Krugman?* The growth of the Internet will slow drastically, as the flaw in "Metcalfe's law"--which states that the number of potential connections in a network is proportional to the square of the number of participants--becomes apparent: most people have nothing to say to each other! By 2005 or so, it will become clear that the Internet's impact on the economy has been no greater than the fax machine's.

Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bidenflation

- Thread starter JamieDimonsBalls

- Start date

I'm confused, does that mean the graph is incorrect?* The growth of the Internet will slow drastically, as the flaw in "Metcalfe's law"--which states that the number of potential connections in a network is proportional to the square of the number of participants--becomes apparent: most people have nothing to say to each other! By 2005 or so, it will become clear that the Internet's impact on the economy has been no greater than the fax machine's.

I'm confused, does that mean the graph is incorrect?

It means even Nobel Prize winners can be stupid

A

anon_6hv78pr714xta

Guest

How do you compare the impacts of unfunded tax cuts versus stimulus money? Both contribute to the deficit and overall debt levels. And depending on how money is spent, can also be inflationary. Serious question and not meant to start a pissing war.You can hate Trump for a lot of reasons. But there’s no denying the mess Biden has made. It’s on Biden and the idiots in his administration.

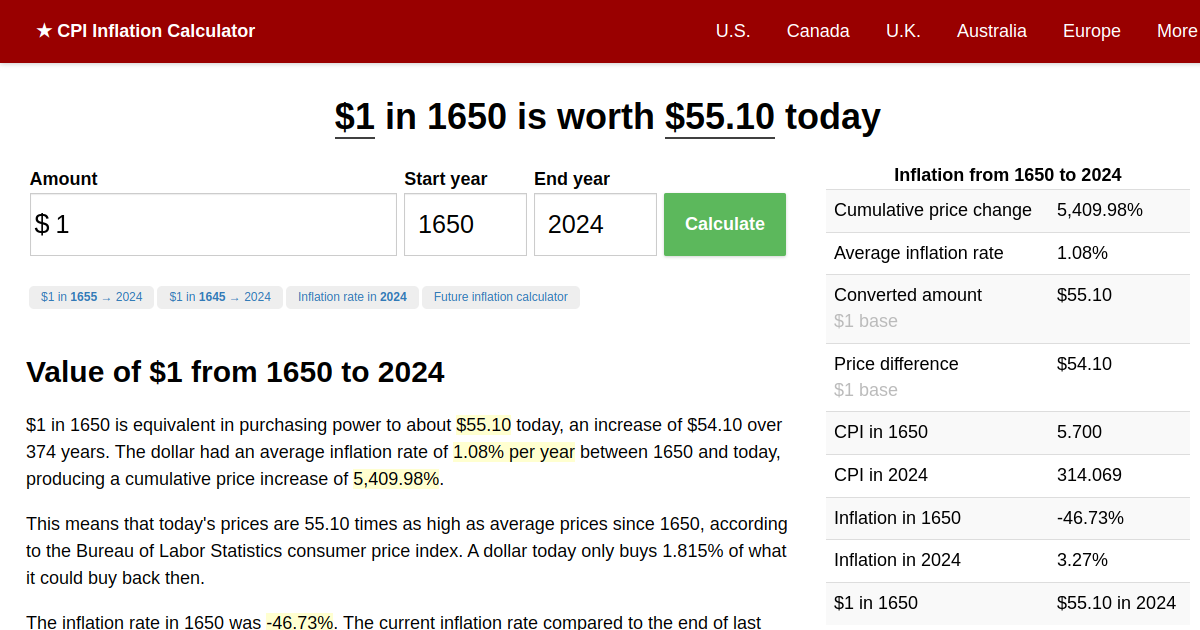

I will suggest there has always been inflation, even when governments barely existed. In 1696 there was over 17% inflation.

$1 in 1650 → 2023 | Inflation Calculator

The 1.07% inflation rate means $1 in 1650 is equivalent to $52.07 today. This inflation calculator uses the official US consumer price index published by the Department of Labor.

There are many reasons inflation can happen. Government spending is certainly part of the equation. Worker shortages and other shortages are also contributors. Fear is another. He ignores all other contributions in the comments made.

And deflation is considered by many to be worse than inflation.

We need to work on the budget, but it isn't a miracle worker.

Wouldn’t it be unfunded spending?How do you compare the impacts of unfunded tax cuts versus stimulus money? Both contribute to the deficit and overall debt levels. And depending on how money is spent, can also be inflationary. Serious question and not meant to start a pissing war.

How do you compare the impacts of unfunded tax cuts versus stimulus money? Both contribute to the deficit and overall debt levels. And depending on how money is spent, can also be inflationary. Serious question and not meant to start a pissing war.

There is no such thing as unfunded tax cuts. It never was the governments money. It’s still unfunded spending as spartan pointed out.

Moreover, rate reductions are not necessarily tax cuts.There is no such thing as unfunded tax cuts. It never was the governments money. It’s still unfunded spending as spartan pointed out.

Tax credits, like electric cars for the privileged class, are mostly definitely unfunded tax cuts.

But either way, most generally applaud tax cuts and/or rate reductions as they allow businesses to expand, flexibility to pass it along to their workforce in form of higher wages or better benefits, etc. All can contribute to inflation.Moreover, rate reductions are not necessarily tax cuts.

My wording above was poor but overall question remains. Why do both sides applaud their versions of stimulus and deride the others?

I will suggest there has always been inflation, even when governments barely existed. In 1696 there was over 17% inflation.

$1 in 1650 → 2023 | Inflation Calculator

The 1.07% inflation rate means $1 in 1650 is equivalent to $52.07 today. This inflation calculator uses the official US consumer price index published by the Department of Labor.www.officialdata.org

There are many reasons inflation can happen. Government spending is certainly part of the equation. Worker shortages and other shortages are also contributors. Fear is another. He ignores all other contributions in the comments made.

And deflation is considered by many to be worse than inflation.

We need to work on the budget, but it isn't a miracle worker.

Inflation is driven by an increase in the unit of monetary account and government debt. The other examples you give are short term and the market would eventually figure out the equilibrium price. Stop one moment and ask yourself why does the cost of a hamburger always continue to go up? There isn’t a shortage of beef and we can produce as much as the market needs, but yet it always continues to go up? The money is sh#t is the answer.

Also, any person or economist that tells you deflation is bad, is either an idiot or liar. Stop listening to them. Why would Marv paying less money for a good be a bad thing? Doesn’t make sense does it? It’s because they are lying to you.

But either way, most generally applaud tax cuts and/or rate reductions as they allow businesses to expand, flexibility to pass it along to their workforce in form of higher wages or better benefits, etc. All can contribute to inflation.

My wording above was poor but overall question remains. Why do both sides applaud their versions of stimulus and deride the others?

If I’m understanding you correctly. I agree both sides do a poor job and we end up with the worst outcome a lot of times. Tax cuts with no government cuts and increased government spending with no government cuts. My answer would be because they all want to get re-elected and Americans love big government and not paying for it.

To answer your other question. Tax cuts are deflationary. The private market is more efficient and when you return it to the market it will have a deflationary effect on the economy. The opposite happens when you increase taxes to pay for more government programs.

Last edited:

When the price of energy goes up, so does all commodities. Energy prices are the biggest driver of our inflation..Inflation is driven by an increase in the unit of monetary account and government debt. The other examples you give are short term and the market would eventually figure out the equilibrium price. Stop one moment and ask yourself why does the cost of a hamburger always continue to go up? There isn’t a shortage of beef and we can produce as much as the market needs, but yet it always continues to go up? The money is sh#t is the answer.

Also, any person or economist that tells you deflation is bad, is either an idiot or liar. Stop listening to them. Why would Marv paying less money for a good be a bad thing? Doesn’t make sense does it? It’s because they are lying to you.

When the price of energy goes up, so does all commodities. Energy prices are the biggest driver of our inflation..

Yep. The war in Ukraine and the war on hydrocarbons are very inflationary. However, if both Europe and the U.S. announced an end to the war on hydrocarbons and cut regulations in those areas, the prices would drop drastically.

Last edited:

Lucy, you forgot to make a grammar or spelling error in this one.When the price of energy goes up, so does all commodities. Energy prices are the biggest driver of our inflation..

A

anon_6hv78pr714xta

Guest

I think this is a good discussion, but I would say that one of the tax-cut rationales is that it actually broadens the tax base and brings in more revenue, not less.But either way, most generally applaud tax cuts and/or rate reductions as they allow businesses to expand, flexibility to pass it along to their workforce in form of higher wages or better benefits, etc. All can contribute to inflation.

My wording above was poor but overall question remains. Why do both sides applaud their versions of stimulus and deride the others?

In Actual Dollars, Tax Cuts Boost Revenue Time After Time

The conventional wisdom in media, political and policymaking circles is that tax cuts cost the federal government so much revenue that they drive the country’s enormous budget deficits. But a look at the major post-war tax cuts, from the Kennedy legislation in 1964 to the Trump package in 2017...

Japan has been stuck in deflation for two decades. It is very hard to break out of. How do you get people to buy today if there money is worth more tomorrow?Inflation is driven by an increase in the unit of monetary account and government debt. The other examples you give are short term and the market would eventually figure out the equilibrium price. Stop one moment and ask yourself why does the cost of a hamburger always continue to go up? There isn’t a shortage of beef and we can produce as much as the market needs, but yet it always continues to go up? The money is sh#t is the answer.

Also, any person or economist that tells you deflation is bad, is either an idiot or liar. Stop listening to them. Why would Marv paying less money for a good be a bad thing? Doesn’t make sense does it? It’s because they are lying to you.

Japan has been stuck in deflation for two decades. It is very hard to break out of. How do you get people to buy today if there money is worth more tomorrow?

Japan’s issues are from too much government debt and poor demographics. Not because they have sound money.

To answer your other question people are still going to spend money on everything they do today. We all still need/want to eat, live in a house, go on vacations, and etc. The difference is people would make more sound decisions where they put their money, because they know it isn’t being inflated away. This is a good thing for economies. You don’t want capital going to sh#t investments because inflation is forcing them out on the risk curve. It’s wasted capital, time, and energy.

Last edited:

Lucy, you forgot to make a grammar or spelling error in this one.

No she didn't.

WTF your problem?No she didn't.

I don't want to pass up a chance to show zeke wrong.WTF your problem?

I mean, do you even recognize the meta in that post?WTF your problem?

NoI mean, do you even recognize the meta in that post?

Good night goat.I mean, do you even recognize the meta in that post?

Lol. I see it now.I don't want to pass up a chance to show zeke wrong.

Grammar and spelling flames bite you in the ass every time.Lol. I see it now.

Yup, can’t deny it.Grammar and spelling flames bite you in the ass every time.

Let's hope you aren't an English teacher.Yup, can’t deny it.

I think this is a good discussion, but I would say that one of the tax-cut rationales is that it actually broadens the tax base and brings in more revenue, not less.

In Actual Dollars, Tax Cuts Boost Revenue Time After Time

The conventional wisdom in media, political and policymaking circles is that tax cuts cost the federal government so much revenue that they drive the country’s enormous budget deficits. But a look at the major post-war tax cuts, from the Kennedy legislation in 1964 to the Trump package in 2017...www.discoursemagazine.com

Haven't read the article yet, but I have to ask what they say about Kansas.

Social media is a bit different. I actually was the one who proofread all our papers to be submitted at school. And lots of the girls’ papers too. I’m pretty good at it.Let's hope you aren't an English teacher.

Oh yeah, I can tell.....Social media is a bit different. I actually was the one who proofread all our papers to be submitted at school. And lots of the girls’ papers too. I’m pretty good at it.

You always talk about yourself and girls and your girls . Why do you hate men so much? I mostly just refer to people as people.Social media is a bit different. I actually was the one who proofread all our papers to be submitted at school. And lots of the girls’ papers too. I’m pretty good at it.

A

anon_6hv78pr714xta

Guest

That they cheat and it's a travesty that Self is still coaching at the collegiate level?Haven't read the article yet, but I have to ask what they say about Kansas.

Inflation is driven by an increase in the unit of monetary account and government debt. The other examples you give are short term and the market would eventually figure out the equilibrium price. Stop one moment and ask yourself why does the cost of a hamburger always continue to go up? There isn’t a shortage of beef and we can produce as much as the market needs, but yet it always continues to go up? The money is sh#t is the answer.

Also, any person or economist that tells you deflation is bad, is either an idiot or liar. Stop listening to them. Why would Marv paying less money for a good be a bad thing? Doesn’t make sense does it? It’s because they are lying to you.

wake up.

the current inflation is driven by price gouging, led by largely monopolistic industries.

the Fed raising interests rates is a beyond idiotic response.

when there's nothing stopping industries from raising prices, they are going to keep raising them.

not personal. just business.

monopoly/oligopoly industries have nothing stopping them, as they don't face normal market competition.

a windfall profits tax should have been response 1.

Sort of like how unions will strike when they know they have the country over a logistics barrel.wake up.

the current inflation is driven by price gouging, led by largely monopolistic industries.

the Fed raising interests rates is a beyond idiotic response.

when there's nothing stopping industries from raising prices, they are going to keep raising them.

not personal. just business.

monopoly/oligopoly industries have nothing stopping them, as they don't face normal market competition.

a windfall profits tax should have been response 1.

Just business.

Whoever you read, stop it. They are clueless and your last sentence is really dumb and would have only compounded the issue. Let me guess you’re also for price controls? I’m sure making companies less or not profitable will help the issue of not enough supply🙄 Please explain how increasing the money supply by 40% isn’t going to cause inflation?wake up.

the current inflation is driven by price gouging, led by largely monopolistic industries.

the Fed raising interests rates is a beyond idiotic response.

when there's nothing stopping industries from raising prices, they are going to keep raising them.

not personal. just business.

monopoly/oligopoly industries have nothing stopping them, as they don't face normal market competition.

a windfall profits tax should have been response 1.

Last edited:

Whoever you read, stop it. They are clueless and your last sentence is really dumb and would have only compounded the issue. Let me guess you’re also for price controls? I’m sure making companies less or not profitable will help the issue of not enough supply🙄 Please explain how increasing the money supply by 40% isn’t going to cause inflation?

you're obviously economically totally illiterate, (like most, as the public is fed a steady diet of economic total lies by Wall St media), ), but i will answer your question. (which you probably don't really want answered).

take 2 scenarios, 1 a monopolistic situation, the other a competitive market situation.

1), monopoly seller,

you're stranded in the desert and out of water.

a guy approaches selling bottles of water, and he's the first person you've seen in 2 weeks, with no one else in sight.

you ask how much. he answers, how much you got.

you empty your pockets and come up with $100.

he says $100, take it or leave it.

obviously you fork over the $100, due to no other options.

2), competitive market,

same desert, same guy, again out of water.

instead of 1 guy selling bottles of water approaching, there are 8 selling water.

you say how much. if the guy says how much you got, you reply $100, and he says ok, $100, that no longer is the end of bargaining.

a 2nd vendor says i'll sell you a bottle for $90.

a third says $80, and so on.

in the end, the price in the competitive market will depend on how much was the cost of a bottle of water to the vendor, and what is the minimum profit they are willing to settle for to make it worth their while.

unlike in the monopoly market scenario, it makes no difference how much money you have on you, the price is determined by the cost of doing business and the competitive market, not by how much you have on you.

how much you can afford for the bottle of water, (money supply), only matters in the monopolistic market.

unfortunately, like oil, many of our industries have been monopolized, or effectively monopolized, and duopolies and oligopolies often to usually behave and price as monopolies. (like oil, real estate, etc).

price gouging by the monopolies and effective monopolies is the main driver of our current price escalation. (falsely portrayed as "inflation" by Wall St's corp media).

Last edited:

Similar threads

- Replies

- 0

- Views

- 521

- Replies

- 5

- Views

- 109

- Replies

- 3

- Views

- 271

ADVERTISEMENT

Latest posts

-

-

Pacers take it to Milwaukee tonight tie the series 1-1

- Latest: TomEric4756

-

-

-

ADVERTISEMENT