What does everyone predict?

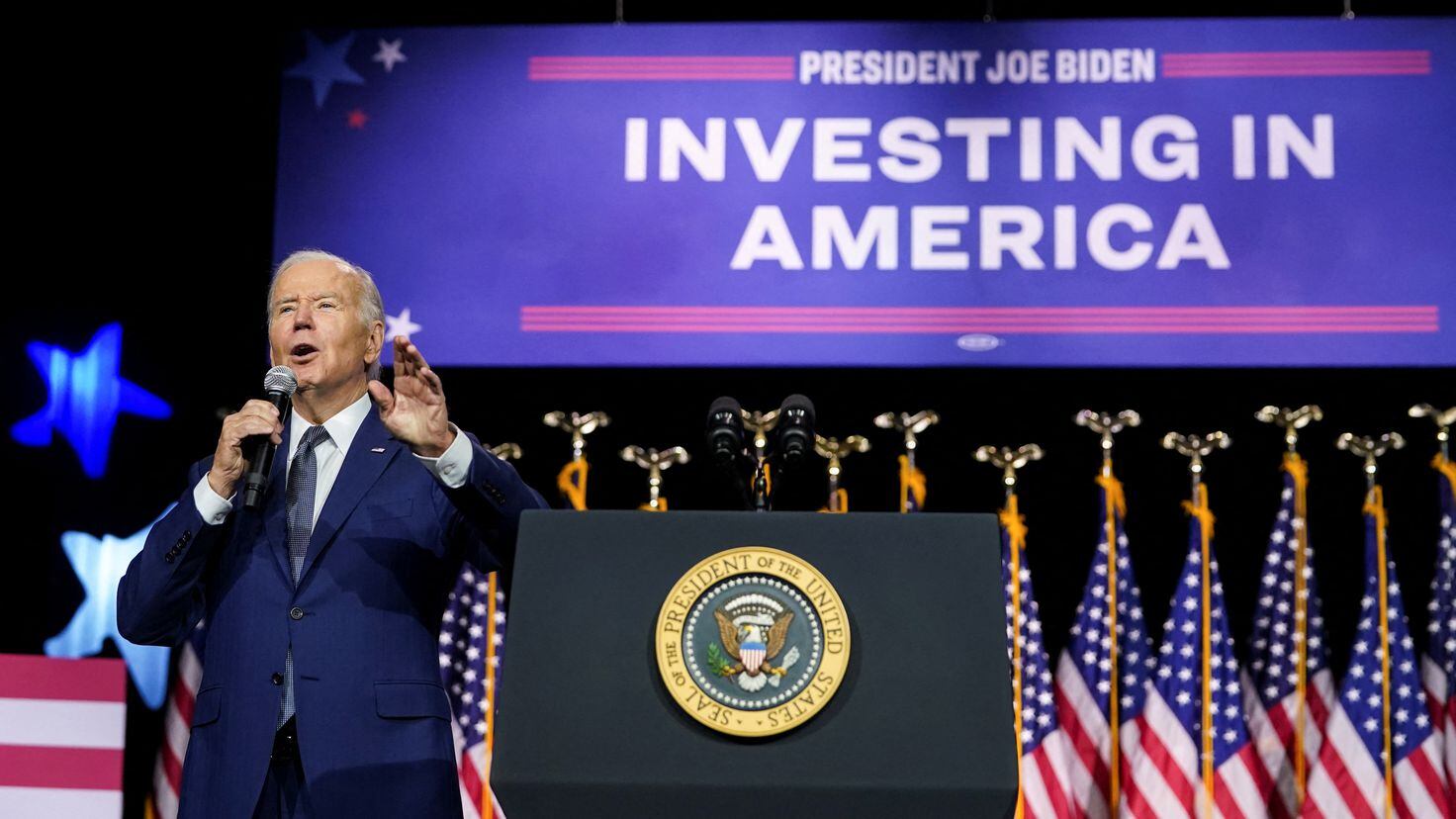

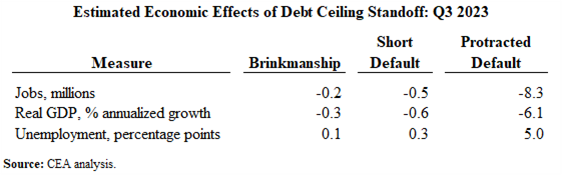

1) Biden/Senate say no to the House proposal and we default.

2) Biden/Senate accepts the Houses proposal and the debt ceiling is raised.

3) Biden/Senate say no to the House proposal, but do negotiate a compromise to raise the debt ceiling.

1) Biden/Senate say no to the House proposal and we default.

2) Biden/Senate accepts the Houses proposal and the debt ceiling is raised.

3) Biden/Senate say no to the House proposal, but do negotiate a compromise to raise the debt ceiling.

Last edited: