The next time he proves anything will be the first time.OK, you've stated your conclusion about the "liberal playbook". Prove your case.

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High School

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

223,000/5.4%

- Thread starter Sope Creek

- Start date

Prove it.We have huge shortages of skilled manual labor and huge oversupply of low and semiskilled labor.

Lol! how did the "out of labor force" numbers look? How did wage growth look for non-management positions? How does consumer debt look and where is that consumer debt concentrated?Jobs numbers for April were good and in line with expectations . . .

. . . the winter dip apparently was related to the port strike on the west coast and weather . . .

. . . and as a result the equity markets are broadly higher in the US, following strong gains globally.

http://www.washingtonpost.com/blogs...elease-jobs-growth-numbers-for-april/?hpid=z1

I understand why you are headline grabbing because most people don't like to read the fine print. This economy is a joke, isn't creating good long term sustainable jobs with benefits, and certainly isn't helping the middle class.

I ask you to really look into the numbers. The trickle down effect of QE never led to quality job creation but it created a lot of paper wealth. We're living in a society of haves and have nots and the middle class is taking a beating. If the economy were so strong wouldn't the FED raise interest rates? Do you really believe the unemployment rate looks this good? Really?

young people get hired as bartenders or servers while workers over 55 as a percentage of labor force is at an all time high.The population is aging, dave. We're in the midst of the greatest reduction in workforce because boomers are retiring daily, many quite comfortably.

I don't know. What does Zero Hedge say? But no one will learn anything from your vacuous unsourced post.Lol! how did the "out of labor force" numbers look? How did wage growth look for non-management positions? How does consumer debt look and where is that consumer debt concentrated?

Why are you still here?

What about short term bonds...aren't you safer there? I know your return won't be as good but if you're older and want to try to minimize risks what do you do?

Yes, you are, but in some cases, you are actually paying the government to preserve your principal. It appears all bills are now positive yielding, but they were not at one point. To me, that is just dumb. German Bunds are still negative.

Prove it.

I don't use the same classifications as CO, but skilled and semi-skilled labor has been a huge issue in manufacturing. We've talked about the imbalance of technically skilled graduates coming out of two year colleges (tech schools) vs. demand for these types of employees. Many CEOs and COOs indicated this issue over the past couple of years, as manufacturing activity rebounded.

One sample is:

http://www.enterpriseminnesota.org/...tate_of_Manufacturing_Invterview_Schedule.pdf

And another:

http://crossroads.newsworks.org/ind...ingly-hard-to-come-by-in-manufacturing-sector

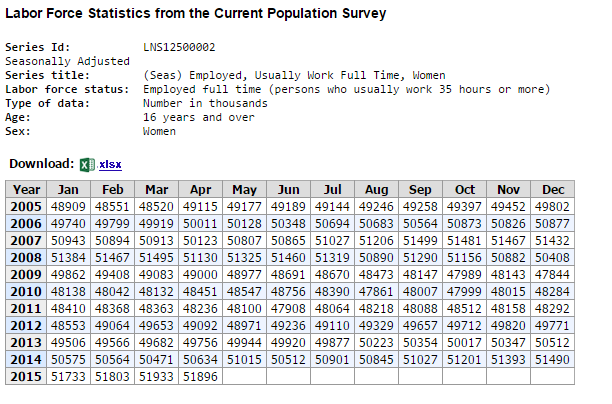

I am not saying the veracity of this report is correct don't have time to check the Bureaus statistics. "All the net job gains among females since the beginning of the recession have gone to foreign-born women, according to data released Friday from the Bureau of Labor Statistics.

Since the beginning of the recession in December 2007 to April 2015, 1.37 million more immigrant women are employed — from 9,041,000 in December 2007 to 10,413,000 in April 2015.

Native-born women, on the other had saw net employment decline by 143,000 in that same timeframe. From 59,322,000 in December 2007 to 59,179,000 last month."

I cannot find anything but the following, though I did see the headlines indicating this.

Well, here's the thing, though. Broad patterns of employment showed high levels of slack in pretty much every sector. Lots of highly skilled economists worked very hard to establish a skills mismatch without much luck,I don't use the same classifications as CO, but skilled and semi-skilled labor has been a huge issue in manufacturing. We've talked about the imbalance of technically skilled graduates coming out of two year colleges (tech schools) vs. demand for these types of employees. Many CEOs and COOs indicated this issue over the past couple of years, as manufacturing activity rebounded.

One sample is:

http://www.enterpriseminnesota.org/...tate_of_Manufacturing_Invterview_Schedule.pdf

And another:

http://crossroads.newsworks.org/ind...ingly-hard-to-come-by-in-manufacturing-sector

But if businesses were losing money because they couldn't find enough skilled laborers to produce the desired output, why didn't we see wages being bid up in skilled sectors? Why didn't we see employers training people to produce the output that would have profited them?

My answer to these questions is that the real problem was inadequate demand, and not a skills mismatch, because the market would have responded to a skills mismatch.

Well, here's the thing, though. Broad patterns of employment showed high levels of slack in pretty much every sector. Lots of highly skilled economists worked very hard to establish a skills mismatch without much luck,

But if businesses were losing money because they couldn't find enough skilled laborers to produce the desired output, why didn't we see wages being bid up in skilled sectors? Why didn't we see employers training people to produce the output that would have profited them?

My answer to these questions is that the real problem was inadequate demand, and not a skills mismatch, because the market would have responded to a skills mismatch.

That's absolutely right. The reason I know you're right is because 20 years ago I took an Econ 101 course. It's obviously not a required course to run for election.

Oh, they're not prepared . . . but that's because of (1) housing stock's huge escalation in prices over their lifetimes (they should have cashed out and traded down when they could have; they don't need the big houses anyway), and (2) they spent their money on conspicuous consumption rather than saving/investing it. What used to be retirement - a couple of years in a rocker on the front porch - is now "supposed" to be 25 years of golf and world travel, plus world class health care. It's a nice idea . . . but not all that realistic, frankly, for the vast majority. It never has been . . . and the idea that it's "supposed" to be that way is the disconnect.

I'm a boomer, but I'm not all that sympathetic to those who've maxed their credit cards their whole lives and now bemoan having to ratchet down their lifestyles . . . .

The best retirement plan in Africa is to have many children.

But if businesses were losing money because they couldn't find enough skilled laborers to produce the desired output, why didn't we see wages being bid up in skilled sectors? Why didn't we see employers training people to produce the output that would have profited them?

You did for certain positions, even though the segment is somewhat narrow in the context of general employment. In an effort to normalize financials, my team dug deeply within a client's W2 database and I witnessed several pay increases that outpaced the average or median pay change. Specific areas were production manager, quality control and engineering.

Wage gains were also offset by losses in other areas where there was oversupply of labor during the downturn (construction, trucking). As was implied, low skill or unskilled labor was (and still is) one of the issues facing the recovery, since the supply outpaces demand. I acknowledge that it could be that, given my geographic location, anecdotal evidence supports Upper Midwestern trends and not those of other areas of the country. I will also point out that there are a vast amount of places seeking to hire low skilled positions in our metro area, particularly retail and restaurants.

These highly skilled economists are also the same ones that, collectively, have failed to predict booms and busts. Just because an economic model says something doesn't necessarily mean that something is accurate. If multiple CEOs and COOs are telling us that labor fulfillment is a challenge to their business due to skills mismatch, I have to take them at their word.

I don't. If it can't be shown in data, the subjective perceptions of CEOs and COOs are no better than the subjective perceptions of anyone else.If multiple CEOs and COOs are telling us that labor fulfillment is a challenge to their business due to skills mismatch, I have to take them at their word.

I understand what you are saying but I think there comes a point in your life where you just have to accept the fact that you may be losing a little money just so you can keep some money safe (safe as possible at least). When you are in your 60s and 70s you don't have much time to recover if you have a big downturn.Yes, you are, but in some cases, you are actually paying the government to preserve your principal. It appears all bills are now positive yielding, but they were not at one point. To me, that is just dumb. German Bunds are still negative.

I don't. If it can't be shown in data, the subjective perceptions of CEOs and COOs are no better than the subjective perceptions of anyone else.

I just provided data. It's your choice whether or not you want to dismiss it.

You provided polling data. You're just aggregating opinions.I just provided data. It's your choice whether or not you want to dismiss it.

This says it's not all low wage stuff.It's all low wage work. I don't this headlines a fundamentally strong economy.

Similar threads

- Replies

- 125

- Views

- 7K

- Replies

- 8

- Views

- 2K

- Replies

- 164

- Views

- 11K

ADVERTISEMENT

ADVERTISEMENT