Mostly agree. Now there are reasonable, logical, non-emotional arguments to be made about the impact that mass migration of low-skilled immigrants has on our economy/society as there is the same questions about what is the proper tax mechanism/rate for hyper-wealthy individuals. But it seems that people gravitate to those that eschew such arguments for the pathos-driven carnival barkers who like stigmatizing of "the other". And when you point out that's what they're doing, they will swear to you that it's justified by the threat posed by the other side and the need to protect those for whom their cause is dedicated..."the real Americans" or "the disenfranchised".Populism - whether from the far right or far left - is always the same thing. Emotional based arguments trying to blame the proverbial boogeyman (immigrants, the rich, etc...) for society's ills.

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High Schools

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Alexandria Ocasio-Cortez - Bringing Moral Courage to American Politics

- Thread starter iuwclurker

- Start date

Thanks for the clips.I'm not defending Scalise. Scalise, in this thread, is just a wutabout deflection from your original point, which seems to be that AOC is "intelligent and articulate."

But per the two I mentioned:

But there are tons of clips of her saying ridiculous things, and looking less that "intelligent and articulate."

Lots of people probably agree with whatever message it is she's carrying. I'm just not sure she's the best messenger.

Okay, the unemployment because people are doing two jobs sounds stupid although I have to admit I have no idea if unemployment statistics tease out that nuance or not.

Your second cherry pick:

is your whopper. You completely mischaracterized her point, which had to do not with offsets but with the societal costs of people without health insurance. That's a major problem. In fact, I've often argued that the root cause of our astronomical medical costs is that MBA America treats medicine like every other business insofar as trying to make every citizen their customer, that is, every citizen a patient. The medical industry is clearly the one industry which has to operate on the opposite paradigm -- the ultimate idealized goal being that no person is sick -- precisely because of the societal costs of sick people.You mean like, saving on funeral costs for people that won't die will help offset the cost of medicare for all?

Her point that medicare for all could cost less than our current system Rock has proved time and again, since our costs are more or less twice of all other systems in the world.

Overall, I see your point but I think she's pretty articulate and is trying to tell the truth. She just has some learning to do. Time will tell. If she's hard-core DSA, she's Fred to me.

Mostly agree. Now there are reasonable, logical, non-emotional arguments to be made about the impact that mass migration of low-skilled immigrants has on our economy/society as there is the same questions about what is the proper tax mechanism/rate for hyper-wealthy individuals. But it seems that people gravitate to those that eschew such arguments for the pathos-driven carnival barkers who like stigmatizing of "the other". And when you point out that's what they're doing, they will swear to you that it's justified by the threat posed by the other side and the need to protect those for whom their cause is dedicated..."the real Americans" or "the disenfranchised".

The reality is our economic systems have become very complex and intertwined....to the point that it's basically impossible for politicians to have any real clue what they are talking about....let alone the avg citizen who is busy living their own life. So it all is forced to evolve to simplistic talking points that are disjointed from any reality.

I'll leave it to Rock to blow your simplicities to smithereens. He's the one with a long list of tinkle-on conservative policies that have been implemented over the last four decades that created our current debt fiasco and wealth disparities.Krugman is a partisan hack.

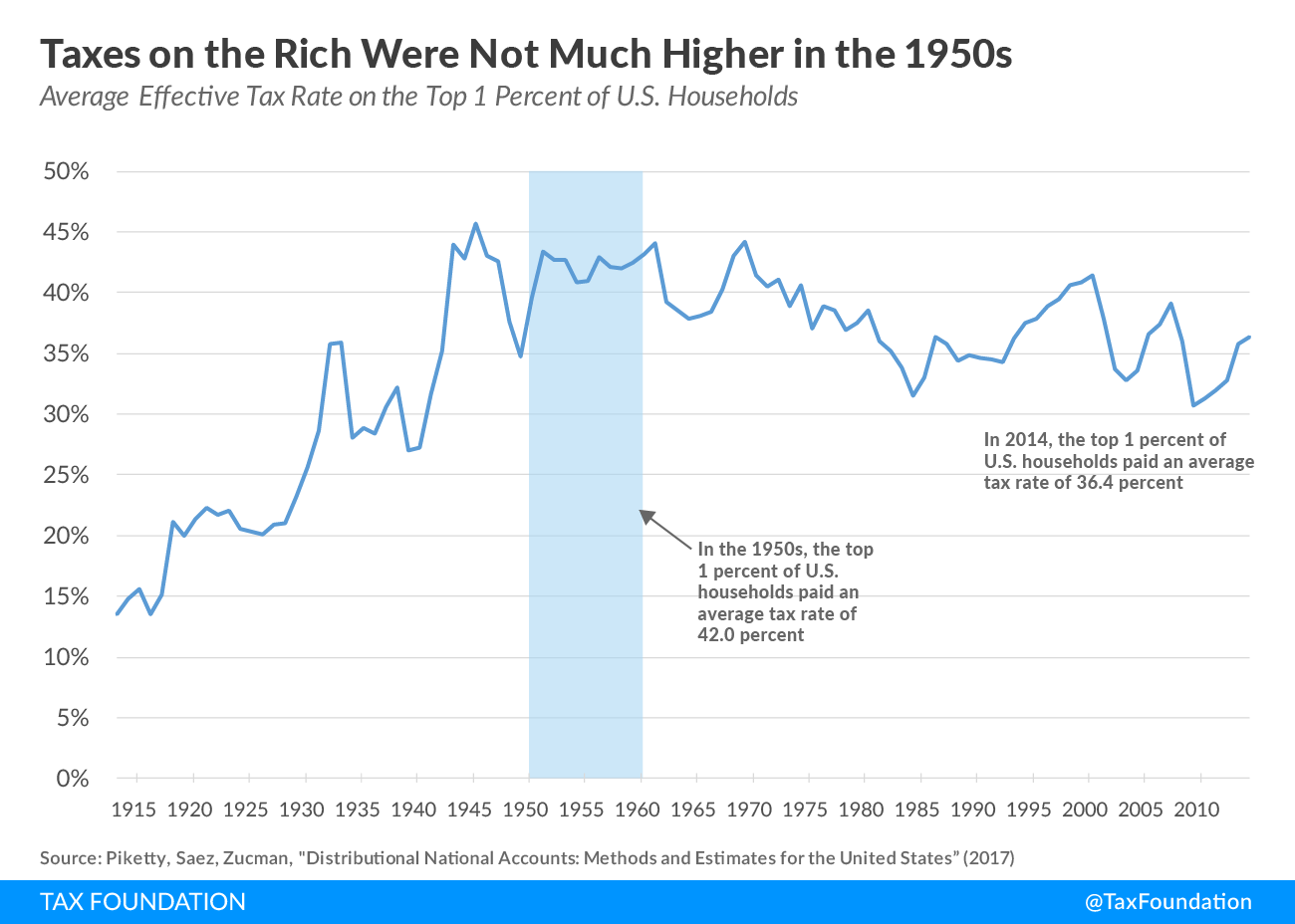

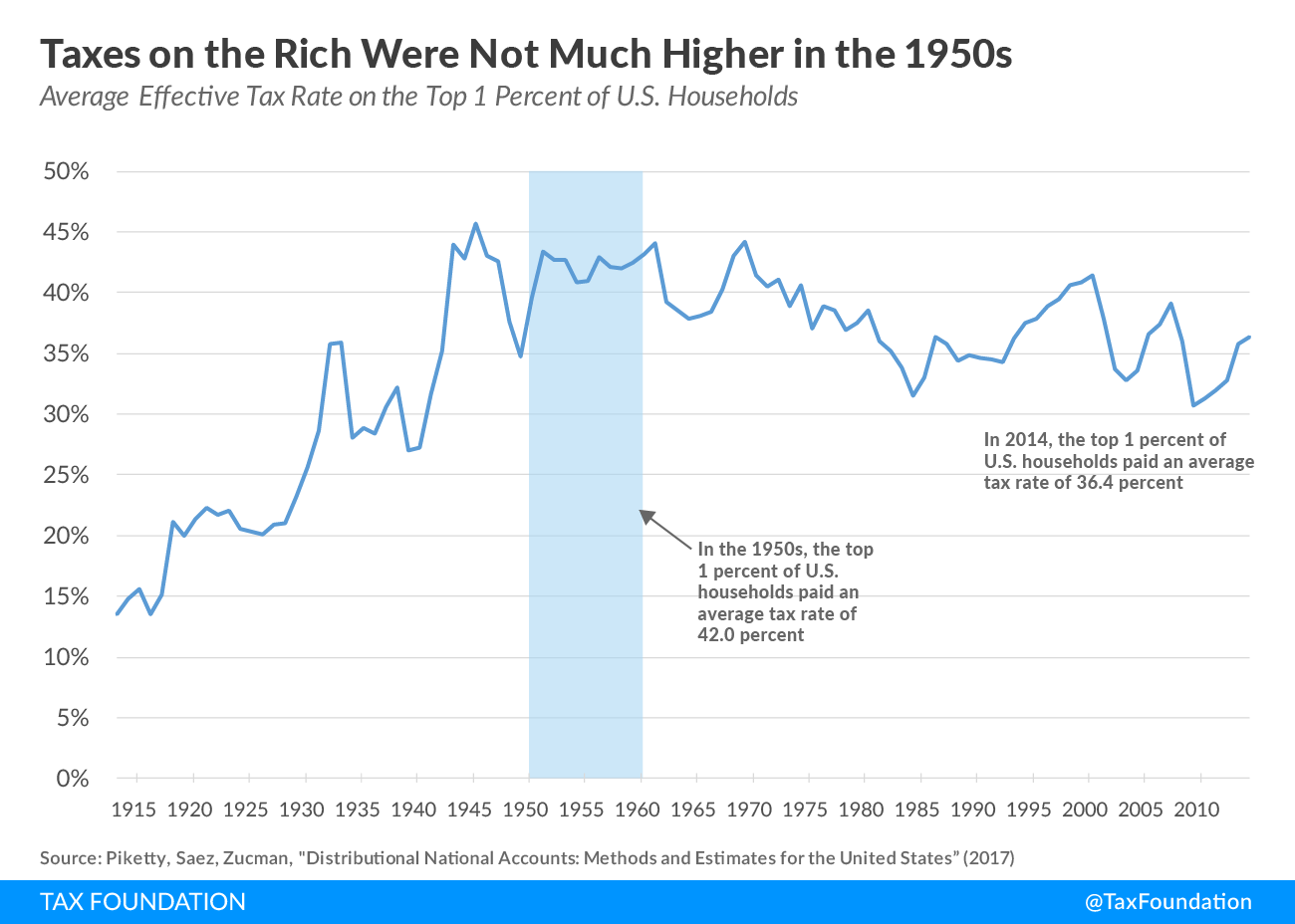

I posted this already....effective tax rates are a bit lower than 50+ years ago....but not substantially.

It bears repeating for the millionth time....individual tax policy is not the driver of growing wealth inequality. It's technology and automation. And to a lesser extent globalization.

No, I'm not proposing a wealth tax necessarily but it's clearly a possibility and if sober minds don't prevail then the pendulum swinging back to the left might lead to some radical changes. Right now sober minds are few and far between.

As for Krugman, do you have a link to your awards?

Lawyers, doctors, accountants, etc.... all face threats due to tech and automation. You can get legal work done online (or just

purchase pre-made docs, legalzoom.com, etc), have a doctor consult online, robots are performing surgeries, etc. Accountants have more and more of their work done by their software system, etc....

Having a professional job isn't owning capital. All you own is a job that may become more and more obsolete (or at least cheaper).

Right, but again it is happening at all levels. The only people exempt are professional athletes and investors. What are we going to do as a society when those are the only two money making sources available?

But more to the point of this discussion, should we continue to tax investment income far less than earned income?

Right, but again it is happening at all levels. The only people exempt are professional athletes and investors. What are we going to do as a society when those are the only two money making sources available?

But more to the point of this discussion, should we continue to tax investment income far less than earned income?

Yeah obviously there is going to have to be some shift in taxation structures as labor becomes more and more irrelevant

I'll leave it to Rock to blow your simplicities to smithereens. He's the one with a long list of tinkle-on conservative policies that have been implemented over the last four decades that created our current debt fiasco and wealth disparities.

No, I'm not proposing a wealth tax necessarily but it's clearly a possibility and if sober minds don't prevail then the pendulum swinging back to the left might lead to some radical changes. Right now sober minds are few and far between.

As for Krugman, do you have a link to your awards?

There is nothing simplistic about what I'm saying....re: automation and tech...and the appropriate policy solutions to adjust to their impact.

Two lines on a graph about top marginal rates and GDP? That would be beyond simplistic.... that if we just pushed up the top rate 6 points to what it's effective rate was 60 years ago all our issues would be solved?

our second cherry pick:is your whopper. You completely mischaracterized her point, which had to do not with offsets but with the societal costs of people without health insurance.

She said:

"We’re paying for this system," she said. "Americans have the sticker shock of health care as it is, and what we’re also not talking about is why aren’t we incorporating the cost of all the funeral expenses of those who died because they can’t afford access to health care? That is part of the cost of our system."

Is she suggesting that people will no longer die if we adopt medicare for all? Because last I was told, everybody is going to die sooner of later. So what exactly is her point about funeral costs, other than some nonsense she tossed at the wall?

She said:

"We’re paying for this system," she said. "Americans have the sticker shock of health care as it is, and what we’re also not talking about is why aren’t we incorporating the cost of all the funeral expenses of those who died because they can’t afford access to health care? That is part of the cost of our system."

Is she suggesting that people will no longer die if we adopt medicare for all? Because last I was told, everybody is going to die sooner of later. So what exactly is her point about funeral costs, other than some nonsense she tossed at the wall?

More people dying saves money on HC expenses....so that really is buffoonery.

Bullchit:

The wealthiest 1 percent of the world's population now owns more than half of the world's wealth, according to a new report.

The total wealth in the world grew by 6 percent over the past 12 months to $280 trillion, marking the fastest wealth creation since 2012, according to the Credit Suisse report. More than half of the $16.7 trillion in new wealth was in the U.S., which grew $8.5 trillion richer.

There's no doubt that a radical reallocation of wealth could pay down debt. The question has to do with the ramifications.

Well, I don't know what number we would have to reach to be "radical" in terms of enough wealth reallocation to actually pay down the deficit, but her 70% plan would account for an additional $72 billion dollars in tax revenue annually for the 10 year complete transition plan away from fossil fuels according to Business Insider.

https://www.businessinsider.com/ale...uld-supply-tens-of-billions-of-dollars-2019-1

To me that number seems way too small to come close to accomplishing her goal on that specific task. But considering that just the annual interest to service our deficit was $371 billion dollars, the tax rate over 10 million could be 80...90...even 100% and likely not make a dent in the deficit.

https://www.cbsnews.com/news/the-skyrocketing-interest-payments-on-u-s-debt/

From the above article our spending on debt servicing was $371 billion on net interest, while the Defense Department budget was $599 billion. Social Security benefits cost $977 billion, Medicare $585 billion and Medicaid $389 billion, according to the CBO estimates. This doesn't account for the rest of our annual budget/spending.

So again I ask, just how radical a tax increase without spending decrease will it take to pay down that deficit again?

Last edited:

Krugman was addressing a specific point, not generalizing the way you were. Of course, automation, tech, and globalization have created a new economic landscape, but it's the policies that allowed the wealth disparities to arise.There is nothing simplistic about what I'm saying....re: automation and tech...and the appropriate policy solutions to adjust to their impact.

Two lines on a graph about top marginal rates and GDP? That would be beyond simplistic.... that if we just pushed up the top rate 6 points to what it's effective rate was 60 years ago all our issues would be solved?

Krugman was addressing a specific point, not generalizing the way you were. Of course, automation, tech, and globalization have created a new economic landscape, but it's the policies that allowed the wealth disparities to arise.

Nothing about that was specific....it was two separate metrics with a pretense there was some correlation between the two. It's the kind of lazy crap Krugman fills his blog with, and why I quit reading it 10+ years ago. He quit being a serious economist at least that far back.... or before. Now he likes to get on tv.

Not sure how many times it will be ignored that effective Income tax rates haven't drastically changed whatsoever.

Simple people are fixated on the top marginal rate....while ignoring the only rate that matters - effective tax rates for the top.

Even the link above from Business Insider makes the same mistake....talking about 91% marginal rates in the 50s. Totally ignoring how much income could be shielded from any tax at all during those periods.

If we want to have a serious discussion, it should revolve around cap gains taxes....not income taxes.

The dumbing down of America continues.

Come one, Hank. First, she's obviously referring to poor and other people disadvantaged for one reason or another. Second, she addressing the sticker shock of health insurance costs. Sticker shock. She's saying that a poor family having to pay funeral costs for a family member who died because of lack of health insurance is also a part of the sticker shock for that family. In short, she's saying there are a lot of costs related to health insurance or lack thereof, and not all those costs are accounted for in the currently accounting of them. And her basic point is that our current system, overall, is far more expensive than that of other developed countries that have single payer. In short, she's saying there should be less sticker shock with medicare for all than now. Dispute that if you will. There's nothing even remotely ignorant about any of that, on her part anyway. You are free to distort it and misinterpret it to make it appear ignorant if you so choose.She said:

"We’re paying for this system," she said. "Americans have the sticker shock of health care as it is, and what we’re also not talking about is why aren’t we incorporating the cost of all the funeral expenses of those who died because they can’t afford access to health care? That is part of the cost of our system."

Is she suggesting that people will no longer die if we adopt medicare for all? Because last I was told, everybody is going to die sooner of later. So what exactly is her point about funeral costs, other than some nonsense she tossed at the wall?

The one point she makes that I wonder about is that the SC called our everyday health insurance payments a tax. Iiuc, the SC said the penalty for not having health insurance was a tax. Her generalization to all health insurance payments, if I understood her point correctly, strikes me as dubious.

Shoot the messenger all you want, your basic point is still weak. It's not automation, tech, and globalization that created the wealth disparities, it's the policies. Different policies, same new landscape, less wealth disparity. Fact.Nothing about that was specific....it was two separate metrics with a pretense there was some correlation between the two. It's the kind of lazy crap Krugman fills his blog with, and why I quit reading it 10+ years ago. He quit being a serious economist at least that far back.... or before. Now he likes to get on tv.

Not sure how many times it will be ignored that effective Income tax rates haven't drastically changed whatsoever.

Simple people are fixated on the top marginal rate....while ignoring the only rate that matters - effective tax rates for the top.

Even the link above from Business Insider makes the same mistake....talking about 91% marginal rates in the 50s. Totally ignoring how much income could be shielded from any tax at all during those periods.

If we want to have a serious discussion, it should revolve around cap gains taxes....not income taxes.

The dumbing down of America continues.

lol Sipping too much too early? Or is your alter ego Donald John Trump? You're making more of a fool of yourself than your feeble attempt to make a fool of AOC. Evidently, she's easy enough of a target that you don't need to twist her meaning. Challenge yourself and your cynical mind.More people dying saves money on HC expenses....so that really is buffoonery.

Shoot the messenger all you want, your basic point is still weak. It's not automation, tech, and globalization that created the wealth disparities, it's the policies. Different policies, same new landscape, less wealth disparity. Fact.

Sorry I don't agree with you or your idea of "fact".

lol Sipping too much too early? Or is your alter ego Donald John Trump? You're making more of a fool of yourself than your feeble attempt to make a fool of AOC. Evidently, she's easy enough of a target that you don't need to twist her meaning. Challenge yourself and your cynical mind.

Good grief....I wish I was drinking after reading your posts.

You are really off your rocker some days.

She's saying that a poor family having to pay funeral costs for a family member who died because of lack of health insurance is also a part of the sticker shock for that family. In short, she's saying there are a lot of costs related to health insurance or lack thereof, and not all those costs are accounted for in the currently accounting of them.

I'm sorry. I don't see the distinction of funeral costs in this discussion. Especially when she singled out "those who died because they can' afford access to health care." Unless she's suggesting that (a) Medicare for All will pay this too, or (b) that those people simply won't die...ever, then I don't know what her point is. Lots of things come with sticker shock. New car prices. An Arby's meal. But those aren't affected by Medicare for All any more than funerals.

The one point she makes that I wonder about is that the SC called our everyday health insurance payments a tax. Iiuc, the SC said the penalty for not having health insurance was a tax. Her generalization to all health insurance payments, if I understood her point correctly, strikes me as dubious.

I admit that I didn't understand her point.

Kristen Hawn says AOC won't be an effective legislator:

Democratic strategist Kristen Hawn said on Monday that she did not believe Rep. Alexandria Ocasio-Cortez (D-N.Y.) would be an effective legislator.

"The way she's going about the legislating process, I don't think she's going to be that effective. I really don't," Hawn, a senior adviser at Agenda Global, told Hill.TV's Krystal Ball and Buck Sexton on "Rising."

"I would actually pose that she has already had a major defeat. She came out immediately against the pay-go rules being reinstated in the rules package, was soundly defeated behind the scenes when more moderate members of the caucus, including members of the Blue Dog coalition, went to the Speaker and said 'we have the votes to take this rules package down if you do not include it,' " she said. "It was a huge defeat. Nobody's talking about."

"The way she's going about the legislating process, I don't think she's going to be that effective. I really don't," Hawn, a senior adviser at Agenda Global, told Hill.TV's Krystal Ball and Buck Sexton on "Rising."

"I would actually pose that she has already had a major defeat. She came out immediately against the pay-go rules being reinstated in the rules package, was soundly defeated behind the scenes when more moderate members of the caucus, including members of the Blue Dog coalition, went to the Speaker and said 'we have the votes to take this rules package down if you do not include it,' " she said. "It was a huge defeat. Nobody's talking about."

Duh, as if I didn't know that when I put that in there.Sorry I don't agree with you or your idea of "fact".

OKGood grief....I wish I was drinking after reading your posts.

You are really off your rocker some days.

In that case, I guess you're right. No policy changes would have prevented the wealth disparities. Got it.

Duh, as if I didn't know that when I put that in there.

OK

In that case, I guess you're right. No policy changes would have prevented the wealth disparities. Got it.

Nah....never once said no policy changes would have impacted it...just saying I don't think the income tax system is where you are going to do all that much to fix "it" (whatever "it" may be).

I'm ready for that drink now, so going to bow out and try to do something productive for a while.

When I first heard her say this, I had to rewind it to see if I had missed a preface to the comment. What I was expecting her to say was something like "there are a number of potential savings opportunities in Heathcare-For-All, among them....(X,Y,Z examples)". Instead she made the funerals comment as a stand-alone factor. It was akward as hell and raised more questions then it answered. Again, being new to the game she may have been a tad nervous and just blurted out a savings factor she may have been thinking of, without a proper preface that would have placed it in the proper contex.She said:

"We’re paying for this system," she said. "Americans have the sticker shock of health care as it is, and what we’re also not talking about is why aren’t we incorporating the cost of all the funeral expenses of those who died because they can’t afford access to health care? That is part of the cost of our system."

Is she suggesting that people will no longer die if we adopt medicare for all? Because last I was told, everybody is going to die sooner of later. So what exactly is her point about funeral costs, other than some nonsense she tossed at the wall?

I get why technology and automation make a difference in the middle class keeping up, but the problem isn't limited to them. People at the 90th percentile are people holding damn fine jobs, and they are being left in the dust by people in the 1%. So we are talking doctors, lawyers, bankers, etc. Expansion is happening between all percentiles. I am not sure why automation would hurt people at 98% more than at 99.

it mostly won't

a lot of the people at the 98th and 99th percentile have ownership in automation, and/or ownership in the industries automation is displacing workers in and lowering the pay/earning power of the workers it isn't replacing.

automation is here and isn't going away.

that said, it has always been here, and has always replaced workers, and often did so at much higher rates than today.

that said, it increased the productivity of workers it didn't replace, for which they had a way to bargain into higher pay, and created more jobs than it replaced.

off shoring and loss of bargaining power to share in the gain are the big differences today.

tech isn't going anywhere, nor should it, and has become a fabricated scapegoat to divert attention from the real culprits, the off shoring of anything and everything that can be off shored, and the loss in workers' ability to bargain for a share in the gains of the industries they work in.

bargained for gains which gave them more purchasing power. which made for more demand for goods and services.

tech doesn't need to go away, as it isn't the real issue. only the diversion from the real issue.

off shoring and the loss of ability for all in an industry to share in the increased wealth and productivity that tech helped generate, are what need to go away.

but then you probably already knew that, yet posted otherwise anyway.

When I first heard her say this, I had to rewind it to see if I had missed a preface to the comment. What I was expecting her to say was something like "there are a number of potential savings opportunities in Heathcare-For-All, among them....(X,Y,Z examples)". Instead she made the funerals comment as a stand-alone factor. It was akward as hell and raised more questions then it answered. Again, being new to the game she may have been a tad nervous and just blurted out a savings factor she may have been thinking of, without a proper preface that would have placed it in the proper contex.

Maybe. But no one has yet explained how there is a savings factor relative to Medicare for all associated with funeral expenses, clumsily articulated or otherwise.

Okay, this is sort of amusing:I'm sorry. I don't see the distinction of funeral costs in this discussion. Especially when she singled out "those who died because they can' afford access to health care." Unless she's suggesting that (a) Medicare for All will pay this too, or (b) that those people simply won't die...ever, then I don't know what her point is. Lots of things come with sticker shock. New car prices. An Arby's meal. But those aren't affected by Medicare for All any more than funerals.

I admit that I didn't understand her point.

I heard a quote from her 60 minutes interview where she seemed to say she might mistakes, but she's got the "moral" accuracy. That might be a point, but she can't just brush off big mistakes and/or complain when folks call them out. I think the next few weeks (or maybe longer) will be a tell whether she's going to need to disappear for a bit (i.e., whether she'll be able to avoid more mistakes and whether she'll have an appropriate response if/when she blunders). It's great that she's got "energy" and all, but taking up lots of oxygen has its downsides too.

Yup. Like I tried to aply MBA Finance 1 class logic to figure out what possible savings could one expect from something as unavoidable (in the long run) as funerals. The only one I could think of was Time-Value of money argument, but I kinda doubt she was getting that technical. As JM Keynes said, "in the long run, we're all dead."Maybe. But no one has yet explained how there is a savings factor relative to Medicare for all associated with funeral expenses, clumsily articulated or otherwise.

Last edited:

Simple.Maybe. But no one has yet explained how there is a savings factor relative to Medicare for all associated with funeral expenses, clumsily articulated or otherwise.

You even quoted her.

You're generalizing to all people dying at all times, she's not. She's limiting it to people who wouldn't have died at this time if they had health care. She's just saying it's a cost for some directly related to health insurance or lack thereof. She's saying it should be included in the cost accounting of our current medical system. She saying that the savings are that such people wouldn't have died under Medicare for all at this time. Why is that so hard for you to understand?why aren’t we incorporating the cost of all the funeral expenses of those who died because they can’t afford access to health care? That is part of the cost of our system.

You might disagree that those costs should be accounted for but her logic is simple and coherent. She takes a more socialistic view of people's lives than you. She defines the social cost of someone dying young as including the funeral costs to the rest of the family. She might just as easily included the opportunity cost to that family of losing a breadwinner. Loss of productivity. Either way, it's a cost to that family that's intimately related to their healthcare or lack thereof and she's sensitive to that.

it mostly won't

a lot of the people at the 98th and 99th percentile have ownership in automation, and/or ownership in the industries automation is displacing workers in and lowering the pay/earning power of the workers it isn't replacing.

automation is here and isn't going away.

that said, it has always been here, and has always replaced workers, and often did so at much higher rates than today.

that said, it increased the productivity of workers it didn't replace, for which they had a way to bargain into higher pay, and created more jobs than it replaced.

off shoring and loss of bargaining power to share in the gain are the big differences today.

tech isn't going anywhere, nor should it, and has become a fabricated scapegoat to divert attention from the real culprits, the off shoring of anything and everything that can be off shored, and the loss in workers' ability to bargain for a share in the gains of the industries they work in.

bargained for gains which gave them more purchasing power. which made for more demand for goods and services.

tech doesn't need to go away, as it isn't the real issue. only the diversion from the real issue.

off shoring and the loss of ability for all in an industry to share in the increased wealth and productivity that tech helped generate, are what need to go away.

but then you probably already knew that, yet posted otherwise anyway.

Tech matters. What happens to truck drivers in 15 years when we have self-driving trucks? They don't need paid and can drive without rest breaks. Human drivers have no chance. The choices for human truck drivers will be to 1) quit driving 2) work for a whole lot less. Foreign competition has no impact on that.

I go to Wal*Mart, Krogers, Taco Bell, McDonalds, I see self-service systems. That isn't someone off-shore taking the job.

Even "Steve from Austin" who is actually sitting in Mumbai can't compete. More and more call centers are going to systems that automatically ask you to describe your problem then attempt to give you solutions in hopes your call can be solved without ever going to a person.

Look at the auto assembly lines. There is a YouTube video out there of an F150 being assembled. It goes through a lot of assembly without any human involvement. 30 years ago teams of humans would have been doing all that. Automation is the biggest issue on working class jobs.

I tried to find documentation in a quick search but couldn't. I will bet that it takes fewer workers today to build a mile of interstate highway then it did in 1960. That has nothing to do with foreign competition. We know it takes FAR fewer miners to pull out a ton of coal today than it did 30 years ago. That has nothing to do with foreign competition.

I don't think you're going to understand her if you don't make the attempt to understand the context she's using. Here the context is those who can't afford health care and don't have health care insurance. What is their reality? What is their destitute day-to-day life like? What's it like to have a loving father (for those lucky enough to have two parents) die at 29? In their grief, how will they pay for his funeral costs, which can cost $1000 or more even for simple cremation, on top of their mounting bills?Yup. Like I tried to aply MBA Finance 1 class logic to figure out what possible savings could one expect from something as unavoidable (in the long run) as funerals. The only one I could think of was Time-Value of money argument, but I kinda doubt she was getting that technical. As JM Keynes said, "in the long run, we're all dead."

Of course tech matters and has for 40 years. So do off-shoring, automation, and other factors. The economic policies of the last forty years facilitated all those changes without addressing the collateral damage to society and now we're in a fix. That's the point.Tech matters. What happens to truck drivers in 15 years when we have self-driving trucks? They don't need paid and can drive without rest breaks. Human drivers have no chance. The choices for human truck drivers will be to 1) quit driving 2) work for a whole lot less. Foreign competition has no impact on that.

I go to Wal*Mart, Krogers, Taco Bell, McDonalds, I see self-service systems. That isn't someone off-shore taking the job.

Even "Steve from Austin" who is actually sitting in Mumbai can't compete. More and more call centers are going to systems that automatically ask you to describe your problem then attempt to give you solutions in hopes your call can be solved without ever going to a person.

Look at the auto assembly lines. There is a YouTube video out there of an F150 being assembled. It goes through a lot of assembly without any human involvement. 30 years ago teams of humans would have been doing all that. Automation is the biggest issue on working class jobs.

I tried to find documentation in a quick search but couldn't. I will bet that it takes fewer workers today to build a mile of interstate highway then it did in 1960. That has nothing to do with foreign competition. We know it takes FAR fewer miners to pull out a ton of coal today than it did 30 years ago. That has nothing to do with foreign competition.

Policies could have addressed more equitable wealth and income distribution. They also could have addressed programs for re-skilling workers, and so on.

She takes a more socialistic view of people's lives than you.

That’s about our only point of agreement here.

Agreement? Who's trying to agree? I don't agree with her socialist position, I'm just trying to understand it.That’s about our only point of agreement here.

She walloped a long-time incumbent who had no particular reason to lose. She clearly resonated with her constituency and if that's the lower 51% of the populace, she theoretically represents a majority of the nation. In an interview after her primary victory (I read somewhere today), she said she realized her only chance of winning was getting out new voters.

Down the road, if she and her sistren and brethren can get out 60-70% of her constituency, they'll be in position to enact their "socialism" so the question is, what is that socialism? That's what I'm trying to discern while you busy yourself with disagreeing with her.

Note that I was one of the first here to take Trump seriously when he was campaigning. Not that I liked or agreed with him then or ever. I just tried to understand him.

I go to Wal*Mart, Kroger's, Taco Bell, McDonalds, I see self-service systems. That isn't someone off-shore taking the job.

Right now we have a significant labor shortage. I don't see it easing. The shortages are in areas where people are the most concerned about automation. Drivers being a specific example. A new Kroger affiliate opened near my home about 18 months ago. It has never been fully staffed. Nobody wants to work those entry level jobs. And the wage offers are pretty good. If it weren't for automated checkouts, the place would be a disaster.

Right, but that is also true of spending. If the US government were to add $1 trillion in aid to Freedonia, it adds almost nothing back to US tax rolls. But a trillion in infrastructure adds back some money but that isn't allowed to be considered in PAYGO. A classic example, I wonder how much revenue TVA brought back into the US by making the areas it impacts more competitive? Same for the hydro-electric power out west?

We assume app expenses are 100% negative to the budget and that isn't entirely true is it?

I agree with you.

I get why technology and automation make a difference in the middle class keeping up, but the problem isn't limited to them. People at the 90th percentile are people holding damn fine jobs, and they are being left in the dust by people in the 1%. So we are talking doctors, lawyers, bankers, etc. Expansion is happening between all percentiles. I am not sure why automation would hurt people at 98% more than at 99.

The mistake you are making is believing that the upper 1% are receiving earned income. When we are talking about the upper incomes, say the top .1%, wages and salaries don't factor in. It serves no purpose to talk about doctors, lawyers, bankers, or other poor slobs who work for a pay check. At this level we are talking about investment returns and hedge fund managers. Those incomes are soaring for reasons unrelated to the labor/compensation markets. The income driver is increasing values of property and stocks--not the value of work. We are also talking about the benefits of the trillions of dollars of QE. That new money/wealth went to the upper reaches of incomes, not because the recepients worked for it, but because they shuffled paper for it. Not much QE benefit went to those who receive pay checks, no matter where they were on the pay scale.

Hedge fund managers made 2016 incomes in the high hundreds of millions or even in the billions. Those incomes far outpaced guys like Bob Iger, who is near the top of CEO pay, and made a measly $45 million.

The mistake you are making is believing that the upper 1% are receiving earned income. When we are talking about the upper incomes, say the top .1%, wages and salaries don't factor in. It serves no purpose to talk about doctors, lawyers, bankers, or other poor slobs who work for a pay check. At this level we are talking about investment returns and hedge fund managers. Those incomes are soaring for reasons unrelated to the labor/compensation markets. The income driver is increasing values of property and stocks--not the value of work. We are also talking about the benefits of the trillions of dollars of QE. That new money/wealth went to the upper reaches of incomes, not because the recepients worked for it, but because they shuffled paper for it. Not much QE benefit went to those who receive pay checks, no matter where they were on the pay scale.

Hedge fund managers made 2016 incomes in the high hundreds of millions or even in the billions. Those incomes far outpaced guys like Bob Iger, who is near the top of CEO pay, and made a measly $45 million.

All of that is why I said unearned income needs taxed at the same rate as earned. Including Social Security.

Why including Social Security?All of that is why I said unearned income needs taxed at the same rate as earned. Including Social Security.

I can't speak to what the platform of the DSA actually is, but (1) they didn't cite AOC at all (unless I'm already mis-remembering it); and (2) some of the "alarming" calls for those positions deemed ultra-liberal probably aren't "ultra" after digging in more.

To know what AOC believes, you have to read what she's actually said. I may have missed it, but I don't know that she's waging war on capitalism. I don't think she's even calling for socialized medicine (which is different than single payer). Her calls for abolishing "for profit" prisons (regardless of her position's merit) isn't calling for abolishment of incarceration. Her call for the abolishment of ICE isn't, to my knowledge, calling for an end to immigration enforcement, but instead for keeping it structured along the way INS formerly was and out of the hands of terrorism hunters who are prone to civil rights abuses*. Etc. Etc.

That's not to vouch for her at all or to suggest she's a thought leader among the Democrats.

I think it was Tom Perez who purportedly said something about AOC being the future of the party, but that wasn't really exactly what he said. It was more along the lines that she is typical of a new voice in the party and that that new voice will be an important one going forward. I don't believe he was suggesting that SHE is the answer, but rather that a new generation has a different viewpoint and perspective and will make itself heard.

Hinging all that on AOC would be a mistake.

To her credit, though, and as I said someplace else over the past couple days, the advantage she (and likely others) is bringing now is a mindset unencumbered by experience and understanding of bureaucratic norms. That's good and bad, obviously. Structural norms have value. But, without intending to compare AOC to a child, sometimes breaking those bureaucratic norms allows for The Emperor Has No Clothes moments.

Finally, even if AOC is very liberal, she's not the king. At worst (for conservatives), she and others like her might push the conversation and negotiation a bit. That's my point about anchoring. Many Democrats believe the negotiation has skewed far too right for too long (e.g., Grover Norquist, NRA, climate, etc.)

*It would be useful if we tethered our immigration and southern border conversations to the reality of the numbers of the past so many years and use those numbers to quantify and explain any issue and the proper response given our current situation (as opposed to the false narrative that is not supported by data).

A call for abolishing ICE is a request to end all border entrance enforcement, leave the borders un-policed and wide open and make no effort to arrest and remove those illegally present who commit crimes. Not a single advocate for eliminating ICE, that I have seen or heard, has ever said one word about replacing ICE with other enforcement. That means they advocate no enforcement.

Why including Social Security?

Simply put, to bring more money into the system. We know the fund has structural issues.

We agree - to some extent. Krugman IS a leftist partisan hack and has proudly admitted it.Krugman is a partisan hack.

I posted this already....effective tax rates are a bit lower than 50+ years ago....but not substantially.

It bears repeating for the millionth time....individual tax policy is not the driver of growing wealth inequality. It's technology and automation. And to a lesser extent globalization.

Similar threads

- Replies

- 7

- Views

- 257

- Replies

- 95

- Views

- 2K

- Replies

- 1

- Views

- 510

- Replies

- 24

- Views

- 655

ADVERTISEMENT

ADVERTISEMENT