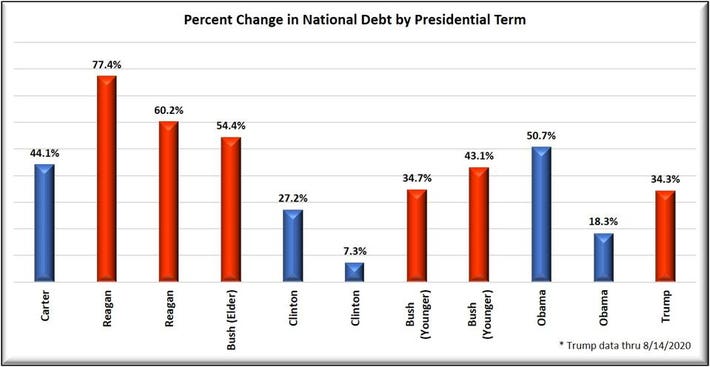

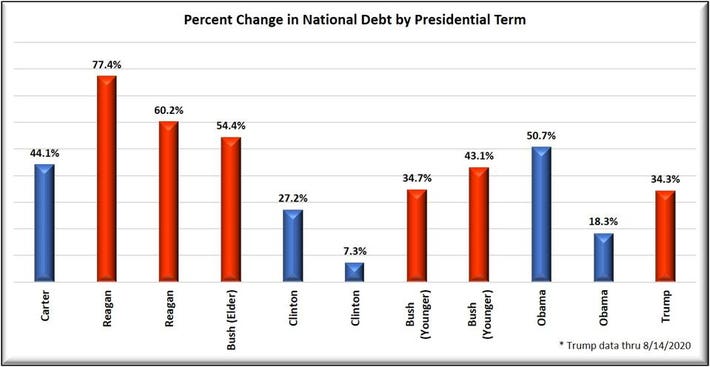

I gave you data. You just don’t like itYou clearly have never seen federal debt plotted- keep on with the feels, not the data

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High Schools

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

General John Kelly

- Thread starter Bowlmania

- Start date

And there are circumstances. Wilson and fdr. But the reality is gov spending is bipartisan historicallyAnd #2 and #3 are Trump and Bush. You know raw dollars doesn't mean much beyond recency.

Obama inherited the GWOT and Iraq/Afghanistan wars as well as the TARP bailout. I don't think Obama would have been Top 10 without them. Trump had COVID, Biden had COVID.

Kind of a shit run for the ol USA the last 20 years or so.

No you spit out a partisan take with zero verifiable data. Republicans own the bulk of debt since Reagan as trickle down always results in federal debt and every president since Reagan has tried to benefit the “the haves and the have mores- my base”I gave you data. You just don’t like it

Look it up. Number one dollars is Obama. Top two by percentage Wilson and fdr.No you spit out a partisan take with zero verifiable data. Republicans own the bulk of debt since Reagan as trickle down always results in federal debt and every president since Reagan has tried to benefit the “the haves and the have mores- my base”

I think buried in the back and forth is why the federal government is paying for TARP bailouts and COVID bailouts. Especially TARP. Banks should have gone under and people should have suffered a little for their bad decisions. Only one side of that coin suffered, and it wasn't the banks.No you spit out a partisan take with zero verifiable data. Republicans own the bulk of debt since Reagan as trickle down always results in federal debt and every president since Reagan has tried to benefit the “the haves and the have mores- my base”

COVID, somewhat the same. Why have nearly 90% of PPP loans been forgiven?

By percentage of GDP is meaningful again but even if you look at federal debt over time Reagan started the exponential growth- it’s not debatable. And you yourself admit trickle down economics don’t work, and My Man Mitch Daniels confirms and that is why he was canned from Director of OMB by W Bush. Daniels told W Bush the numbers didn’t add up- they haven’t for a single Republican president since Reagan. How many data points are needed? I’m older than you, I might get social security but you better save hard and find a career with a pension, we are broke AFLook it up. Number one dollars is Obama. Top two by percentage Wilson and fdr.

Yeah I don’t believe in trickle downBy percentage of GDP is meaningful again but even if you look at federal debt over time Reagan started the exponential growth- it’s not debatable. And you yourself admit trickle down economics don’t work, and My Man Mitch Daniels confirms and that is why he was canned from Director of OMB by W Bush. Daniels told W Bush the numbers didn’t add up

Obama inherited the GWOT and Iraq/Afghanistan wars as well as the TARP bailout. I don't think Obama would have been Top 10 without them. Trump had COVID, Biden had COVID.

Kind of a shit run for the ol USA the last 20 years or so.

Well.....yeah. So, do we get the millionaires and billionaires to pay back their PPP loans?

YES. With interest.Well.....yeah. So, do we get the millionaires and billionaires to pay back their PPP loans?

percentage debt contributions, per administration, from Forbes

Reagan 1 >Reagan 2 >GHWBush >Obama 1 >Carter >GW Bush 2 >GW Bush 1 >Trump >Clinton 1 >Obama 2 >Clinton 2

Reagan 1 >Reagan 2 >GHWBush >Obama 1 >Carter >GW Bush 2 >GW Bush 1 >Trump >Clinton 1 >Obama 2 >Clinton 2

And there are circumstances. Wilson and fdr. But the reality is gov spending is bipartisan historically

what i find amusing/pathetic, is that those running hardest on lowering the debt, also run hardest on lowering taxes, as their 2 primary political agendas.

we live in a true idiocracy.

what i find amusing/pathetic, is that those running hardest on lowering the debt, also run hardest on lowering taxes, as their 2 primary political agendas.

we live in a true idiocracy.

Nothing wrong with lowering taxes for those not making 6 figure salaries. But lowering taxes disproportionately in favor of the top wage earners is indeed idiotic and explained only by the politicians themselves benefitting from it.

Nothing wrong with lowering taxes for those not making 6 figure salaries.

There's everything wrong with that. Everyone needs to pay his "fair share", including poor bastards like me and the vast number of people in the middle.

By fair share, you mean the same amount, considering we enjoy the same benefits from our tax money, right?There's everything wrong with that. Everyone needs to pay his "fair share", including poor bastards like me and the vast number of people in the middle.

Sure if that means blowing the caps off of SS/Medicare taxes. You know…for the percentage. And poor people will always benefit more from tax revenues. But, then again, they’re poor which is harder than being rich.By fair share, you mean the same amount, considering we enjoy the same benefits from our tax money, right?

Should capital gains taxes more closely resemble income taxes?

Jets acting like a big baller.By fair share, you mean the same amount, considering we enjoy the same benefits from our tax money, right?

Stoll.Define a “big baller”…

😎

Couple things. When Mark said fair share and you equated that to same amount, that goes against a progressive tax system. He was simply saying everyone should pay something.Define a “big baller”…

In fairness to you, I first read your "our tax money" as talking down to Mark. Rereading, I don't think that was your intent.

I'll never define big baller or rich. It is a relative term. Most Americans would define me as rich, but believe me I know people with real money would consider me a piss ant. All a matter of perspective .

Ask @mcmurtry66. Better wear bigger pantsDefine a “big baller”…

This is true, Stoll is a baller.Stoll.

😎

The Democrat whining about tax cuts for the rich has the same credibility as those on Martha’s Vineyard saying “all are welcome here”. The rich democrats screamed bloody murder when Trump’s tax reform capped the state and local tax deduction which cap hit the wealthy right in the snout.Nothing wrong with lowering taxes for those not making 6 figure salaries. But lowering taxes disproportionately in favor of the top wage earners is indeed idiotic and explained only by the politicians themselves benefitting from it.

That is so weak. I doubt you really believe your own argument. Surely you realize the primary intention of capping the state and local tax deduction was a shot at blue states as opposed to trying to hit the wealthy in the snout.The Democrat whining about tax cuts for the rich has the same credibility as those on Martha’s Vineyard saying “all are welcome here”. The rich democrats screamed bloody murder when Trump’s tax reform capped the state and local tax deduction which cap hit the wealthy right in the snout.

Sure, it was targeted at blue states, but it's the kind of tax policy Democrats have advocated for over and over again. It only hits "the rich." It's making "the rich" pay more of their "fair share." Aren't you in favor of that?That is so weak. I doubt you really believe your own argument. Surely you realize the primary intention of capping the state and local tax deduction was a shot at blue states as opposed to trying to hit the wealthy in the snout.

Sure, it was targeted at blue states, but it's the kind of tax policy Democrats have advocated for over and over again. It only hits "the rich." It's making "the rich" pay more of their "fair share." Aren't you in favor of that?

it didn't only hit the rich, that's a beyond stupid thing to say.

making the rich pay a more equitable share of the tax burden relative to their totally out of whack disproportionate share of the nation's wealth and earnings, isn't rocket science.

you just tax them as the Eisenhower administration did, and tax investment earnings the same as earnings from labor.

your next intelligent post, will be your first ever.

your next honest post, will be your first ever.

not a good track record to have.

You’re beyond stupid. Why do you post?it didn't only hit the rich, that's a beyond stupid thing to say.

making the rich pay a more equitable share of the tax burden relative to their totally out of whack disproportionate share of the nation's wealth and earnings, isn't rocket science.

you just tax them as the Eisenhower administration did, and tax investment earnings the same as earnings from labor.

your next intelligent post, will be your first ever.

your next honest post, will be your first ever.

not a good track record to have.

The wealthy bitched about it because that limit hit them where it hurts, in their bank accounts. As far as the blue state thing is concerned, why should the US treasury subsidize high blue state taxes?That is so weak. I doubt you really believe your own argument. Surely you realize the primary intention of capping the state and local tax deduction was a shot at blue states as opposed to trying to hit the wealthy in the snout.

Why aren’t those blue staters willing to pay their fair share?That is so weak. I doubt you really believe your own argument. Surely you realize the primary intention of capping the state and local tax deduction was a shot at blue states as opposed to trying to hit the wealthy in the snout.

They should pay their fair share.

The wealthy bitched about it because that limit hit them where it hurts, in their bank accounts. As far as the blue state thing is concerned, why should the US treasury subsidize high blue state taxes?

Why aren’t those blue staters willing to pay their fair share?

They should pay their fair share.

you guys are either totally ignorant, totally dishonest, or both.

blue states heavily subsidize red states financially, and i'm guessing you both already knew that..

why can't lazy freeloading conservative red states start carrying their own share of the load?

The blue states subsidize red states talking point is as phony as a three dollar bill. People pay taxes, not states. It shouldn’t be a surprise that rich taxpayers subsidize other people and that a helluva lot of rich people live in blue states. And guess what? Biden wants to make the subsidy more pronounced as he still doesn’t believe rich taxpayers pay their fair share.you guys are either totally ignorant, totally dishonest, or both.

blue states heavily subsidize red states financially, and i'm guessing you both already knew that..

why can't lazy freeloading conservative red states start carrying their own share of the load?

Last edited:

A

anon_108jmb6yxelfn

Guest

I wish. If I were I would have given the waitress at Wings & Rings more than the $200 tip I have her Sunday night. 😂Stoll.

😎

On the subject of the rich paying more in taxes, the late Bruce Bartlett who was recognized by the Republicans as a top tax analyst during the Reagan years had the following to say...The blue states subsidize red states talking point is as phony as a three dollar bill. People pay taxes, not states. It shouldn’t be a surprise that rich taxpayers subsidize other people and that a helluva lot of rich people live in blue states. And guess what? Biden wants to make the subsidy more pronounced as he still doesn’t believe rich taxpayers pay their fair share.

The point is not to punish the rich for being rich — Republicans routinely scream class warfare whenever anyone suggests higher taxes on the rich — but to raise revenue. If the rich don’t pay more, everyone else will have to.

In his later years Bartlett became an advocate for the value added tax (VAT). This may still be the only way for us to reduce deficits with a system both Dems and Pubs may have to begrudgingly accept.

A couple of things.On the subject of the rich paying more in taxes, the late Bruce Bartlett who was recognized by the Republicans as a top tax analyst during the Reagan years had the following to say...

The point is not to punish the rich for being rich — Republicans routinely scream class warfare whenever anyone suggests higher taxes on the rich — but to raise revenue. If the rich don’t pay more, everyone else will have to.

In his later years Bartlett became an advocate for the value added tax (VAT). This may still be the only way for us to reduce deficits with a system both Dems and Pubs may have to begrudgingly accept.

First of all, to raise tax revenue, you must increase the thing to be taxed. To raise more excise tax revue on tires, the best way to do that is have people buy more tires. To raise income Tax revenue, you raise gross national income. Fooling areound with rates is not as useful.

Second, tax policy has morphed into a behavior modification tool. Electric cars is an easily understood example. But there are scores of examples in business and commerce we don’t feel as individuals, but the rent seekers spend big bucks on lobbyists for tax breaks.

Similar threads

- Replies

- 11

- Views

- 831

- Replies

- 46

- Views

- 2K

ADVERTISEMENT