Sounds like you need a better neighborhood more than a better truck.Well, it looks like my vehicle decision will need to be made sooner than I had planned.

My truck was stolen from in front of my house this afternoon.

Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

What are you going to do with your Covid check?

- Thread starter UncleMark

- Start date

I trust unclebulk's the defacto mayor of his trailer park. Can't leave when the neighborhood needs him mostSounds like you need a better neighborhood more than a better truck.

I can buy a lot of old trucks for what it would cost to move to a better neighborhood.Sounds like you need a better neighborhood more than a better truck.

And truthfully, this is the first bad experience I've had around here in 20 or more years. Worst before was someone just getting into the car and rifling through it.

Not hardly. That would be worse than being a Mod.I trust unclebulk's the defacto mayor of his trailer park. Can't leave when the neighborhood needs him most

I remember when that was a hamburger

I remember when it was 2 hamburgers and 3 cents change.

1921 - 5 cent sliders sold by the sack. If you hate onions they’re the worst burger ever madeI remember when it was 2 hamburgers and 3 cents change.

Or they tried to trade it for crack and no dealer would take it.Probably a getaway car...now you’re a target...or will have respect...like Walter white

1921 - 5 cent sliders sold by the sack. If you hate onions they’re the worst burger ever made

More grilled onions than meat. Onions were real, not so sure about the meat.

A

anon_mlxxvlbug9dpa

Guest

You don’t know what you got til it’s gone.1921 - 5 cent sliders sold by the sack. If you hate onions they’re the worst burger ever made

no castles near me

Hmmm. What about the knock off? Krystal’s?You don’t know what you got til it’s gone.

no castles near me

You don’t know what you got til it’s gone.

no castles near me

Those little grimy stand alones that looked like a castle and had only a walk up window were the best. I always associated them with steel mills and oil refineries in The Region.

I trust unclebulk's the defacto mayor of his trailer park. Can't leave when the neighborhood needs him most

So? Do you have a problem with authority figures?

Some of those popped up in Saint louis in the mid to late 1930s. CrazyThose little grimy stand alones that looked like a castle and had only a walk up window were the best. I always associated them with steel mills and oil refineries in The Region.

A

anon_mlxxvlbug9dpa

Guest

Nada. We buy the frozen White Castles from the grocery store. My 10 yr old can’t get enough of them.Hmmm. What about the knock off? Krystal’s?

krystals are in the south. I’m in western Pennsylvania. A veritable desert of good food.

Krystal's, answering the need for a poor man's White Castle.Hmmm. What about the knock off? Krystal’s?

LOL. "a poor man's white castle." that has to be the first time in history those words have ever been written in that orderKrystal's, answering the need for a poor man's White Castle.

Kanuckistani wife isn't a fan either. She buys me a gift card at Christmas as a gag gift. She doesn't realize it's usually the best gift she gives me.Nada. We buy the frozen White Castles from the grocery store. My 10 yr old can’t get enough of them.

krystals are in the south. I’m in western Pennsylvania. A veritable desert of good food.

Holy shit you're oldSome of those popped up in Saint louis in the mid to late 1930s. Crazy

Nada. We buy the frozen White Castles from the grocery store. My 10 yr old can’t get enough of them.

krystals are in the south. I’m in western Pennsylvania. A veritable desert of good food.

And yet a cornucopia of yinzers.

He's not as old as he looks.Holy shit you're old

They were definitely antifaEvidence that they'd thrashed it. Sandbags in the back were shifted around, it was out of gas (it had a lot of gas when they took it) and it was way low on oil. Old truck actually runs great and is pretty quick, so I'm sure they had some fun.

Evidence that they'd thrashed it. Sandbags in the back were shifted around, it was out of gas (it had a lot of gas when they took it) and it was way low on oil. Old truck actually runs great and is pretty quick, so I'm sure they had some fun.

Democrats, at the very least. Probably voted by mail.They were definitely antifa

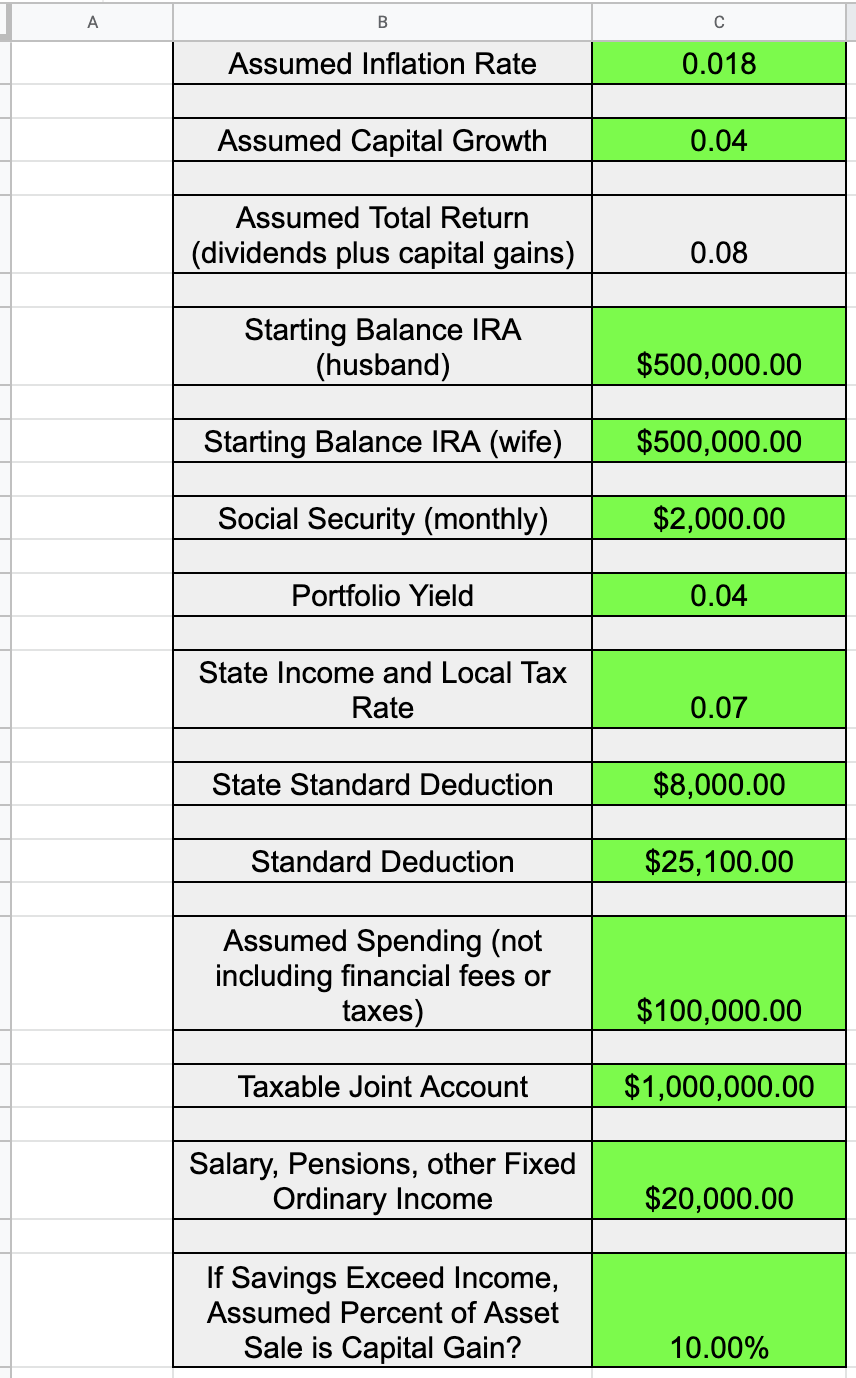

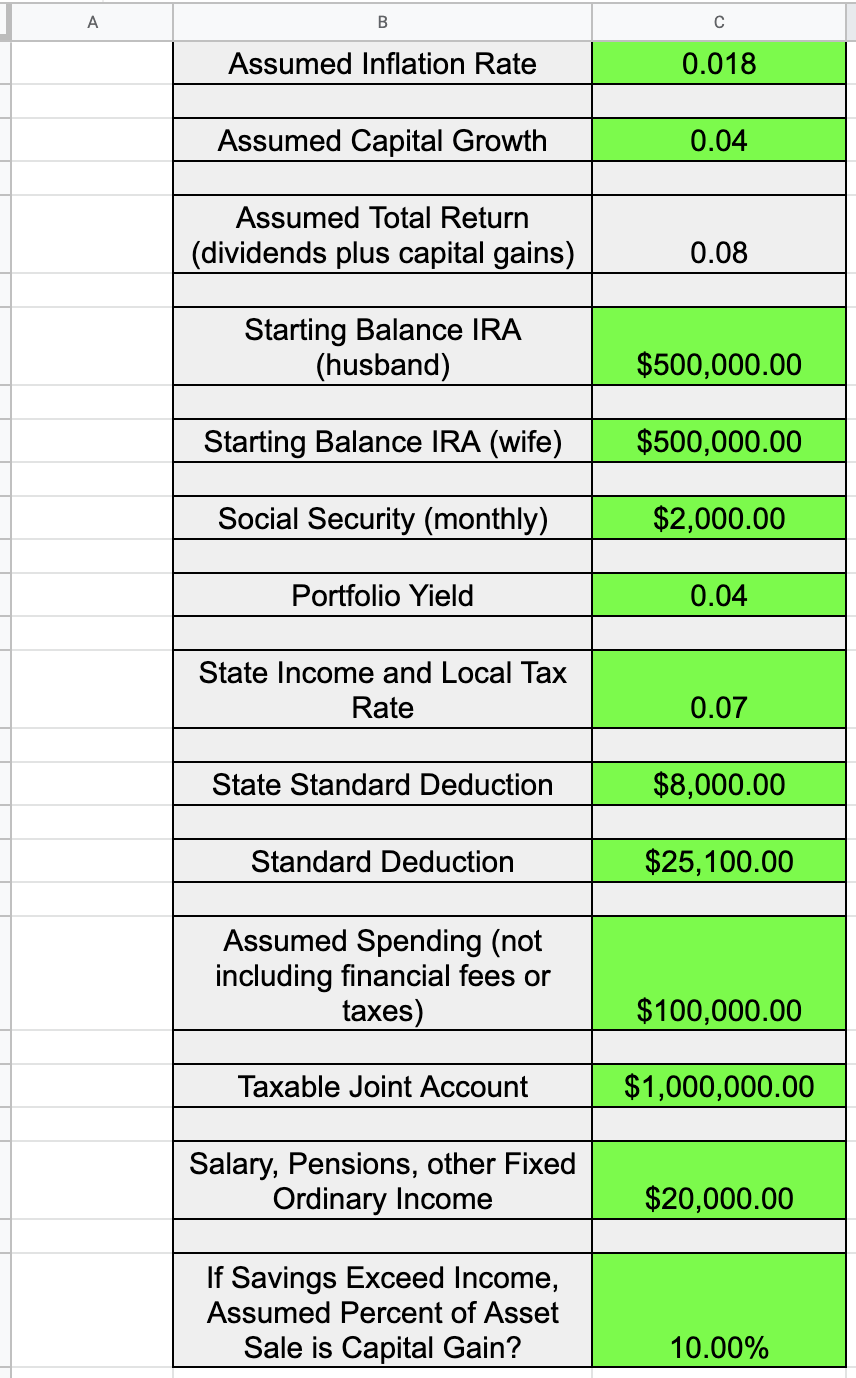

Before Nick Cage and his gang of thieves found Uncle Mark's truck with keys in the ignition, someone was asking about Roth vs. Traditional IRAs and when converting made sense.

Seeking Alpha: How To Analyze Roth IRA Conversions.

seekingalpha.com

seekingalpha.com

Seeking Alpha: How To Analyze Roth IRA Conversions.

How To Analyze Roth IRA Conversions

The key strategy for Roth IRA conversions is to spread income over a period of years to garner the lowest overall income tax rate.

I'd seen reports that the stimulus payments could start hitting bank accounts as early as this weekend. I don't normally check my bank account details online more than a couple times a week but did log in this morning just for grins. Today I have a "Pending" $10.00 deposit sitting there with no idea what it might be, and no other details available. Unless it's some prelude to a hack of some sort, I'm wondering if the Feds are doing something to check their account info prior to making the full deposit. Anyone have a better idea, or seeing anything similar?

Okay all you finance guys, tell me if there's a good reason for Chase and Wells Fargo delaying the availability of these funds. Since this is HuffPo, I'm not taking their angle at face value, but it sounds a little slimy to me.

www.huffpost.com

www.huffpost.com

Customers Angry Over Bank Delays On Stimulus Funds

Wells Fargo and Chase won't start processing federal stimulus direct deposits until March 17.

I'd assume that they are investing the incoming funds and making a profit during the delay.Okay all you finance guys, tell me if there's a good reason for Chase and Wells Fargo delaying the availability of these funds. Since this is HuffPo, I'm not taking their angle at face value, but it sounds a little slimy to me.

Customers Angry Over Bank Delays On Stimulus Funds

Wells Fargo and Chase won't start processing federal stimulus direct deposits until March 17.www.huffpost.com

Don’t forget all those sweet sweet overdraft fees.I'd assume that they are investing the incoming funds and making a profit during the delay.

Time for mcm to dryclean his class-action suit.Don’t forget all those sweet sweet overdraft fees.

Wells Fargo has already been hit for manipulating overdraft fees. Judge ordered them to pay back $230 mil. Chase settled their overdraft lawsuit for 110 million. Wells Fargo was also one of the banks whacked for robo signing foreclosures. These banks aren’t nice. F em.Time for mcm to dryclean his class-action suit.

Last edited:

It's coming from someone who is 22 trillion dollars in debt.Okay all you finance guys, tell me if there's a good reason for Chase and Wells Fargo delaying the availability of these funds. Since this is HuffPo, I'm not taking their angle at face value, but it sounds a little slimy to me.

Customers Angry Over Bank Delays On Stimulus Funds

Wells Fargo and Chase won't start processing federal stimulus direct deposits until March 17.www.huffpost.com

Seriously I would guess that it's standard procedure and like someone said they make money on it. Some banking stuff just stops on the weekend so that may be a factor.

I was reading at one time that some banks would cash checks in a certain order to maximize overdraft fees. In other words if you had $500 in your checking account and wrote five $100 checks and one $500 check they would run the $500 check first so all the $100 checks would bounce whereas if the had done the opposite only the $500 check would have bounced.Don’t forget all those sweet sweet overdraft fees.

I was reading at one time that some banks would cash checks in a certain order to maximize overdraft fees. In other words if you had $500 in your checking account and wrote five $100 checks and one $500 check they would run the $500 check first so all the $100 checks would bounce whereas if the had done the opposite only the $500 check would have bounced.

Thats exactly how overdraft fee programs work.

No his example isn’t clear. The banks would reorder transactions to push people into overdraft. They settled the lawsuitsThats exactly how overdraft fee programs work.

This is funny. Blaming the bank for you writing a check on funds that you don’t necessarily have.I was reading at one time that some banks would cash checks in a certain order to maximize overdraft fees. In other words if you had $500 in your checking account and wrote five $100 checks and one $500 check they would run the $500 check first so all the $100 checks would bounce whereas if the had done the opposite only the $500 check would have bounced.

As if the banks are writing your checks for you…

Bank of America paid 410 million dollars for reordering customer transactions and charging overdraft fees.This is funny. Blaming the bank for you writing a check on funds that you don’t necessarily have.

As if the banks are writing your checks for you…

You mean re-ordering as in I deposit 1000 bucks and then write a check on the thousand, they transact the check first and then transact my deposit, allowing them to charge a fee.Bank of America paid 410 million dollars for reordering customer transactions and charging overdraft fees.

banks are constantly trying to find new ways to F with customers either through garbage like this or by sneaking in fees that they never disclosed or tucked away in tiny font in a thirty page brochure. they're fertile ground for class action lawyers and professional objectorsYou mean re-ordering as in I deposit 1000 bucks and then write a check on the thousand, they transact the check first and then transact my deposit, allowing them to charge a fee.

Judge Approves $410M Bank of America Overdraft Fee Settlement

Judge gives final approval to $410 million Bank of America overdraft fee class action lawsuit settlement.

”The Bank of America overdraft fee class action lawsuit claimed BofA processed its debit card transactions in the order of highest to lowest dollar amount so it could maximize the overdraft fees customers paid. It also charged the bank with waiting to process charges until days after a purchase was made, when users’ accounts were depleted.”banks are constantly trying to find new ways to F with customers either through garbage like this or by sneaking in fees that they never disclosed or tucked away in tiny font in a thirty page brochure. they're fertile ground for class action lawyers and professional objectors

Judge Approves $410M Bank of America Overdraft Fee Settlement

Judge gives final approval to $410 million Bank of America overdraft fee class action lawsuit settlement.topclassactions.com

Unlike my proposed scam, sounds to me like the customers were guilty of overdrafting. Then the banks took advantage of the overdraft.

The banks didn’t illegally create the overdraft.

Ianal but it sounds like the judgment is based on an assumption the bank had some fiduciary responsibility to the customers.

ADVERTISEMENT

ADVERTISEMENT