The fruits of the Holy Spirit reveal hidden truths to earthly winners. The losers can only do the works of the Holy Spirit and hope for salvation by grace.Jesus said in Mathew 6: 19 “Do not lay up for yourselves treasures on earth, where moth and rust[a] destroy and where thieves break in and steal, 20 but lay up for yourselves treasures in heaven, where neither moth nor rust destroys and where thieves do not break in and steal. 21 For where your treasure is, there your heart will be also.

Someone once said none of us can take it (our money) with us when we die, but we can send it on ahead. Once we get to Heaven we find out that the most precious metal we have on Earth which is gold is something they use for asphalt up there.

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High Schools

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I didn't realize just how lousy a deal Social Security is . . .

- Thread starter Aloha Hoosier

- Start date

What is someone going to do with their money that is totally risk free? 2008 showed just sticking it in the bank. Jeremy Clarkson used some Swiss financial group that told him to move mass sums to AIG "advanced fund" for the richest of the rich because it was completely safe. Of course it wasn't.

Many workers may soon discover Social Security wasn't 100% safe.

Was the AIG fund insured by the government like a bank account is? I didn't follow the stream of AIG's bailout proceeds, but did any of that get to people like this?

It's not like the Boomers are intentionally raping the economy and telling their kids to fend for themselves.

That's exactly what they are doing. Let's not pretend things aren't exactly what you just described. Boomers are fatter and unhealthier than any prior generation, have massively under-saved for retirement and are going to cause a considerable amount of growth in SS and Medicare spending over the next two decades.

Running up massive debt and deficits while in power and who is going to pickup the bill? At some point, there is going to be a scenario where US Gov't Debt does not possess an appropriate risk/return profile and rates are going to appreciate considerably. That will result in higher taxation for the generations that are starting to generate reasonable incomes and wealth.

Just saying there was a time where IBM and P&G and the like were the gold standard because of solid returns. I do not know which is better.

I had buddies at P&G when their CEO made a big deal about them being a growth company. It seems crazy a huge and ancient firm like P&G trying to be growth, but that's what investors demand.

I am not sure which is better for employees.

I'm just pointing out the fact that there were plenty of debates and complaints about corporate dividends, buybacks, etc. that create shareholder wealth. As I've acknowledge before, although they may be prudent uses of capital for an individual company, they aren't likely going to be positive for the broader economy, at least in the long run.

Clarkson had a funny story. He learned congress approved a bailout and was excited, I think he was in America at the time but wherever he was he was thanking as many Americans as he could find.Was the AIG fund insured by the government like a bank account is? I didn't follow the stream of AIG's bailout proceeds, but did any of that get to people like this?

Then he discovered only Americans were eligible for the bailout funds

Clarkson had a funny story. He learned congress approved a bailout and was excited, I think he was in America at the time but wherever he was he was thanking as many Americans as he could find.

Then he discovered only Americans were eligible for the bailout funds

Politically I am miles from Clarkson but I find him hilarious. If I were born into one of the wealthiest families in Europe, I might be conservative too

He's trolling. He has no financial knowledge anyway.Why is it greedy to want SS when you've paid into it. I'll bet if you put money in a bank you expect it back. Would you be okay with letting the bank decide who to give the money back to and telling you "Sorry, we gave your money to person X since they needed it a lot worse than you did."?

Or did I misinterpret your meaning? :0

FYI - The President and Speaker of the House and Senate Leader Schumer are not baby boomers.That's exactly what they are doing. Let's not pretend things aren't exactly what you just described. Boomers are fatter and unhealthier than any prior generation, have massively under-saved for retirement and are going to cause a considerable amount of growth in SS and Medicare spending over the next two decades.

Running up massive debt and deficits while in power and who is going to pickup the bill? At some point, there is going to be a scenario where US Gov't Debt does not possess an appropriate risk/return profile and rates are going to appreciate considerably. That will result in higher taxation for the generations that are starting to generate reasonable incomes and wealth.

FYI - The President and Speaker of the House and Senate Leader Schumer are not baby boomers.

is that a good fact for Boomers? They don’t even have anyone qualified enough to be in charge

Clinton and W were boomers. So was Obama. Make of that what you will.is that a good fact for Boomers? They don’t even have anyone qualified enough to be in charge

Wasn't Schumer born in '50? The other two are notFYI - The President and Speaker of the House and Senate Leader Schumer are not baby boomers.

Was the AIG fund insured by the government like a bank account is? I didn't follow the stream of AIG's bailout proceeds, but did any of that get to people like this?

AIG was insuring so many of Goldman Sachs' and the other major Wall St bank's shorts, that Goldman Sachs took out insurance with a 3rd party in the event of AIG going bankrupt, which they thought it would.

the Fed bailed out AIG.

these were/are out and out crooks on a whole nother level than the world of thieves and crooks had/has ever seen before.

a movie script of this would be considered as too unbelievable to be taken seriously.

Yes, he was. He just acts like an old fogey.Wasn't Schumer born in '50? The other two are not

McConnell was born in 1942 - not a boomer.

Take your money as soon as you can.until I did some quick calculations this morning. I'm 59 and I'm thinking about retiring (again) at 62, give or take. So I logged into my social security account and saw that if I elected to get payments at 62 I'd bet almost $2100 a month and if I delayed to 70 I'd get almost $3100 a month. I and my employers have contributed more than $310,000 so far. If I stuffed that money in a closet every year and didn't earn a penny of interest I could take out $2100 a month for 12 years and $3100 a month for 8 years. If that was the case, SS looks OK. However, using an investment calculator and a conservative interest rate of 6% (well less than an investment in the stock market would average over 40 years) and under estimating my average contribution per year, my account would be worth more than $7 million. Using a ridiculously conservative rate of 3%, it would be worth $3.5 million. If I withdrew $2100 per month I'd be able to do that for 138 to 273 years (3% return and 6% return amounts) and $3100 a month for 94 to 185 years. Of course if I had either amount of that I'd probably take out much more. I could take out more than I actually currently make each month if I wanted to and it would still last many more years than I have left on earth. I could throw in a couple of long international vacations each year too without sweating it. I could play Pebble Beach a few times every year to boot. Obviously, I make and contribute more than most Americans (currently, but most of my life my income was below to just above average), but even halving the calculations the account would be worth far more than what the average American will receive in benefits for the remaining 15 to 20 years of his/her life. Doing the calculations with the average American's income also shows Social Security is a lousy deal as well.

I've said it many times, and I'm more convinced than ever, that Social Security is a good idea, but it was set up in a ridiculously inefficient way making it a lousy deal for the majority of Americans. Thrift Savings Plans (TSP) for all Americans would be far more efficient and would prove lucrative to probably 80 to 90 percent of Americans. It would also be sustainable and not threaten insolvency for our federal government. The remaining 10% could be provided minimum Social Security safety net benefit.

My TSP is worth nearly $400K to date and I couldn't even have one until at least half my military career was over because military weren't eligible for them until then. If I had been able to contribute since I joined the military in 1985 it would probably be worth a couple mil. If I could have contributed from my first paycheck until now - it would be worth millions (see first paragraph). Once again, Social Security is a lousy deal for the vast majority of us.

I think that varies person to person. Every person needs to consider:Take your money as soon as you can.

- Do you really need the money to live

- Your health (if your health is bad I'd say take it unless your spouse might need it to live after you have passed)

- Tax consequences (I'm in the process of converting traditional IRAs into Roth IRAs so I don't want the additional income)

Up front money is always the best money. Too often people outsmart themselves by accepting delayed money, even if you receive a marginally higher amount. The early retirement SS payment at age 62 is subject to an other earned-income offset. A full retirement at age 66 isn’t.I think that varies person to person. Every person needs to consider:

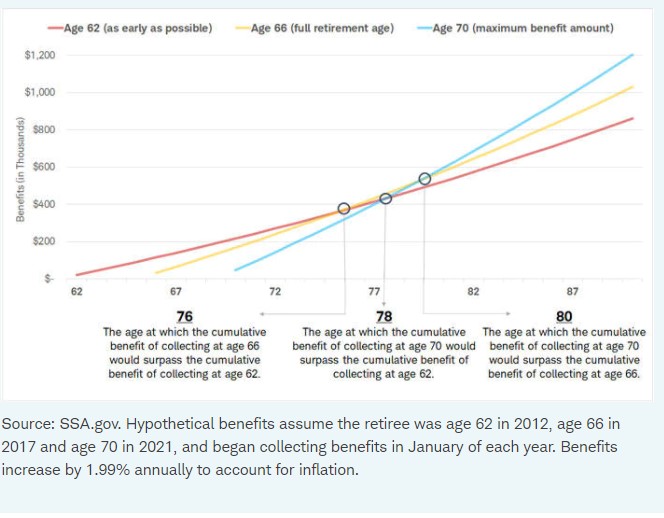

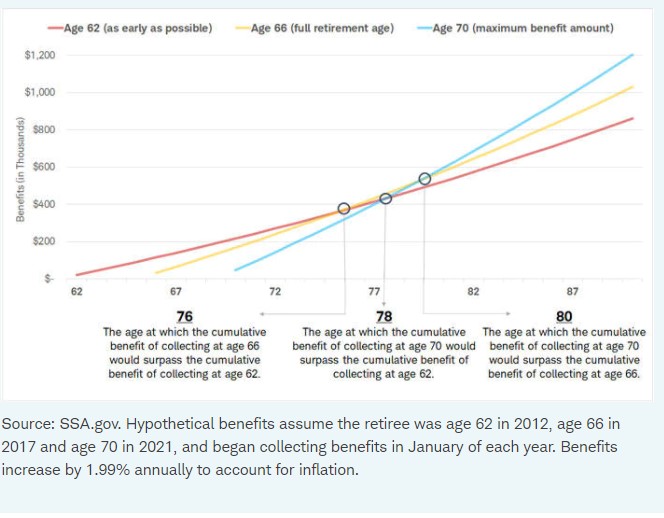

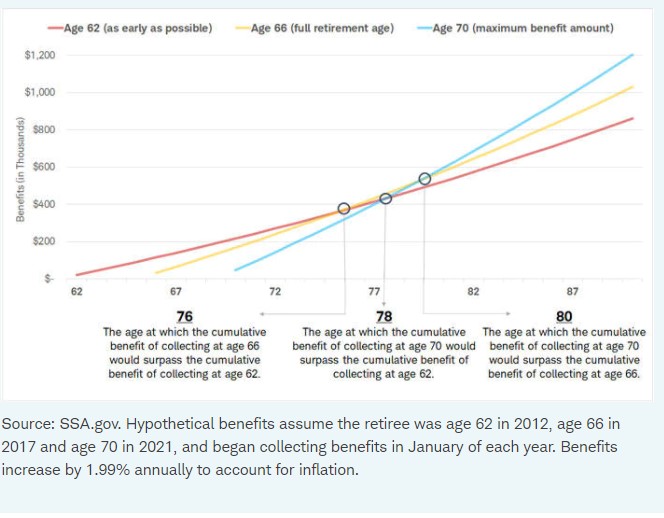

The one the the graph doesn't take into account is the fact that a person could take it at 62 and invest the money and if the market did good it would make the breakeven point later.

- Do you really need the money to live

- Your health (if your health is bad I'd say take it unless your spouse might need it to live after you have passed)

- Tax consequences (I'm in the process of converting traditional IRAs into Roth IRAs so I don't want the additional income)

I don't think it's that simple. There are other factors (I listed some) that are involved so I think it will vary from person to person. In general I agree with you but there are exceptions in my opinion.Up front money is always the best money. Too often people outsmart themselves by accepting delayed money, even if you receive a marginally higher amount. The early retirement SS payment at age 62 is subject to an other earned-income offset. A full retirement at age 66 isn’t.

This is the way I'm leaning if I'm fully retired. I won't be able to collect it if I'm not because I make too much so I'm thinking I'll start collecting immediately after I retire-retire.Up front money is always the best money. Too often people outsmart themselves by accepting delayed money, even if you receive a marginally higher amount. The early retirement SS payment at age 62 is subject to an other earned-income offset. A full retirement at age 66 isn’t.

I don't think it's that simple. There are other factors (I listed some) that are involved so I think it will vary from person to person. In general I agree with you but there are exceptions in my opinion.

The actuaries know what they're doing. In the aggregate, the system will pay out evenly. Individuals may or may not be winners or losers. It depends on whether or not they have a working crystal ball.

In my case, the 66 age worked out well. That was about my limit, physically and mentally, and the benefit hit a level that was sufficient while giving me the option to earn as much as I wanted without there being any hits.

Exactly... if you live a long time you'd be better off to wait if you can. What one person loses another person gains because like you say the actuaries know what they are doing. Some say a bird in hand is worth two in the bush and I would go along with that in most cases but not all.The actuaries know what they're doing. In the aggregate, the system will pay out evenly. Individuals may or may not be winners or losers. It depends on whether or not they have a working crystal ball.

In my case, the 66 age worked out well. That was about my limit, physically and mentally, and the benefit hit a level that was sufficient while giving me the option to earn as much as I wanted without there being any hits.

I've done the math on my social security payout and my breakeven would be just under 12 years at 62, just under 11 at 67 and 10'ish at 70. My dad passed away this year at 85 so waiting till 70 is out for me because there's no guarantee I'll make it that long. In actuality there probably won't be any waiting at all. My kids won't inherit uncollected social security money so my wife and I will probably both draw day one. Along with 401k's, Roth's,... we each have a pensions that we were grandfathered into, mine is beer and pizza money but her's is respectable, and we could live on just those and SS-$, she retired a year ago January at 60, I'll probably do the same this coming January. I probably could have retired this January but it's hard to believe you've got enough even if you have an advisor telling you, you do.The actuaries know what they're doing. In the aggregate, the system will pay out evenly. Individuals may or may not be winners or losers. It depends on whether or not they have a working crystal ball.

In my case, the 66 age worked out well. That was about my limit, physically and mentally, and the benefit hit a level that was sufficient while giving me the option to earn as much as I wanted without there being any hits.

We have known unknowns and unknown unknowns. Up front money deals with both. If one doesn’t need the money put it away. At least you‘ll have it under your exclusive control. Actuaries can‘t calculate all the intangibles and unknowns involved.I don't think it's that simple. There are other factors (I listed some) that are involved so I think it will vary from person to person. In general I agree with you but there are exceptions in my opinion.

I agree with your line of thinking. I’ve known too many people who died early into their retirement. We don’t know what tomorrow will bring so get what you can while you can.We have known unknowns and unknown unknowns. Up front money deals with both. If one doesn’t need the money put it away. At least you‘ll have it under your exclusive control. Actuaries can‘t calculate all the intangibles and unknowns involved.

There is a calculator on the SS website that estimates the expected monthly benefit if you began collecting SS at different ages. Of course, you will get a larger benefit at, say, age 68 than you would at age 66, but you have fewer remaining years to collect the higher benefit. Duh, everyone probably knows that.The actuaries know what they're doing. In the aggregate, the system will pay out evenly. Individuals may or may not be winners or losers. It depends on whether or not they have a working crystal ball.

In my case, the 66 age worked out well. That was about my limit, physically and mentally, and the benefit hit a level that was sufficient while giving me the option to earn as much as I wanted without there being any hits.

But I was curious which age-weighted benefits would yield the most total money over a person's remaining life. Would he earn more total money (not monthly benefit) over his remaining years if he waited till age 68 to begin collecting instead of age 66?

So, using the IRS life expectancy table on the IRS web site (the one you must use to figure the tax when you begin withdrawing from a tax-deferred IRA), I created an Excel spreadsheet to display the monthly benefits estimated for ages 66, 68 and 70, each multiplied by the corresponding remaining months shown on the life expectancy table.

All three yielded almost exactly the same total money.

Here's a question for the experts. I've heard that in planning on retirement the 4% rule is what one should use. But as you read along, people say that is outdated because safer retirement investments, bonds, are paying almost nothing. Others say keep the money invested in a wide variety and 4% is low.

So here's the question, what are people actually doing?

So here's the question, what are people actually doing?

Another factor to consider is political risk.I think that varies person to person. Every person needs to consider:

The one the the graph doesn't take into account is the fact that a person could take it at 62 and invest the money and if the market did good it would make the breakeven point later.

- Do you really need the money to live

- Your health (if your health is bad I'd say take it unless your spouse might need it to live after you have passed)

- Tax consequences (I'm in the process of converting traditional IRAs into Roth IRAs so I don't want the additional income)

In 2026, Trump and others were emphatically proposing new legislation to reduce Social Security benefits. Turns out he/they didn't follow through with the reductions, but we didn't know that then -- it was still a legitimate risk that should have been considered by anybody considering whether to begin claiming Social Security retirement benefits that year. (Trump is not the only politician to propose such reductions, by the way.)

There are a lot of bond mutual funds that pay a distribution yield of 4.5 to 5 % or higher. I don't know what bonds themselves are yielding but I would think it varies quite a bit.Here's a question for the experts. I've heard that in planning on retirement the 4% rule is what one should use. But as you read along, people say that is outdated because safer retirement investments, bonds, are paying almost nothing. Others say keep the money invested in a wide variety and 4% is low.

So here's the question, what are people actually doing?

Here’s the problem with that analysis If you die at the break even date, your heirs have money in the bank with taking money early. If you chose the wait until 70 option, they have zip. You have to not only outlive life expectancy to have a better lifetime income, you have to do much better to make up for the risk of not converting future income to a present time asset.There is a calculator on the SS website that estimates the expected monthly benefit if you began collecting SS at different ages. Of course, you will get a larger benefit at, say, age 68 than you would at age 66, but you have fewer remaining years to collect the higher benefit. Duh, everyone probably knows that.

But I was curious which age-weighted benefits would yield the most total money over a person's remaining life. Would he earn more total money (not monthly benefit) over his remaining years if he waited till age 68 to begin collecting instead of age 66?

So, using the IRS life expectancy table on the IRS web site (the one you must use to figure the tax when you begin withdrawing from a tax-deferred IRA), I created an Excel spreadsheet to display the monthly benefits estimated for ages 66, 68 and 70, each multiplied by the corresponding remaining months shown on the life expectancy table.

All three yielded almost exactly the same total money.

I agree. My analysis showed there is no advantage in waiting. Take the money and run (for most people).Here’s the problem with that analysis If you die at the break even date, your heirs have money in the bank with taking money early. If you chose the wait until 70 option, they have zip. You have to not only outlive life expectancy to have a better lifetime income, you have to do much better to make up for the risk of not converting future income to a present time asset.

Let's face it ... our whole life is a gamble so waiting on SS is just one more gamble. I took mine at 62.... the main reason is that I believe they'll start doing means testing one of these days and I'd be left out. And if they did do means testing they would reward the irresponsible people and punish the responsible people (that's the way the government works).I agree with your line of thinking. I’ve known too many people who died early into their retirement. We don’t know what tomorrow will bring so get what you can while you can.

The majority of people won't have a penny of what they've gotten because they will have spent it. I'm not concerned it my heirs anyway.. she's gonna be in good shape unless everything falls apart.Here’s the problem with that analysis If you die at the break even date, your heirs have money in the bank with taking money early. If you chose the wait until 70 option, they have zip. You have to not only outlive life expectancy to have a better lifetime income, you have to do much better to make up for the risk of not converting future income to a present time asset.

People that retire early also are going to be much more likely to enjoy the added income from say 62-75. I don't know many retirees that want to travel the world at age 88. Take the money and enjoy.We have known unknowns and unknown unknowns. Up front money deals with both. If one doesn’t need the money put it away. At least you‘ll have it under your exclusive control. Actuaries can‘t calculate all the intangibles and unknowns involved.

I really don't have any rules... don't really need to because we aren't using our savings. The pandemic really lowered our spending because we didn't go anywhere to spend any money.Here's a question for the experts. I've heard that in planning on retirement the 4% rule is what one should use. But as you read along, people say that is outdated because safer retirement investments, bonds, are paying almost nothing. Others say keep the money invested in a wide variety and 4% is low.

So here's the question, what are people actually doing?

I have read where instead of the 4% rule to use 3%.

But I read this not long ago too so who knows.

Sure, we should tax all political organizations too. Let's start with #BLM.Tax churches to pay for the shortage in future Social Security funds. Problem solved.

It is funny reading the board on the issue. Most Americans don't really have a good early opportunity. The site below lists median and average retirement amounts. Neither bodes well for early retirement. Fortunately, I'm above where the average or median person my age is, but even looking at my number's retirement might be feasible at 65 but I'm skeptical. The average American at 60 has $221,000. Let's assume that is $250,000 at 62. 4% rule is $10,000/year. The average family income in the US is around $70,000, which probably puts a person at $1500/month or so Social Security or $18,000 per year. So early retirement is $28,000/year at 62. Not a pretty sight. If it is a couple making the same money, $56,000/year. Livable, but not a lot of international travel.I really don't have any rules... don't really need to because we aren't using our savings. The pandemic really lowered our spending because we didn't go anywhere to spend any money.

I have read where instead of the 4% rule to use 3%.

But I read this not long ago too so who knows.

If you know of any bond mutual fund that pays 5% or higher, let's hear what it is.There are a lot of bond mutual funds that pay a distribution yield of 4.5 to 5 % or higher. I don't know what bonds themselves are yielding but I would think it varies quite a bit.

Quality corporate bonds aren't paying even 2%.

Similar threads

- Replies

- 2

- Views

- 246

- Replies

- 132

- Views

- 3K

- Replies

- 168

- Views

- 3K

- Replies

- 31

- Views

- 752

ADVERTISEMENT

Latest posts

-

-

-

-

Too bad our government totally ignored the Simpson-Bowles report.

- Latest: crazed_hoosier2

-

ADVERTISEMENT