All options are politically difficult, including both yours and mine. That's why the problem hasn't been solved yet.That's fine too if that's the direction one wishes to go...I'll await the next Democrat that runs on the platform of raising taxes back to 2000 level on everyone.

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High Schools

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

Why the coming global recession will be harder to get out of

- Thread starter sglowrider

- Start date

Asked a guy who's nowhere near retirement age and doesn't plan to need Social Security.Why?

Biden has already said he will reverse the Trump Tax cuts. If that happens, sell every stock or mutual fund that you have. The market will fall dramatically.That's fine too if that's the direction one wishes to go...I'll await the next Democrat that runs on the platform of raising taxes back to 2000 level on everyone.

I agree with you about health care. It is a mess. That is not what I am talking about.

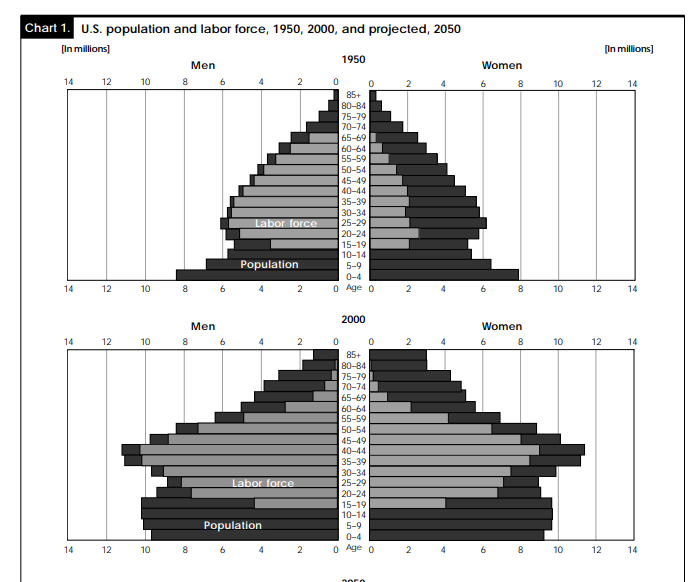

Social Security was started in 1935. The life expectancy in the United States in 1935 was approx 62. Full Retirement age was 65. Today, Life expectancy is close to 80. Full retirement age is basically 67. If you can make sense out of that I would love to hear it.

While life expectancy has changed like you suggest, much of that is due to other improvements. In 1935, a lot more people died before reaching adulthood than today. We had many more diseases that killed them off. It doesn't take many 8 year olds dying to really drop that life expectancy. So while it is also true that people who reach 65 have a greater life expectancy than they did in 1930, it isn't as great as it would seem by those numbers.

Raising the retirement age may/may not be a good idea. There are disadvantages too. The first is that there are still people who do manual labor and use up their bodies. For those in really taxing fields, moving three years will be significant. Second, corporations don't like old people on their payroll. Everyone I know that works in fortune 500 doesn't expect their jobs to be around for them at 60. And it isn't just people I know. It's just the nature of the beast. What are people going to do who lose their good job at 58 then struggle to 70 to get Social Security? Third, if older people do keep their jobs longer, what does that mean for younger people behind them who want to move up?

I'm not averse to changing the age if we have to, but we need to consider the consequences. I've known several people around age 60 that lost their jobs due to "reorganization". It becomes very hard to go out and find a job that pays close to what you were making at that age. And of course, the amount they make from Social Security will be greatly lowered by lower paying jobs late in their career.

I understand those consequences, and I don't have time to respond in a meaningful way. But when I look at the alternatives, I don't see any other way. You and I may be long gone when the sh!t hits the fan, but it will come. As I said earlier in this thread, I feel sorry for our kids and grand-kids.While life expectancy has changed like you suggest, much of that is due to other improvements. In 1935, a lot more people died before reaching adulthood than today. We had many more diseases that killed them off. It doesn't take many 8 year olds dying to really drop that life expectancy. So while it is also true that people who reach 65 have a greater life expectancy than they did in 1930, it isn't as great as it would seem by those numbers.

Raising the retirement age may/may not be a good idea. There are disadvantages too. The first is that there are still people who do manual labor and use up their bodies. For those in really taxing fields, moving three years will be significant. Second, corporations don't like old people on their payroll. Everyone I know that works in fortune 500 doesn't expect their jobs to be around for them at 60. And it isn't just people I know. It's just the nature of the beast. What are people going to do who lose their good job at 58 then struggle to 70 to get Social Security? Third, if older people do keep their jobs longer, what does that mean for younger people behind them who want to move up?

I'm not averse to changing the age if we have to, but we need to consider the consequences. I've known several people around age 60 that lost their jobs due to "reorganization". It becomes very hard to go out and find a job that pays close to what you were making at that age. And of course, the amount they make from Social Security will be greatly lowered by lower paying jobs late in their career.

While life expectancy has changed like you suggest, much of that is due to other improvements. In 1935, a lot more people died before reaching adulthood than today. We had many more diseases that killed them off. It doesn't take many 8 year olds dying to really drop that life expectancy. So while it is also true that people who reach 65 have a greater life expectancy than they did in 1930, it isn't as great as it would seem by those numbers.

Raising the retirement age may/may not be a good idea. There are disadvantages too. The first is that there are still people who do manual labor and use up their bodies. For those in really taxing fields, moving three years will be significant. Second, corporations don't like old people on their payroll. Everyone I know that works in fortune 500 doesn't expect their jobs to be around for them at 60. And it isn't just people I know. It's just the nature of the beast. What are people going to do who lose their good job at 58 then struggle to 70 to get Social Security? Third, if older people do keep their jobs longer, what does that mean for younger people behind them who want to move up?

I'm not averse to changing the age if we have to, but we need to consider the consequences. I've known several people around age 60 that lost their jobs due to "reorganization". It becomes very hard to go out and find a job that pays close to what you were making at that age. And of course, the amount they make from Social Security will be greatly lowered by lower paying jobs late in their career.

You can vary the retirement age by occupation. Many countries have lower retirement ages for women then men. It could be that women have low labor participation rates in those states. Based on life expectancy alone it should be the opposite.

I don't understand why we can't be creative in our solution.

Have you ever done manual labor? I've not since college, but you try slinging shingles, hanging drywall, or being an airport baggage handler at age 70. The body eventually breaks down.Why?

Asked a guy who's nowhere near retirement age and doesn't plan to need Social Security.

My generation are the ones who are paying for an entitlement of which we will likely not recieve our full share.

Have you ever done manual labor? I've not since college, but you try slinging shingles, hanging drywall, or being an airport baggage handler at age 70. The body eventually breaks down.

You could have a lower retirement age for physically demanding occupations.

The current occupant in the whitehouse is above the age of 70, as are his 2 leading challangers. Please forgive me if i think the retirement age shouldn't be a penny short of 70.

Then you and your generation should stop supporting policies that ensure you won't receive your full share.My generation are the ones who are paying for an entitlement of which we will likely not recieve our full share.

Then you and your generation should stop supporting policies that ensure you won't receive your full share.

My generation doesn't vote.

You could have a lower retirement age for physically demanding occupations.

The current occupant in the whitehouse is above the age of 70, as are his 2 leading challangers. Please forgive me if i think the retirement age shouldn't be a penny short of 70.

Just remember, a lot of people your age are behind me on the ladder. The longer you keep me around, the longer they stay a rung or more further down. There are trade-offs.

Just remember, a lot of people your age are behind me on the ladder. The longer you keep me around, the longer they stay a rung or more further down. There are trade-offs.

Understood, but from what I see around me it appears that people are delaying their retirements regardless of whether the SS age is 65 or 70. E.g. many are now waiting till 70 to retire due to their own circumstances.

Judging from this thread there seems to enough consensus on Social Security reform to resolve the upcoming financial shortfall.

Healthcare discussion, on the other hand, still revolves around entrenched talking points which leave arriving at consensus impossible. Government programs versus private/individual initiatives as if the twain shall never meet hopelessly leaves us in limbo. It is the old socialism versus free enterprise argument over and over again.

Healthcare discussion, on the other hand, still revolves around entrenched talking points which leave arriving at consensus impossible. Government programs versus private/individual initiatives as if the twain shall never meet hopelessly leaves us in limbo. It is the old socialism versus free enterprise argument over and over again.

Last edited:

Judging from this thread there seems to enough consensus on Social Secuity reform to resolve the upcoming financial shortfall.

Healthcare discussion, on the other hand, still revolves around entrenched talking points which leave arriving at consensus impossible. Government programs versus private/individual iniatives as if the twains can never meet hopelessly leaves us in limbo. It is the old socialism versus free enterprise argument over and over again.

That's an astute observation. You'd make a good diplomat.

Rock also said that the tax cuts have further exacerbated the income/wealth disparities. I may have missed it, but didn't notice where you addressed his comment.Nice answer. For you information, the vast majority of Americans benefited from the tax cuts. Now do you have a civil reply to what I said about raising eligibility ages, or do you just want to argue with everybody?

Do you agree with Rock's assertion that the tax cuts furthered, rather than resolved, the problem of income/wealth disparity?

So? The markets aren't the economy . . . not all Americans benefit from a strong performance of those markets.Biden has already said he will reverse the Trump Tax cuts. If that happens, sell every stock or mutual fund that you have. The market will fall dramatically.

Besides, I am preparing a plan to shed equities in favor of cash and debt instruments in anticipation of the Trump recession coming in 2020/21.

Then you and your generation should stop supporting policies that ensure you won't receive your full share.

Lol, as if it's our problem a ponzi scheme was constructed in the midst of birth rate reductions

Wealth disparity is only a problem if you're a jealous assh*le.

If expanding your investment portfolio depends on the middle class and below buying your goods and/or services wealth distribution could be a problem.

Furthermore a good many of the wealthy are dependent on the less affluent happily showing up for work each day and being productive.

The wealthy not caring about others and the less affluent wanting to bring the upperclass down gets neither of them anywhere.

There are many reasons for the income/wealth disparity. I would start with education, and not taxes to help resolve that.Rock also said that the tax cuts have further exacerbated the income/wealth disparities. I may have missed it, but didn't notice where you addressed his comment.

Do you agree with Rock's assertion that the tax cuts furthered, rather than resolved, the problem of income/wealth disparity?

Hence the problem. If your generation wants to have any input on how these problems are going to get fixed, they’d better start voting. The young ones I know that are politically involved are most concerned about the environment and gun control. Someone needs to be speaking to them about Social Security, Medicare, etc.My generation doesn't vote.

I would encourage everyone here to read the report that Twenty has linked and after reading it, if anybody thinks that the simple idea of “taxing the rich” has any bearing whatsoever on our financial outcomes 20-30-40 years from now really don’t understand what we are up against as a nation.The only spending cuts that matter would be those to SS/Medicare. Those two programs face a $100 trillion cash shortfall over the next 30 years.

Everything else has a $16 trillion surplus over that same period.

Yet nobody will even come within a hundred yards of this albatross....instead they squabble over proverbial pennies in the discretionary budget.

The linked report makes a good mockery of both conservative and liberal "fantasy" solutions.

The rich will always find ways to avoid taxes including moving to another country.

Think where the country might be in the future if all the immigrants were poor and the rich were migrating elsewhere.

Even with the wide range of tax policies we've had over the last 70 years

...govt revenue as a % of GDP has always remained in a fairly tight range.

Raising the retirement age may/may not be a good idea. There are disadvantages too. The first is that there are still people who do manual labor and use up their bodies. For those in really taxing fields, moving three years will be significant.

Our regular UPS route driver is a 40-something guy with kids in their very early teens. He makes good money, yes (UPS drivers are Teamsters), but he earns every freaking dime.Have you ever done manual labor? I've not since college, but you try slinging shingles, hanging drywall, or being an airport baggage handler at age 70. The body eventually breaks down.

He's had a leg bothering him. Went to the doctor. Turns out he's got a stress fracture. He was hoping to put off doing anything about it until after December (that is, of course, their rush season, and there's more money to be made). Doctor said he'd better get something done right now -- all he needs to do is step out of the truck carrying a 40LB carton and that leg could snap.

Yes, he'll be able to retire before 67 and have a good income due to the benefits of his union contract, but he's the exception. The majority of people doing the kind of work he does don't have that kind of backup. They have to go up to full retirement age. Many of them are physically broken by the time they get there.

I tend to take a pragmatic stance: it's both. The real problem for all of us happens to be a Republican problem -- McConnell et al. came to realize that Big Government is great for the economy and since liberals are already stigmatized as Big GOvernmenters, the Republicans can bloat the GOvernment to their hearts' content with impunity. In other words, the last surplus we had was when Republicans still sincerely endeavored to lower expenditures. In those days, there was always a push-pull between liberals pushing to help people and conservatives pulling back on government expenditures. Our society got better and the economy grew. Now that Republicans also stand for Big Government (granted they're still in the closet), we're doomed.Do actually believe that it is a revenue problem more than a spending problem?

You have brought this up before, and Thyrsis and I, have responded. What you fail to take into account, is that higher marginal rates were doing their job. (Albeit, the progressiveness of the tax code is more important than the rate.) You say, when rates were higher and the tax code was more progressive, the wealthy were still paying roughly the same rate(6% more), because there were more deductions.Even with the wide range of tax policies we've had over the last 70 years

...govt revenue as a % of GDP has always remained in a fairly tight range.

First, when the tax code was more progressive, owners/management were forced to make a choice. For example they could pay a CEO $2 million/yr, but the higher the salary, the more likely it was that that money would end up in the government's hands. The higher the salary, the higher the rate. Once we lowered the rate and broadened the base, every million paid to a CEO was capped at the top marginal rate (as low as 20% IIRC). (*Note: please check out the correlation between CEO compensation and top marginal rates, and notice the spike after the Tax Reform Act of 1986.)

You say that the rate paid by the wealthy were roughly the same. So then it's obvious, by logic and historical data, that they chose lower incomes, rather than paying the higher rates. So what did they do then, and what is done now, with the capital? Back then they took advantage of the extra deductions and spent more money. They hired more workers, they bought more equipment, or they just bought more stuff... artificially increasing aggregate demand, and wages.

And what did our government do with the taxes they collected? They built tanks and aircraft, and paid soldiers, in times of war, and built roads, schools, and bridges, in times of peace. All of these things artificially inflated demand, which in turn, artificially inflated pressure on wages.

To be a true free market capitalist you must believe that market participants act rationally. That is to say, that a person would buy product X over product Z, if product X is cheaper, and all other things are equal. Likewise, we expect the laws of supply and demand to always hold true. That's great in theory, but in the real world, people don't always act rationally. Who on this board, checked the unemployment rate, before conceiving a child? Labor isn't provided based on demand. And throughout the history of the world, there has always been way more indians, than chiefs. All those things we did back then, to make America great, was done to counter that irrational capitalistic behavior, and is blasted today as Socialism.

Now, after 40 years of a more capitalistic society, that capital lies in the hands of fewer people, and is reinvested in the form of stocks, bonds, and mortgage backed securities. So much so, and for so long, that you would admit, the better way to balance wealth distribution is to address capital gains instead of income.

We now live in a society where hundreds of thousands of people are living paycheck to paycheck. Which isn't new, but now they are buying things at 2019 prices, with 1979 wages. And every year healthcare goes up, and the electric bill goes up, and tuition goes up, and on and on. Therefore, the average American family has less discretionary income to buy things corporations produce. This was made evident, with the Great Recession. $17 trillion dollars lost, simply because investments were inflated well beyond the value of the underlying asset. If that money would have been taxed, and/or redistributed through wages, aggregate demand would have been higher and the underlying value of those assets would have been higher.

Also note that since 1980, GDP has never been over 5%. So tax revenue, in terms of real dollars, would have been significantly higher given the higher GDP rates pre 1980, even if the percentage of GDP were similar.

I was going to also write about tax rates, aggregate demand, and the velocity of money, and how they're related and how they've changed since 1980, but I'm on my 4th or 5th attempt at finishing this post. Hopefully, that explains why this post wonders so much. I'm sorry for rambling and poor grammar.

My last point: think about how many Republicans on this board, claim they were for the Trump tax cuts, but didn't support, or think tax cuts were needed at the top. Those posters are effectively saying the tax code needs to be more progressive...those socialist bastards.

Last edited:

Very nice post.You have brought this up before, and Thyrsis and I, have responded. What you fail to take into account, is that higher marginal rates were doing their job. (Albeit, the progressiveness of the tax code is more important than the rate.) You say, when rates were higher and the tax code was more progressive, the wealthy were still paying roughly the same rate(6% more), because there were more deductions.

First, when the tax code was more progressive, owners/management were forced to make a choice. For example they could pay a CEO $2 million/yr, but the higher the salary, the more likely it was that that money would end up in the government's hands. The higher the salary, the higher the rate. Once we lowered the rate and broadened the base, every million paid to a CEO was capped at the top marginal rate (as low as 20% IIRC). (*Note: please check out the correlation between CEO compensation and top marginal rates, and notice the spike after the Tax Reform Act of 1986.)

You say that the rate paid by the wealthy were roughly the same. So then it's obvious, by logic and historical data, that they chose lower incomes, rather than paying the higher rates. So what did they do then, and what is done now, with the capital? Back then they took advantage of the extra deductions and spent more money. They hired more workers, they bought more equipment, or they just bought more stuff... artificially increasing aggregate demand, and wages.

And what did our government do with the taxes they collected? They built tanks and aircraft, and paid soldiers, in times of war, and built roads, schools, and bridges, in times of peace. All of these things artificially inflated demand, which in turn, artificially inflated pressure on wages.

To be a true free market capitalist you must believe that market participants act rationally. That is to say, that a person would buy product X over product Z, if product X is cheaper, and all other things are equal. Likewise, we expect the laws of supply and demand to always hold true. That's great in theory, but in the real world, people don't always act rationally. Who on this board, checked the unemployment rate, before conceiving a child? Labor isn't provided based on demand. And throughout the history of the world, there has always been way more indians, than chiefs. All those things we did back then, to make America great, was done to counter that irrational capitalistic behavior, and is blasted today as Socialism.

Now, after 40 years of a more capitalistic society, that capital lies in the hands of fewer people, and is reinvested in the form of stocks, bonds, and mortgage backed securities. So much so, and for so long, that you would admit, the better way to balance wealth distribution is to address capital gains instead of income.

We now live in a society where hundreds of thousands of people are living paycheck to paycheck. Which isn't new, but now they are buying things at 2019 prices, with 1979 wages. And every year healthcare goes up, and the electric bill goes up, and tuition goes up, and on and on. Therefore, the average American family has less discretionary income to buy things corporations produce. This was made evident, with the Great Recession. $17 trillion dollars lost, simply because investments were inflated well beyond the value of the underlying asset. If that money would have been taxed, and/or redistributed through wages, aggregate demand would have been higher and the underlying value of those assets would have been higher.

Also note that since 1980, GDP has never been over 5%. So tax revenue, in terms of real dollars, would have been significantly higher given the higher GDP rates pre 1980, even if the percentage of GDP were similar.

I was going to also write about tax rates, aggregate demand, and the velocity of money, and how they're related and how they've changed since 1980, but I'm on my 4th or 5th attempt at finishing this post. Hopefully, that explains why this post wonders so much. I'm sorry for rambling and poor grammar.

My last point: think about how many Republicans on this board, claim they were for the Trump tax cuts, but didn't support, or think tax cuts were needed at the top. Those posters are effectively saying the tax code needs to be more progressive...those socialist bastards.

You have brought this up before, and Thyrsis and I, have responded. What you fail to take into account, is that higher marginal rates were doing their job. (Albeit, the progressiveness of the tax code is more important than the rate.) You say, when rates were higher and the tax code was more progressive, the wealthy were still paying roughly the same rate(6% more), because there were more deductions.

First, when the tax code was more progressive, owners/management were forced to make a choice. For example they could pay a CEO $2 million/yr, but the higher the salary, the more likely it was that that money would end up in the government's hands. The higher the salary, the higher the rate. Once we lowered the rate and broadened the base, every million paid to a CEO was capped at the top marginal rate (as low as 20% IIRC). (*Note: please check out the correlation between CEO compensation and top marginal rates, and notice the spike after the Tax Reform Act of 1986.)

You say that the rate paid by the wealthy were roughly the same. So then it's obvious, by logic and historical data, that they chose lower incomes, rather than paying the higher rates. So what did they do then, and what is done now, with the capital? Back then they took advantage of the extra deductions and spent more money. They hired more workers, they bought more equipment, or they just bought more stuff... artificially increasing aggregate demand, and wages.

And what did our government do with the taxes they collected? They built tanks and aircraft, and paid soldiers, in times of war, and built roads, schools, and bridges, in times of peace. All of these things artificially inflated demand, which in turn, artificially inflated pressure on wages.

To be a true free market capitalist you must believe that market participants act rationally. That is to say, that a person would buy product X over product Z, if product X is cheaper, and all other things are equal. Likewise, we expect the laws of supply and demand to always hold true. That's great in theory, but in the real world, people don't always act rationally. Who on this board, checked the unemployment rate, before conceiving a child? Labor isn't provided based on demand. And throughout the history of the world, there has always been way more indians, than chiefs. All those things we did back then, to make America great, was done to counter that irrational capitalistic behavior, and is blasted today as Socialism.

Now, after 40 years of a more capitalistic society, that capital lies in the hands of fewer people, and is reinvested in the form of stocks, bonds, and mortgage backed securities. So much so, and for so long, that you would admit, the better way to balance wealth distribution is to address capital gains instead of income.

We now live in a society where hundreds of thousands of people are living paycheck to paycheck. Which isn't new, but now they are buying things at 2019 prices, with 1979 wages. And every year healthcare goes up, and the electric bill goes up, and tuition goes up, and on and on. Therefore, the average American family has less discretionary income to buy things corporations produce. This was made evident, with the Great Recession. $17 trillion dollars lost, simply because investments were inflated well beyond the value of the underlying asset. If that money would have been taxed, and/or redistributed through wages, aggregate demand would have been higher and the underlying value of those assets would have been higher.

Also note that since 1980, GDP has never been over 5%. So tax revenue, in terms of real dollars, would have been significantly higher given the higher GDP rates pre 1980, even if the percentage of GDP were similar.

I was going to also write about tax rates, aggregate demand, and the velocity of money, and how they're related and how they've changed since 1980, but I'm on my 4th or 5th attempt at finishing this post. Hopefully, that explains why this post wonders so much. I'm sorry for rambling and poor grammar.

My last point: think about how many Republicans on this board, claim they were for the Trump tax cuts, but didn't support, or think tax cuts were needed at the top. Those posters are effectively saying the tax code needs to be more progressive...those socialist bastards.

Nice post and I agree with much of it. I'll note, however, that my comment really had nothing to do with the how progressive or not the code is.... Actually the opposite.... only that total revenue collected (as % of GDP) has been tightly range bound regardless of how we've shaped the code ...progressive or not. As such, not sure it's even possible (if one was so inclined) to tax our way out the coming fiscal hole.

Not sure how relative....but will note that there was no economic panacea under the tax policy you described during the 1970s. I've been doing a lot of research on historic inflation rates for a particular "out of the box" investment I'm considering, that's dependant upon the idea we never return to 1970s level inflation.....I'm now wondering how the tax policy you described impacted that. Likely not much, but makes me think.

Last edited:

You have brought this up before, and Thyrsis and I, have responded. What you fail to take into account, is that higher marginal rates were doing their job. (Albeit, the progressiveness of the tax code is more important than the rate.) You say, when rates were higher and the tax code was more progressive, the wealthy were still paying roughly the same rate(6% more), because there were more deductions.

First, when the tax code was more progressive, owners/management were forced to make a choice. For example they could pay a CEO $2 million/yr, but the higher the salary, the more likely it was that that money would end up in the government's hands. The higher the salary, the higher the rate. Once we lowered the rate and broadened the base, every million paid to a CEO was capped at the top marginal rate (as low as 20% IIRC). (*Note: please check out the correlation between CEO compensation and top marginal rates, and notice the spike after the Tax Reform Act of 1986.)

You say that the rate paid by the wealthy were roughly the same. So then it's obvious, by logic and historical data, that they chose lower incomes, rather than paying the higher rates. So what did they do then, and what is done now, with the capital? Back then they took advantage of the extra deductions and spent more money. They hired more workers, they bought more equipment, or they just bought more stuff... artificially increasing aggregate demand, and wages.

And what did our government do with the taxes they collected? They built tanks and aircraft, and paid soldiers, in times of war, and built roads, schools, and bridges, in times of peace. All of these things artificially inflated demand, which in turn, artificially inflated pressure on wages.

To be a true free market capitalist you must believe that market participants act rationally. That is to say, that a person would buy product X over product Z, if product X is cheaper, and all other things are equal. Likewise, we expect the laws of supply and demand to always hold true. That's great in theory, but in the real world, people don't always act rationally. Who on this board, checked the unemployment rate, before conceiving a child? Labor isn't provided based on demand. And throughout the history of the world, there has always been way more indians, than chiefs. All those things we did back then, to make America great, was done to counter that irrational capitalistic behavior, and is blasted today as Socialism.

Now, after 40 years of a more capitalistic society, that capital lies in the hands of fewer people, and is reinvested in the form of stocks, bonds, and mortgage backed securities. So much so, and for so long, that you would admit, the better way to balance wealth distribution is to address capital gains instead of income.

We now live in a society where hundreds of thousands of people are living paycheck to paycheck. Which isn't new, but now they are buying things at 2019 prices, with 1979 wages. And every year healthcare goes up, and the electric bill goes up, and tuition goes up, and on and on. Therefore, the average American family has less discretionary income to buy things corporations produce. This was made evident, with the Great Recession. $17 trillion dollars lost, simply because investments were inflated well beyond the value of the underlying asset. If that money would have been taxed, and/or redistributed through wages, aggregate demand would have been higher and the underlying value of those assets would have been higher.

Also note that since 1980, GDP has never been over 5%. So tax revenue, in terms of real dollars, would have been significantly higher given the higher GDP rates pre 1980, even if the percentage of GDP were similar.

I was going to also write about tax rates, aggregate demand, and the velocity of money, and how they're related and how they've changed since 1980, but I'm on my 4th or 5th attempt at finishing this post. Hopefully, that explains why this post wonders so much. I'm sorry for rambling and poor grammar.

My last point: think about how many Republicans on this board, claim they were for the Trump tax cuts, but didn't support, or think tax cuts were needed at the top. Those posters are effectively saying the tax code needs to be more progressive...those socialist bastards.

I tip my cap to thee.

Doesn't your logic essentially say instead of the $1.5T to $2.3T the tax cuts will add to the the debt over 10 years we could have just as easily shrunk it by so much with a tax increase without violating your GDP % factor?Nice post and I agree with much of it. I'll note, however, that my comment really had nothing to do with the how progressive or not the code is.... Actually the opposite.... only that total revenue collected (as % of GDP) has been tightly range bound regardless of how we've shaped the code ...progressive or not. As such, not sure it's even possible (if one was so inclined) to tax our way out the coming fiscal hole.

Not sure how relative....but will note that there was no economic panacea under the tax policy you described during the 1970s. I've been doing a lot of research on historic inflation rates for a particular "out of the box" investment I'm considering, that's dependant upon the idea we never return to 1970s level inflation.....I'm now wondering how the tax policy you described impacted that. Likely not much, but makes me think.

That would be a difference of $3T to $4.6T.

Thank you. I think I was addressing your chart(that showed top earners only paid an ETR 6% higher back then- with higher top marginal rates- than they do today. But I definitely addressed your current post in paragraph 8. If percent of GDP is limited, doesn't that make GDP an even more important number?Nice post and I agree with much of it. I'll note, however, that my comment really had nothing to do with the how progressive or not the code is.... Actually the opposite.... only that total revenue collected (as % of GDP) has been tightly range bound regardless of how we've shaped the code ...progressive or not. As such, not sure it's even possible (if one was so inclined) to tax our way out the coming fiscal hole.

Not sure how relative....but will note that there was no economic panacea under the tax policy you described during the 1970s. I've been doing a lot of research on historic inflation rates for a particular "out of the box" investment I'm considering, that's dependant upon the idea we never return to 1970s level inflation.....I'm now wondering how the tax policy you described impacted that. Likely not much, but makes me think.

To be clear, because money is relative, a panacea is not possible. However, isn't inflation a good measure of how well a majority of the country is doing? IOW, if we printed money and gave it to the middle class, or gave the middle class a large tax cut, or significantly increased middle class wages, wouldn't the expected result be inflation? Conversely, isn't it telling that we've had a historic period of low interest rates and an absence of inflation? There's little doubt in my mind that tax policy plays a role in inflation.

WRT your possible investment there are several things to consider. First, the FED has changed strategy since then. So, it's not exactly apples to apples.

https://www.frbsf.org/education/publications/doctor-econ/2003/january/monetary-policy-1970s-1980s/

Second, there is another side to the equation. Inflation is too much money chasing too few goods. I think the supply side of goods are often overlooked. The Great Depression had the dust bowl. The 70's had the Nixon soybean embargo and 1st and 2nd oil shocks. The Great Recession-which may be more relevant to your possible investment-had inflation of investments, including commodities. And even though there were some supply issues, prices were inflated significantly due to the elimination of spec limits. $150/ barrel oil, $8.50 corn, $18 soybeans.

As for Medicare and S.S, I read your link, and think we should take our growing deficits seriously. I don't think it's helpful to lump the two together, because they each face different circumstances. As I've stated before, allowing healthcare to grow at 1-2% in perpetuity is going to skew a lot of numbers, especially the longer we let it accumulate. Because your link was focused on our debt, I didn't see where it mentioned that the taxpayers will not only be on the hook for the entitlements and tax burdens that accompany them, but we will also be on the hook for the rise in our own healthcare- which economically speaking is no different than a tax.

WRT S.S, isn't this what we debated in 2000? Gore said we should put the budget surplus in a lock box to help offset the retiring baby boomers that we could see on the horizon. Bush wanted to give people back their money in the form of across the board tax cuts. Bush won. He got his tax cuts. So we pursued a tax policy that widened the income gap, and put more money in the hands of the 1%, and then capped FICA at what $120k? And now we have a problem?

Last edited:

Thank you. I think I was addressing your chart(that showed top earners only paid an ETR 6% higher back then- with higher top marginal rates- than they do today. But I definitely addressed your current post in paragraph 8. If percent of GDP is limited, doesn't that make GDP an even more important number?

To be clear, because money is relative, a panacea is not possible. However, isn't inflation a good measure of how well a majority of the country is doing? IOW, if we printed money and gave it to the middle class, or gave the middle class a large tax cut, or significantly increased middle class wages, wouldn't the expected result be inflation? Conversely, isn't it telling that we've had a historic period of low interest rates and an absence of inflation? There's little doubt in my mind that tax policy plays a role in inflation.

WRT your possible investment there are several things to consider. First, the FED has changed strategy since then. So, it's not exactly apples to apples.

https://www.frbsf.org/education/publications/doctor-econ/2003/january/monetary-policy-1970s-1980s/

Second, there is another side to the equation. Inflation is too much money chasing too few goods. I think the supply side of goods are often overlooked. The Great Depression had the dust bowl. The 70's had the Nixon soybean embargo and 1st and 2nd oil shocks. The Great Recession-which may be more relevant to your possible investment-had inflation of investments, including commodities. And even though there were some supply issues, prices were inflated significantly due to the elimination of spec limits. $150/ barrel oil, $8.50 corn, $18 soybeans.

As for Medicare and S.S, I read your link, and think we should take our growing deficits seriously. I don't think it's helpful to lump the two together, because they each face different circumstances. As I've stated before, allowing healthcare to grow at 1-2% in perpetuity is going to skew a lot of numbers, especially the longer we let it accumulate. Because your link was focused on our debt, I didn't see where it mentioned that the taxpayers will not only be on the hook for the entitlements and tax burdens that accompany them, but we will also be on the hook for the rise in our own healthcare- which economically speaking is no different than a tax.

WRT S.S, isn't this what we debated in 2000? Gore said we should put the budget surplus in a lock box to help offset the retiring baby boomers that we could see on the horizon. Bush wanted to give people back their money in the form of across the board tax cuts. Bush won. He got his tax cuts. So we pursued a tax policy that widened the income gap, and put more money in the hands of the 1%, and then capped FICA at what $120k? And now we have a problem?

Few comments....

1) regarding my alt investment....you hit the nail on the head regarding how the Fed changed their strategy in the early 80s. If that continues the next 20-30 years it's a killer winner. If it doesn't, and things are like the 50s-70s it's a loser. My "bet" is that the Fed will continue to fight inflation over everything else.... But who knows, things change. It works through mild inflation.....it is killed in big/hyper inflation.

2) healthcare growth rates are non-sustainable, but those growth rates.....(GROWTH RATES) they've already come way down...and I think it will continue to. I have conservative Docs in my family that think that some realm of even larger govt HV is inevitable. They are there every day and agree the system isn't working. I believe we are headed towards a much larger public/private partnership system than we have now, and I'm fine with that. I want the max benefit per $, just as everyone else....and nobody would agree we get that now.

I do think the lid has been put on to some degree... much like college tuition has flat-lined.

3) SS can be fixed relatively easily, with only minor pain. Not really that worried with that program.

A-plusYou have brought this up before, and Thyrsis and I, have responded. What you fail to take into account, is that higher marginal rates were doing their job. (Albeit, the progressiveness of the tax code is more important than the rate.) You say, when rates were higher and the tax code was more progressive, the wealthy were still paying roughly the same rate(6% more), because there were more deductions.

First, when the tax code was more progressive, owners/management were forced to make a choice. For example they could pay a CEO $2 million/yr, but the higher the salary, the more likely it was that that money would end up in the government's hands. The higher the salary, the higher the rate. Once we lowered the rate and broadened the base, every million paid to a CEO was capped at the top marginal rate (as low as 20% IIRC). (*Note: please check out the correlation between CEO compensation and top marginal rates, and notice the spike after the Tax Reform Act of 1986.)

You say that the rate paid by the wealthy were roughly the same. So then it's obvious, by logic and historical data, that they chose lower incomes, rather than paying the higher rates. So what did they do then, and what is done now, with the capital? Back then they took advantage of the extra deductions and spent more money. They hired more workers, they bought more equipment, or they just bought more stuff... artificially increasing aggregate demand, and wages.

And what did our government do with the taxes they collected? They built tanks and aircraft, and paid soldiers, in times of war, and built roads, schools, and bridges, in times of peace. All of these things artificially inflated demand, which in turn, artificially inflated pressure on wages.

To be a true free market capitalist you must believe that market participants act rationally. That is to say, that a person would buy product X over product Z, if product X is cheaper, and all other things are equal. Likewise, we expect the laws of supply and demand to always hold true. That's great in theory, but in the real world, people don't always act rationally. Who on this board, checked the unemployment rate, before conceiving a child? Labor isn't provided based on demand. And throughout the history of the world, there has always been way more indians, than chiefs. All those things we did back then, to make America great, was done to counter that irrational capitalistic behavior, and is blasted today as Socialism.

Now, after 40 years of a more capitalistic society, that capital lies in the hands of fewer people, and is reinvested in the form of stocks, bonds, and mortgage backed securities. So much so, and for so long, that you would admit, the better way to balance wealth distribution is to address capital gains instead of income.

We now live in a society where hundreds of thousands of people are living paycheck to paycheck. Which isn't new, but now they are buying things at 2019 prices, with 1979 wages. And every year healthcare goes up, and the electric bill goes up, and tuition goes up, and on and on. Therefore, the average American family has less discretionary income to buy things corporations produce. This was made evident, with the Great Recession. $17 trillion dollars lost, simply because investments were inflated well beyond the value of the underlying asset. If that money would have been taxed, and/or redistributed through wages, aggregate demand would have been higher and the underlying value of those assets would have been higher.

Also note that since 1980, GDP has never been over 5%. So tax revenue, in terms of real dollars, would have been significantly higher given the higher GDP rates pre 1980, even if the percentage of GDP were similar.

I was going to also write about tax rates, aggregate demand, and the velocity of money, and how they're related and how they've changed since 1980, but I'm on my 4th or 5th attempt at finishing this post. Hopefully, that explains why this post wonders so much. I'm sorry for rambling and poor grammar.

My last point: think about how many Republicans on this board, claim they were for the Trump tax cuts, but didn't support, or think tax cuts were needed at the top. Those posters are effectively saying the tax code needs to be more progressive...those socialist bastards.

I will stand corrected, but it's not like Bush stole SS funds to finance his tax cuts. The Treasury just borrowed from the trust fund. It now needs to borrow more money on the open market to pay that money back. The whole "lockbox" discussion was political theater, and it played on the fantasy people have that their SS dollars are sitting in some account with their names on it.WRT S.S, isn't this what we debated in 2000? Gore said we should put the budget surplus in a lock box to help offset the retiring baby boomers that we could see on the horizon. Bush wanted to give people back their money in the form of across the board tax cuts. Bush won. He got his tax cuts.

They were discussing what should be done with the budget surplus.I will stand corrected, but it's not like Bush stole SS funds to finance his tax cuts. The Treasury just borrowed from the trust fund. It now needs to borrow more money on the open market to pay that money back. The whole "lockbox" discussion was political theater, and it played on the fantasy people have that their SS dollars are sitting in some account with their names on it.

I thought the "lockbox" discussion was with regards to the surplus in the SS trust fund, not any overall budget surplus. But I'm old and my memory fails me sometimes and I don't give enough of a shit to research it, so will stand corrected instead.They were discussing what should be done with the budget surplus.

Thank you. I think I was addressing your chart(that showed top earners only paid an ETR 6% higher back then- with higher top marginal rates- than they do today. But I definitely addressed your current post in paragraph 8. If percent of GDP is limited, doesn't that make GDP an even more important number?

To be clear, because money is relative, a panacea is not possible. However, isn't inflation a good measure of how well a majority of the country is doing? IOW, if we printed money and gave it to the middle class, or gave the middle class a large tax cut, or significantly increased middle class wages, wouldn't the expected result be inflation? Conversely, isn't it telling that we've had a historic period of low interest rates and an absence of inflation? There's little doubt in my mind that tax policy plays a role in inflation.

WRT your possible investment there are several things to consider. First, the FED has changed strategy since then. So, it's not exactly apples to apples.

https://www.frbsf.org/education/publications/doctor-econ/2003/january/monetary-policy-1970s-1980s/

Second, there is another side to the equation. Inflation is too much money chasing too few goods. I think the supply side of goods are often overlooked. The Great Depression had the dust bowl. The 70's had the Nixon soybean embargo and 1st and 2nd oil shocks. The Great Recession-which may be more relevant to your possible investment-had inflation of investments, including commodities. And even though there were some supply issues, prices were inflated significantly due to the elimination of spec limits. $150/ barrel oil, $8.50 corn, $18 soybeans.

As for Medicare and S.S, I read your link, and think we should take our growing deficits seriously. I don't think it's helpful to lump the two together, because they each face different circumstances. As I've stated before, allowing healthcare to grow at 1-2% in perpetuity is going to skew a lot of numbers, especially the longer we let it accumulate. Because your link was focused on our debt, I didn't see where it mentioned that the taxpayers will not only be on the hook for the entitlements and tax burdens that accompany them, but we will also be on the hook for the rise in our own healthcare- which economically speaking is no different than a tax.

WRT S.S, isn't this what we debated in 2000? Gore said we should put the budget surplus in a lock box to help offset the retiring baby boomers that we could see on the horizon. Bush wanted to give people back their money in the form of across the board tax cuts. Bush won. He got his tax cuts. So we pursued a tax policy that widened the income gap, and put more money in the hands of the 1%, and then capped FICA at what $120k? And now we have a problem?

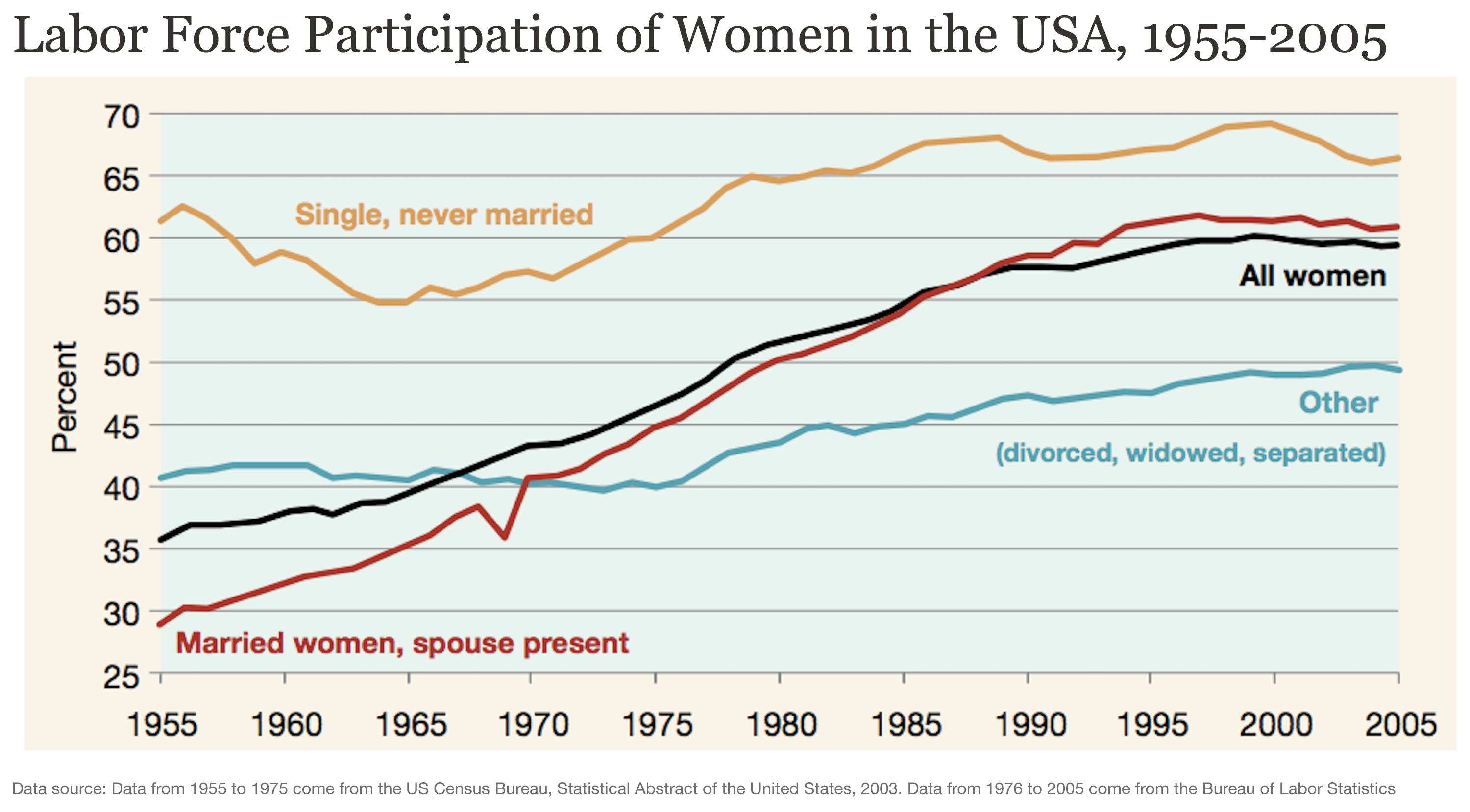

Again, solid posts ITT. My question to you is, if you point this turning point circa 1980, which happens to be the beginning of Reaganomics, how does the drastic change in women's participation in the workforce factor into you consideration regarding wage growth? As I think about my mom, first generation on either side of my family tree to have women working outside the home for a non-war period, she started working circa 1978.

Obviously I've made this point before, but I don't think the influx of supply has received the obvious attention that it should, particularly when considering middle-class wage stagnation.

Similar threads

- Replies

- 18

- Views

- 826

- Replies

- 704

- Views

- 17K

- Replies

- 33

- Views

- 990

- Replies

- 58

- Views

- 2K

ADVERTISEMENT

ADVERTISEMENT