Fareed Zakaria wrote an editorial for WaPo criticizing the Biden economic doctrine.

The general idea, America has no economic problem compared to the world. In 1990, the US was 25% of the world GDP. That figure is true today. In 1990, the average American made 17% more than the typical Japanese. That number is 54% more today.

He covers using government to invest in industry. My phone isn't allowed indent, so the paragraph between dotted lines:

--------------------------

Ironically, only a couple of weeks before Sullivan made his speech, the Economist had a cover story on “America’s astonishing economic record.” It begins with 1990 — often used as the start of the rot in the narrative of decline — and points out that despite the rise of huge new economies such as China and India, the United States’ share of global gross domestic product has stayed roughly the same since then: around 25 percent. During that same period, America’s share of the Group of Seven’s economic output increased substantially, from 40 percent to 58 percent. Today, eight of the world’s 10 biggest companies are American. In 1989, only four were American (and six were Japanese). As for building, during these decades, the United States created and built the information economy, surely one of the greatest transformations and advances in human history

-----------------------------

Zakaria discusses protectionism too:

---------------------------

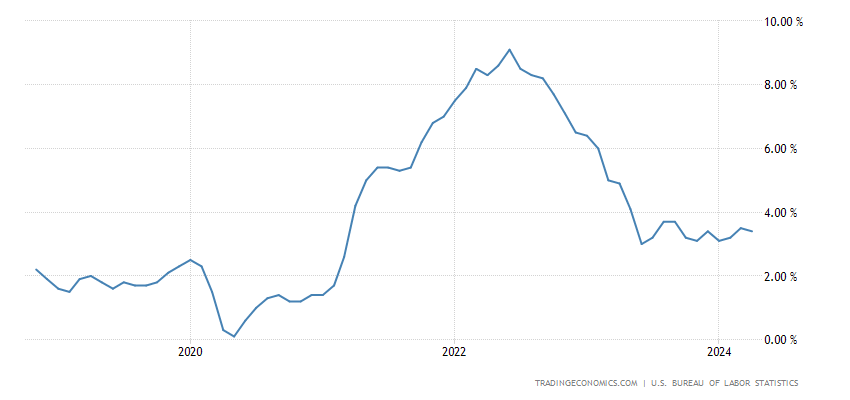

The greatest challenge for Americans over the past few decades has been that middle-class wages have not kept up with rising costs of living. That problem will surely get exacerbated by raising costs of goods throughout the economy through tariffs and industrial policy. As former treasury secretary and Post contributing columnist Lawrence H. Summers points out, protecting the 60,000 workers in the American steel industry sounds smart, but when you do it by raising the price of steel, the 6 million workers who use steel as an input in their goods all suffer. A foreign policy that produces persistent, systemic inflation will fail to deliver for the middle class, who are, as Joe Biden often says, its intended beneficiaries.

---------------------------------

The general idea, America has no economic problem compared to the world. In 1990, the US was 25% of the world GDP. That figure is true today. In 1990, the average American made 17% more than the typical Japanese. That number is 54% more today.

He covers using government to invest in industry. My phone isn't allowed indent, so the paragraph between dotted lines:

--------------------------

Ironically, only a couple of weeks before Sullivan made his speech, the Economist had a cover story on “America’s astonishing economic record.” It begins with 1990 — often used as the start of the rot in the narrative of decline — and points out that despite the rise of huge new economies such as China and India, the United States’ share of global gross domestic product has stayed roughly the same since then: around 25 percent. During that same period, America’s share of the Group of Seven’s economic output increased substantially, from 40 percent to 58 percent. Today, eight of the world’s 10 biggest companies are American. In 1989, only four were American (and six were Japanese). As for building, during these decades, the United States created and built the information economy, surely one of the greatest transformations and advances in human history

-----------------------------

Zakaria discusses protectionism too:

---------------------------

The greatest challenge for Americans over the past few decades has been that middle-class wages have not kept up with rising costs of living. That problem will surely get exacerbated by raising costs of goods throughout the economy through tariffs and industrial policy. As former treasury secretary and Post contributing columnist Lawrence H. Summers points out, protecting the 60,000 workers in the American steel industry sounds smart, but when you do it by raising the price of steel, the 6 million workers who use steel as an input in their goods all suffer. A foreign policy that produces persistent, systemic inflation will fail to deliver for the middle class, who are, as Joe Biden often says, its intended beneficiaries.

---------------------------------