cars are so insane. and college tuitionAnd cars are woefully overpriced and bloated to satisfy a consumerist market.

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High School

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Has anyone here stretched for their primary residence?

- Thread starter JamieDimonsBalls

- Start date

i have friends spending $25k per year per kid for high school. that's really nutty to me.And cars are woefully overpriced and bloated to satisfy a consumerist market.

Put it in a brokerage account and give it to them after they graduate public highschool and a state college. They'll be better off.i have friends spending $25k per year per kid for high school. that's really nutty to me.

i've still never reconciled whether it's better to finish in the top 10 percent of a good school or the middle of the class at an elite school. most of the kids at our elite high schools still end up at mizzou and ku and indiana and blah blah blah. they aren't all at colombia and mitPut it in a brokerage account and give it to them after they graduate public highschool and a state college. They'll be better off.

Got it. But while the monthly payment has stayed the same, comparatively, income has lagged behind.

Well no. Let's look at it this way, all based in 2023 dollars and monthly amounts.

1983 (inflation adjusted) :

Median household income: $6,333

Mortgage payment: $2,200

2023:

Median HHI : $7,083

Mortgage payment: $2,208

What they have in common?. Both times were really shitty to buy a home, comparatively to a lot of other periods

None of this seems right to me. I don’t have time today but this weekend I’m going to consider it. This stuff is real hard on my brainWell no. Let's look at it this way, all based in 2023 dollars and monthly amounts.

1983 (inflation adjusted) :

Median household income: $6,333

Mortgage payment: $2,200

2023:

Median HHI : $7,083

Mortgage payment: $2,208

What they have in common?. Both times were really shitty to buy a home, comparatively to a lot of other periods

Found the neighborhood...650,000. Crazy! Colorado went through a Californication after 1990. Prices skyrocketed after that. It was like a Big City sleeper, old oil money town. I lived downtown in the Barclay for a couple years and jumped on the free bus every morning to go a few blocks to a high rise office which was 30-40% vacant. IDK why Californians suddenly moved there.Where in CO and what year was this? Half a mil might be low balling it.

The Denver Post Online - Growth in the '90s

This article down plays it, but ask any local back then and they hated it.

None of this seems right to me. I don’t have time today but this weekend I’m going to consider it. This stuff is real hard on my brain

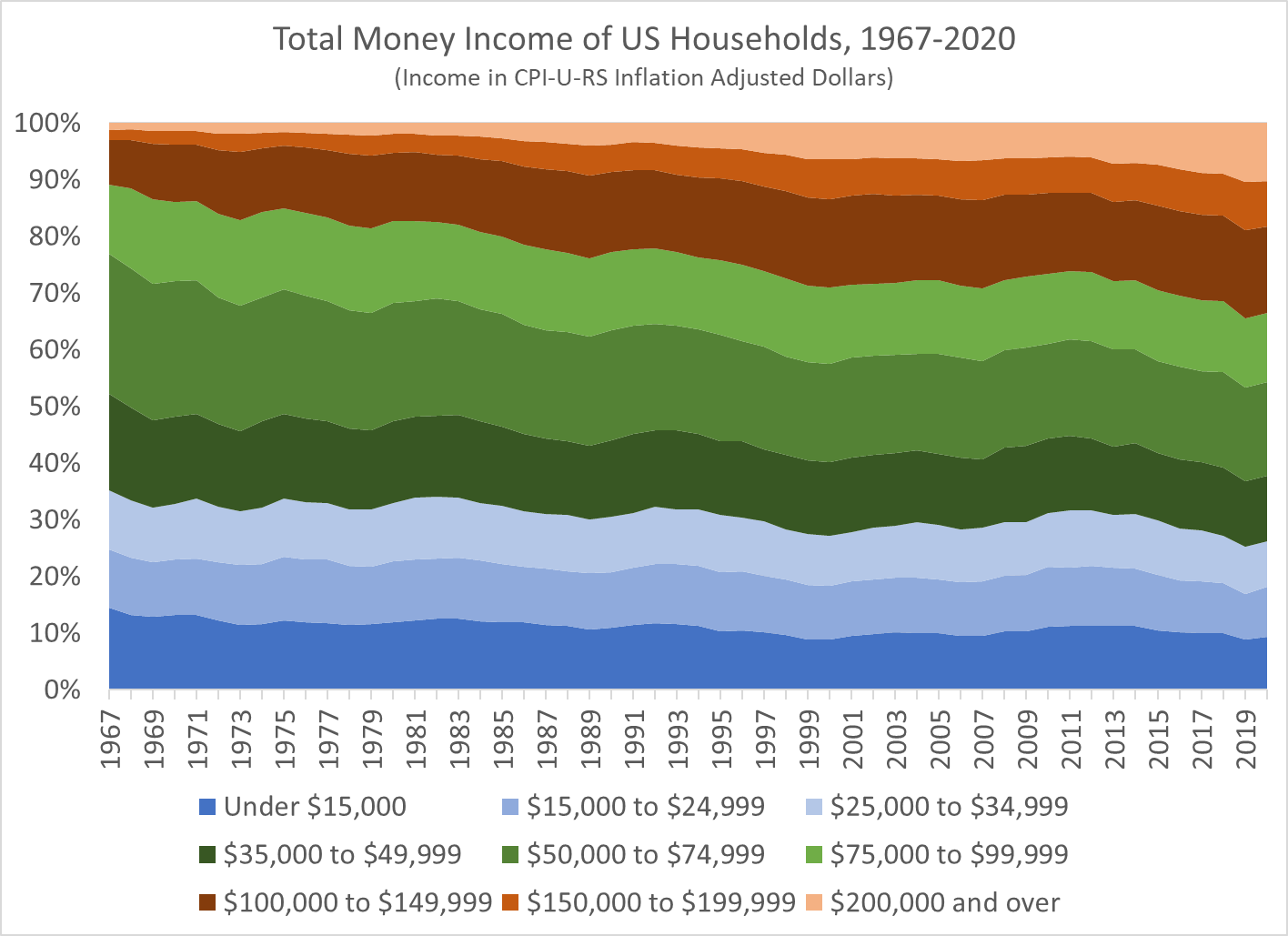

Here's an interesting piece. One thing that has changed over time is there are a lot more "high income" households than there were a generation or two ago. There are also more low income ones. Dual earnering professionals with degrees, etc....

We've seen a long term trend of bifurcation in household incomes.

I’ve shaded the chart to suggest that over $100,000 of annual income is high income, and under $35,000 is low income, with everything else considered “middle class.” By these definitions, the number of high-income households in the US increased dramatically from 6.6 million (10.9% of the total) in 1967 to 43.7 million (33.6% of the total) in 2020. The number of low-income households also rose, unfortunately, from 21.4 million in 1967 to 34 million in 2020, but the portion of the total fell (from 35.2% to 26.2%) since it increased slower than the overall growth of the number of households. Today, there are more high-income households (43.7 million) than low-income households (34 million) in the US.

But even if you don’t like those definitions, I’ve provided as much detail in the chart as Census makes available publicly. For example, let’s say you think $200,000 is what makes you high income. There were fewer than 1 million of these households in 1967 (1.3% of the total). Today, there are over 13 million of them (10.3% of the total). However we slice the data, there are a lot more high-income households in the US than in the past. (Remember remember, this is all adjusted for inflation.)

US Households Have a Lot More Income Than 1967, and It’s Probably Not Just Because of the Rise of Dual-Income Households

We are going through some tough economic times right now: high rates of inflation (generally exceeding wage growth) with the strong possibility of a recession in the near future. In times like this…

Yeah, anything west and north of Denver (and west of I-25) is crazy. That $650K house was likely $450-500K a few years ago. South of Denver (Castle Rock, Parker) are getting pretty crazy too. As mccurty mentioned, Boulder prices are essentially Cali prices ($1M+). People are getting priced out then move down to Colorado Springs which prices more people out of that area.Found the neighborhood...650,000. Crazy! Colorado went through a Californication after 1990. Prices skyrocketed after that. It was like a Big City sleeper, old oil money town. I lived downtown in the Barclay for a couple years and jumped on the free bus every morning to go a few blocks to a high rise office which was 30-40% vacant. IDK why Californians suddenly moved there.

The Denver Post Online - Growth in the '90s

extras.denverpost.com

This article down plays it, but ask any local back then and they hated it.

Honestly, I see more transplants from Texas and other areas than California, at least recently. My neighborhood has a few from Indiana (a few IU grads), St. Louis, Minnesota, Texas, and East Coast. I don't really see prices dropping here anytime soon.

Boulder has nothing on Aspen.Yeah, anything west and north of Denver (and west of I-25) is crazy. That $650K house was likely $450-500K a few years ago. South of Denver (Castle Rock, Parker) are getting pretty crazy too. As mccurty mentioned, Boulder prices are essentially Cali prices ($1M+). People are getting priced out then move down to Colorado Springs which prices more people out of that area.

Honestly, I see more transplants from Texas and other areas than California, at least recently. My neighborhood has a few from Indiana (a few IU grads), St. Louis, Minnesota, Texas, and East Coast. I don't really see prices dropping here anytime soon.

Aspen, Vail, etc. are another story. There's lots of ongoing controversy in those areas because resort employees can't afford to live in the area. Someone will propose developing affordable housing for those employees, then city council or some rich dude (or both) find a reason to shut down the idea. I think the last reason was more environmental and somewhat legit.Boulder has nothing on Aspen.

I'd like to buy up in Dillon or Golden but I don't have that kind of money.

We vacationed in Beaver Creek a couple years back. Talk about expensive. Great ski area though!Boulder has nothing on Aspen.

My son and I met a 70 year old guy on the lift trying to break his total vertical foot record in a day of over 70,000 vertical feet. I about crapped when I heard that. We had an amazing conversation.

Last edited:

Sounds like rich white liberals wanting to keep the minorities out.Aspen, Vail, etc. are another story. There's lots of ongoing controversy in those areas because resort employees can't afford to live in the area. Someone will propose developing affordable housing for those employees, then city council or some rich dude (or both) find a reason to shut down the idea. I think the last reason was more environmental and somewhat legit.

I'd like to buy up in Dillon or Golden but I don't have that kind of money.

i have friends spending $25k per year per kid for high school. that's really nutty to me.

That's cheap. The top private schools near me are $32-$35K per year from 1st grade on

Put it in a brokerage account and give it to them after they graduate public highschool and a state college. They'll be better off.

mine are going to public, but I'm not sure that is the case. Kids at those schools benefit significantly from smaller class sizes and better individual instruction / attention.

So dumb. Although I pay $25k for my little guy. Tho with his behavior I’m probably winning. He’s going to force the old bird that’s the TA into retirementThat's cheap. The top private schools near me are $32-$35K per year from 1st grade on

That's how much it costs to go to Carmel Public Schools.That's cheap. The top private schools near me are $32-$35K per year from 1st grade on

Yeah, I'm gauging my experience off living in a top tier school district and growing up in one. I have no idea why people in Carmel pay for their kids to go to privates.mine are going to public, but I'm not sure that is the case. Kids at those schools benefit significantly from smaller class sizes and better individual instruction / attention.

I get where you're going, but is it?That's how much it costs to go to Carmel Public Schools.

Figure a mortgage in Indy is $1000/month and Carmel is median $2500. That's only $18,000/year. Still cheaper.

I know. I did the math 12 years ago and I don't pay anywhere near $2500/month. Yes, I got lucky(ish).

Speaking of Buzzkill.I get where you're going, but is it?

Figure a mortgage in Indy is $1000/month and Carmel is median $2500. That's only $18,000/year. Still cheaper.

I know. I did the math 12 years ago and I don't pay anywhere near $2500/month. Yes, I got lucky(ish).

I stretched, but not by choice lol. Mortgage went up $1300 a month in May, due to increased taxes and insurance. Looking to sell in a few months. It’s not sustainable.And how did that work out?

I'm talking going 25% beyond your initial budget because you find "the one". The first mistake I made was allowing my wife ot convince me to look at a house that was that far beyond. Nothing else has been comparable after two weeks.

Here in NE Fla, I’m not alone in this plight. Hurricane Ian payback time.

That's how much it costs to go to Carmel Public Schools.

Wrong. We're talking incremental costs. People are living in the highest cost, highest income zip code in our state and paying instead of sending their kids to a top-ranked public school district.

Inflation adjusting the payment is weird in a way because it's static unless you refinance.Well no. Let's look at it this way, all based in 2023 dollars and monthly amounts.

1983 (inflation adjusted) :

Median household income: $6,333

Mortgage payment: $2,200

2023:

Median HHI : $7,083

Mortgage payment: $2,208

What they have in common?. Both times were really shitty to buy a home, comparatively to a lot of other periods

So, while the $600 1983 payment is like an inflation adjusted $2,200 back then in year 1. It stayed at $600 and got relatively cheaper until it's presumably paid off in 2013 in year 30. Because it would still be $600 in 2013 even though inflation, including wage inflation, made the median household income rise substantially.

BUT the big news in TMFT land is that, much like @JamieDimonsBalls, I bought a foreclosure at the nadir of the housing market (2012) for a song that I'm fixin to have all the way paid off in the next few months. Not bad for a simple country lawyer.

Last edited:

Inflation adjusting the payment is weird in a way because it's static unless you refinance.

So, while the $600 1983 payment is like an inflation adjusted $2,200 back then in year 1. It stayed at $600 and got relatively cheaper until it's presumably paid off in 2013 in year 30. Because it would still be $600 in 2013 even though inflation, including wage inflation, made the median household income rise substantially.

BUT the big news in TMFT land is that, much like @JamieDimonsBalls, I bought a foreclosure at the nadir of the housing market (2012) for a song that I'm fixin to have all the way paid off in the next few months. Not bad for a simple country lawyer.

Sure. Of course that's always the main financial argument for owning vs renting. Fixed housing cost that should theoretically get cheaper each year as inflation eats away.

Congrats on the payoff

I did but it was at the time of virtually free money and I highly suspected my income would increase significantly over time. And it has.And how did that work out?

I'm talking going 25% beyond your initial budget because you find "the one". The first mistake I made was allowing my wife ot convince me to look at a house that was that far beyond. Nothing else has been comparable after two weeks.

But times have changed. Unless your initial budget was very affordable - I wouldn’t push the envelope today.

I did but it was at the time of virtually free money and I highly suspected my income would increase significantly over time. And it has.

But times have changed. Unless your initial budget was very affordable - I wouldn’t push the envelope today.

Income should continue to grow and IRs have likely peaked. I'm thinking I can refi in 12-24 mos.

That's where my wife got her degree.God I used to go to all the Buffs games. We couldn't get out of Boulder quick enough.

She's a Buff! Go Buffs! Ever been to a game there? Its the best man. The view and Ralphie! Thats an awesome venue!That's where my wife got her degree.

No I haven't. I was just through Boulder the first part of July.She's a Buff! Go Buffs! Ever been to a game there? Its the best man. The view and Ralphie! Thats an awesome venue!

Dude...Ya gotta go to a Buffs game. Seriously thinking about next weekend against the corn. I hope Deion has these boys ready.No I haven't. I was just through Boulder the first part of July.

What's your prediction for Prime Time? It should be interesting. They were hyping the shit out of him last night.Dude...Ya gotta go to a Buffs game. Seriously thinking about next weekend against the corn. I hope Deion has these boys ready.

Line play...They have a sh!tload of talent at all the skill positions, but I'm interested at how the OL and DL will be. He's a winner at everything he's ever done in football so I expect him to bring the Buffs back. IDK how long that will take though.What's your prediction for Prime Time? It should be interesting. They were hyping the shit out of him last night.

Mine was $630 a month for a house and 25 acres in God’s country. Paid off 6 years ago. These prices are out of boundsI stretched, but not by choice lol. Mortgage went up $1300 a month in May, due to increased taxes and insurance. Looking to sell in a few months. It’s not sustainable.

Here in NE Fla, I’m not alone in this plight. Hurricane Ian payback time.

Wake up every stinking day, knowing that you have to punch the systems buttons or be homeless. That sounds like bliss.

OR, wake up every day knowing that no one owns you. Never go over your budget (get rid of the wife first, prison is prison). Pay cash, improve, sell for more and roll it roll it roll it... The borrower is SLAVE to the lender.

How good would it feel to wake up tomorrow and you owe NO ONE, ANYTHING? NO ONE ! !

OR, wake up every day knowing that no one owns you. Never go over your budget (get rid of the wife first, prison is prison). Pay cash, improve, sell for more and roll it roll it roll it... The borrower is SLAVE to the lender.

How good would it feel to wake up tomorrow and you owe NO ONE, ANYTHING? NO ONE ! !

@mcmurtry66 why you laugh? Have you ever been in a totally debit free position? It is amazing.Wake up every stinking day, knowing that you have to punch the systems buttons or be homeless. That sounds like bliss.

OR, wake up every day knowing that no one owns you. Never go over your budget (get rid of the wife first, prison is prison). Pay cash, improve, sell for more and roll it roll it roll it... The borrower is SLAVE to the lender.

How good would it feel to wake up tomorrow and you owe NO ONE, ANYTHING? NO ONE ! !

Get rid of the wife first prison is prison@mcmurtry66 why you laugh? Have you ever been in a totally debit free position? It is amazing.

I stretched, but not by choice lol. Mortgage went up $1300 a month in May, due to increased taxes and insurance. Looking to sell in a few months. It’s not sustainable.

Here in NE Fla, I’m not alone in this plight. Hurricane Ian payback time.

I really don't see how this plays out in FL, as the home insurance market looks like a death spiral. Particularly on the coasts.

Concrete housing. Codes that would make a house impenetrable. Then maybe, just maybe, insurance companies will drop rates.I really don't see how this plays out in FL, as the home insurance market looks like a death spiral. Particularly on the coasts.

hahahaha who am i kidding

From what I can see it's not the housing/insurance that is the main problem, it's the 50 year old infrastructure and the counties trying to recoup their costs from damages by way of taxes. Florida, with all the good, hasn't planned well in this area. Ian was a great indicator that the 'building strip mall after strip mall and 500 unit apartment complexes on massive marshlands' has not played out too well. Water has a way of doing whatever the hell it wants.I really don't see how this plays out in FL, as the home insurance market looks like a death spiral. Particularly on the coasts.

Ask Houston about Harvey. The Army Corp of Engineers warned them, but they didn't listen either.

Houston’s flooding shows what happens when you ignore science and let developers run rampant

The city's gung-ho approach to development has destroyed the area's natural ability to drain away hurricane floodwaters.

qz.com

qz.com

There are a couple of sane politicians down here trying to talk some sense into their clientele, but they're not listening. Flagler County also lost a pissing match with the Army Corp of Engineers over who was responsible for the dredging of the intercoastal waterways, so Flagler county taxes have skyrocketed. My son's went up almost 4k from '22 to '23.

On the insurance side it's been a cluster since Andrew in '92. If you like torturing yourself, here's a wiki page on the timeline and details...https://en.wikipedia.org/wiki/Citizens_Property_Insurance_Corporation

The roofing fiasco has been quite interesting to be a part of as well. It's how we ended up with Citizens (Insurance). They offer insurance for rejects. No insurer will cover a roof over 15 years old in Florida, so you get handed to Citizens, at 4k plus per year. For homeowner's insurance! So, we put a new roof on right after Ian, but Citizens ended up being cheaper than anyone else, because of Ian! Oh, well isn't home ownership grand!

Similar threads

- Replies

- 19

- Views

- 652

- Replies

- 263

- Views

- 4K

- Replies

- 0

- Views

- 127

- Replies

- 18

- Views

- 1K

ADVERTISEMENT

ADVERTISEMENT