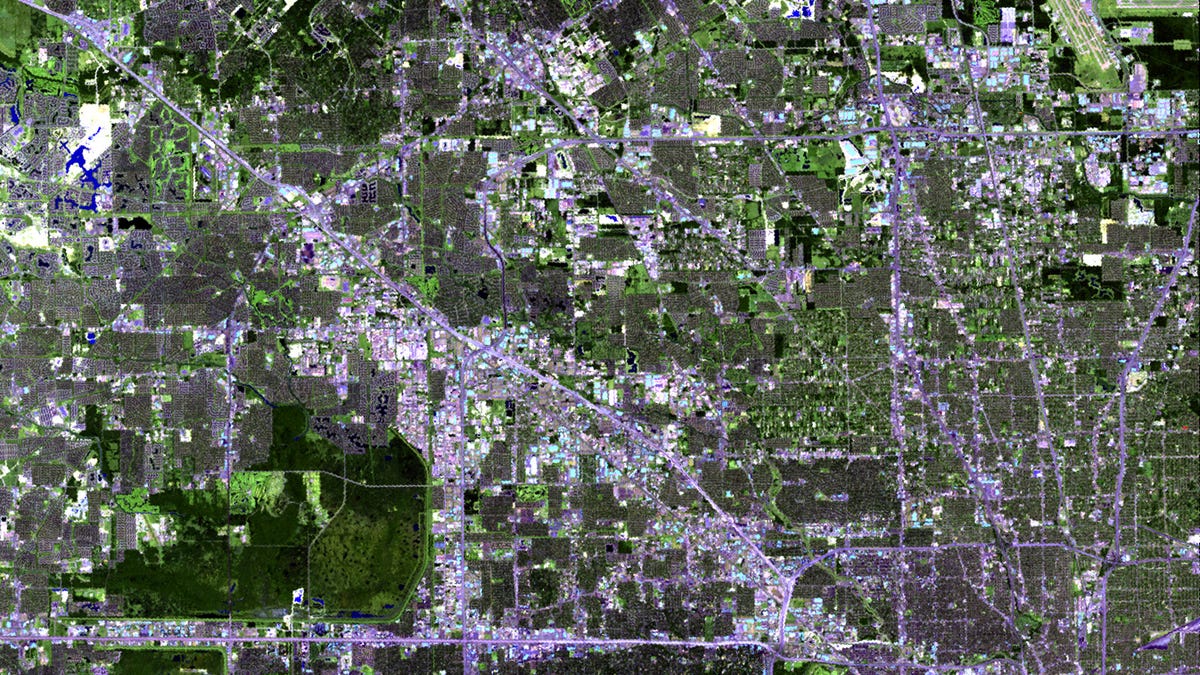

From what I can see it's not the housing/insurance that is the main problem, it's the 50 year old infrastructure and the counties trying to recoup their costs from damages by way of taxes. Florida, with all the good, hasn't planned well in this area. Ian was a great indicator that the 'building strip mall after strip mall and 500 unit apartment complexes on massive marshlands' has not played out too well. Water has a way of doing whatever the hell it wants.

Ask Houston about Harvey. The Army Corp of Engineers warned them, but they didn't listen either.

Houston’s flooding shows what happens when you ignore science and let developers run rampant

The city's gung-ho approach to development has destroyed the area's natural ability to drain away hurricane floodwaters.qz.com

There are a couple of sane politicians down here trying to talk some sense into their clientele, but they're not listening. Flagler County also lost a pissing match with the Army Corp of Engineers over who was responsible for the dredging of the intercoastal waterways, so Flagler county taxes have skyrocketed. My son's went up almost 4k from '22 to '23.

On the insurance side it's been a cluster since Andrew in '92. If you like torturing yourself, here's a wiki page on the timeline and details...https://en.wikipedia.org/wiki/Citizens_Property_Insurance_Corporation

The roofing fiasco has been quite interesting to be a part of as well. It's how we ended up with Citizens (Insurance). They offer insurance for rejects. No insurer will cover a roof over 15 years old in Florida, so you get handed to Citizens, at 4k plus per year. For homeowner's insurance! So, we put a new roof on right after Ian, but Citizens ended up being cheaper than anyone else, because of Ian! Oh, well isn't home ownership grand!

I had read something that Citizens may run out of funds to pay claims.... and it can't go bankrupt like a regular insurance firm, so they will just basically assess every insurance policy in the state for the shortfall. I think they are OK now, but if another couple storms hit the state this year, and possibly they run dry?

My in laws have a condo on the beach in Ft Myers Beach that got hit hard by lan. They are still a ways away from getting the building back online. My FIL is on the board, and what their coming insurance policies look like for the condo buildings and association is looking really, really bad. Like 3-4x what they were paying, and that's if they can even get anyone other than Citizens to underwrite it.

The whole thing just doesn't seem sustainable.

Jimmy Carter.....Yeah I think my parents had like a 12% mortgage at one point in late 70s/ early 80s.

Good call.Line play...They have a sh!tload of talent at all the skill positions, but I'm interested at how the OL and DL will be. He's a winner at everything he's ever done in football so I expect him to bring the Buffs back. IDK how long that will take though.

Yes… at age 48 we’d set a goal of $700K for a nice house in the Chicago suburbs. Came across a GREAT house for $925K and just couldn’t pass it up. Very glad I did. I refinanced 3 times over 8 years, managing costs and lowering interest. We put another $50K into and it was simply a great home in a great area. We had THE basement where our HS kids and their friends hung out - a huge benefit. Got transferred and sold it after 8 years for $1.2M. Timing has a lot to do with this… but in the end I pushed myself a bit and was very happy I did.

Makes sense. People need soapYes… at age 48 we’d set a goal of $700K for a nice house in the Chicago suburbs. Came across a GREAT house for $925K and just couldn’t pass it up. Very glad I did. I refinanced 3 times over 8 years, managing costs and lowering interest. We put another $50K into and it was simply a great home in a great area. We had THE basement where our HS kids and their friends hung out - a huge benefit. Got transferred and sold it after 8 years for $1.2M. Timing has a lot to do with this… but in the end I pushed myself a bit and was very happy I did.

Yes… at age 48 we’d set a goal of $700K for a nice house in the Chicago suburbs. Came across a GREAT house for $925K and just couldn’t pass it up. Very glad I did. I refinanced 3 times over 8 years, managing costs and lowering interest. We put another $50K into and it was simply a great home in a great area. We had THE basement where our HS kids and their friends hung out - a huge benefit. Got transferred and sold it after 8 years for $1.2M. Timing has a lot to do with this… but in the end I pushed myself a bit and was very happy I did.

This is what I should have done.

I fvcked up and we went in under ask and they ended up accepting an offer pretty close to. Not sure why they didn’t ask us for a best in final, but it’s gone.

There’s no coming back from it. We may not found a house we like as much for years.

There’s no coming back from it. We may not found a house we like as much for years.

Like you said, not everyone can live like @Lucy01 .

I think the OL shocked everybody. Sanders had all day and that dude is tremendously accurate. There is Heisman talent on that team btwn Sanders, Travis Hunter. Did you see Hunter played both ways and 151 snaps? It was 120 degrees on that field I have no clue how he did it.Good call.

Next week in Boulder will be electric. The corn and Buffs do not like each other. Crappy seats for that game start at 350 and saw some in the thousands.

Like you said, not everyone can live like @Lucy01 .

I said that?

That sucks!This is what I should have done.

I fvcked up and we went in under ask and they ended up accepting an offer pretty close to. Not sure why they didn’t ask us for a best in final, but it’s gone.

There’s no coming back from it. We may not found a house we like as much for years.

That sucks!

Being a finance guy is a blessing and a curse. I kept thinking from that lens instead of just doing it.

Been there.Being a finance guy is a blessing and a curse. I kept thinking from that lens instead of just doing it.

Yea but if it was a “CP Morgan style house” it might have fallen apart by now.Where in CO and what year was this? Half a mil might be low balling it.

"Looked Like".Yea but if it was a “CP Morgan style house” it might have fallen apart by now.

Thankfully no- I’ve never been house poor. I’m one that believes in not running up debt. These days with interest rates increasing maybe I need to rethink that strategy but also I want to retire within a few years- and most folks I know who went house poor came out better for it

Last edited:

It's hard to figure what you should do sometimes. What I mean is should you put your money in the market (or a slice of it) and buy a smaller house or is the house a better investment? I know a lot of people look at a house as an investment but I don't.... it's a place to live to me. Not saying that I am right it's just the way I look at it.Yes… at age 48 we’d set a goal of $700K for a nice house in the Chicago suburbs. Came across a GREAT house for $925K and just couldn’t pass it up. Very glad I did. I refinanced 3 times over 8 years, managing costs and lowering interest. We put another $50K into and it was simply a great home in a great area. We had THE basement where our HS kids and their friends hung out - a huge benefit. Got transferred and sold it after 8 years for $1.2M. Timing has a lot to do with this… but in the end I pushed myself a bit and was very happy I did.

Take her to have a look at Mark's place then maybe you can meet somewhere in the middle.And how did that work out?

I'm talking going 25% beyond your initial budget because you find "the one". The first mistake I made was allowing my wife ot convince me to look at a house that was that far beyond. Nothing else has been comparable after two weeks.

To me, a house/ real estate is an investment If and only if, you have the cash to invest. Do you borrow money to buy stocks as an investment? If you say no, then why would you for a house? Obviously there is no one answer fits all, but borrowing for something that can be gone tomorrow is a bad plan, IF the loss effects your life in anyway at all. Most people can't go pay cash ($750k) and then it just go poof.It's hard to figure what you should do sometimes. What I mean is should you put your money in the market (or a slice of it) and buy a smaller house or is the house a better investment? I know a lot of people look at a house as an investment but I don't.... it's a place to live to me. Not saying that I am right it's just the way I look at it.

Buy low, sell high, move up. THEN

Buy low, sell high, move again. THEN

............. If you can't get into real estate with at least 50% equity on day 1, you are not ready to have it.

I say this NOT because it CAN'T work out if everything goes perfectly to plan (it never does), I say this because it the chance of everything working to plan is 2%. Will you bet your next 30 years on 2% odds?

It's hard to figure what you should do sometimes. What I mean is should you put your money in the market (or a slice of it) and buy a smaller house or is the house a better investment? I know a lot of people look at a house as an investment but I don't.... it's a place to live to me. Not saying that I am right it's just the way I look at it.

That's the problem, I can't get the finance out of the decision. This wasn't about making a return. It shouldn't factor in whether or not the house is overpriced. It really should be, can we afford it and will that make the family happy.

No I don't but I wish I had about 10-15 years ago.😀Do you borrow money to buy stocks as an investment?

Actually I did borrow money to invest one time... but it wasn't risky. I could get a HELP loan at 2% so I borrowed $50,000 and invested it in a 6% CD,

I agree with that to a certain extent but I'd have to know what you mean by "can we afford it" because that means different things to different people. If it means we can afford it if we quit saving for the future, not having an emergency fund, and so on then I wouldn't agree. It's always been kinda difficult for me to balance the here and now with planning for the future so I'm not a burden on anyone and my spouse is taken care of because I tilt too much towards planning for the future too much.It really should be, can we afford it and will that make the family happy.

but those things aren't always stagnant. they can change. just by way of example, when i was married i was trying to decide whether i could afford a girlfriend too. i knew it wouldn't make the family happy at the time but they didn't need to know. and guess what? i was right. i could afford a girlfriend too. and for almost a year IT WORKED!!! well then the expenses changed. and so did the family's happiness. my daughter took to my stoker like a second mom and in truth likes her better than her own mom. those two were thick as thieves. but we all know what happened. so now i'm not with either of them BUT I PAY FOR THEM BOTH. and it's very expensive jdb. and the family isn't happy.can we afford it and will that make the family happy.

sometimes the grass isn't always greener. you guys are happy now. losing out on the uncertainty that attends that more expensive house isn't always a bad thing.

i don't think we're going to see a correction. remember what gave rise to 08. self employed guys went into their ged derelict mortgage buddy from high school and told him he makes $250k a year and wants a $600,000 house. six months later they couldn't afford the mortgages. foreclosures ensued and the market turned upside down.

people who bought during the inflated period of the pandemic may or may not have gotten a shitty deal, but they could afford what they bought. that is to say they were qualified. so again i think the nature of the market is very different than 08.

as for supply. i don't know what needs to be done to increase same. i don't really know much about that industry

This is Joe Biden’s America. In all seriousness I think this is the biggest issue america faces

This is Joe Biden’s America. In all seriousness I think this is the biggest issue america faces

She needs her family to get her a conservatorship!!

She needs a strong steady hand to guide her through all this. I see opportunity, Murt.She needs her family to get her a conservatorship!!

I’m gonna try and get into her dms. She’s the mess I needShe needs a strong steady hand to guide her through all this. I see opportunity, Murt.

This explains so much. Women who have abortions always turn into trainwrecks.She needs her family to get her a conservatorship!!

I don’t think that’s why. She was a young dumb kid who became the biggest star in the world and didn’t have the skills to handle it. That said she is really going to let it fly now. NAME NAMES BRIT!!!!

You should go for this. Think of all the press you would get, likely more than this Taylor Swift/KC Chief notoriety. You‘d be famous. You could get on The View, The Five, and Oprah. More business opportunities than you could handle.I don’t think that’s why. She was a young dumb kid who became the biggest star in the world and didn’t have the skills to handle it. That said she is really going to let it fly now. NAME NAMES BRIT!!!!

You’d just have to watch out for the knives. . . .but you’re not sleeping so well at night so you’d likely be okay.

and those are the type of business opportunities that actually interest me and that i want!You should go for this. Think of all the press you would get, likely more than this Taylor Swift/KC Chief notoriety. You‘d be famous. You could get on The View, The Five, and Oprah. More business opportunities than you could handle.

You’d just have to watch out for the knives. . . .but you’re not sleeping so well at night so you’d likely be okay.

Well, that and the crazy celebrity sex.and those are the type of business opportunities that actually interest me and that i want!

The Spears/McMurtry power couple alliance would take that gummy business to the moon!and those are the type of business opportunities that actually interest me and that i want!

Imagine a mellowed out, calm, sexy Brittany looking into the camera and saying "I owe it all to my handsome life partner's gummies. They've changed my life."

Similar threads

- Replies

- 19

- Views

- 647

- Replies

- 263

- Views

- 4K

- Replies

- 0

- Views

- 119

- Replies

- 18

- Views

- 1K

ADVERTISEMENT

ADVERTISEMENT