David Leonhardt notes that, in almost every year since we began our ongoing recovery from the Great Recession, the economy has performed worse than the experts predicted. If the economy had performed as well as the forecasts, GDP would be $1.3 trillion higher today.

Leonhardt credits economist Larry Summers for spotting this trend of "secular stagnation" before anyone else did: Even though the economy seems to be running at peak capacity, there's no inflation, and aggregate demand remains slack. It looks like we're seeing a long term reduction of potential GDP. The economy is sick.

[This, by the way, was among the consequences that were actually predicted -- right here, among other places -- as a result of our historic failure to make no-brainer infrastructure investments during a period when the bond market would literally have paid us to borrow the money. Thanks again, Republicans, for your obstinate insistence on austerity when there's a Democrat in the White House.]

Needless to say, none of this will happen if we elect Republicans. And all the Very Serious People ridicule the loony Democrats who are proposing action in all of these areas. We really just aren't very bright, it seems.

Leonhardt credits economist Larry Summers for spotting this trend of "secular stagnation" before anyone else did: Even though the economy seems to be running at peak capacity, there's no inflation, and aggregate demand remains slack. It looks like we're seeing a long term reduction of potential GDP. The economy is sick.

[This, by the way, was among the consequences that were actually predicted -- right here, among other places -- as a result of our historic failure to make no-brainer infrastructure investments during a period when the bond market would literally have paid us to borrow the money. Thanks again, Republicans, for your obstinate insistence on austerity when there's a Democrat in the White House.]

Several years ago, Lawrence Summers — the economist and former Treasury secretary — began using the phrase “secular stagnation” to describe the problem. The term was originally coined during the Great Depression, and it describes an economy that can’t quite get healthy.

When Summers first made his case in 2013, some other economists criticized it as too pessimistic. But the repeated growth shortfalls of recent years suggest he was onto something. At last week’s conference, hosted by the Brookings Institution, Olivier Blanchard — the former chief economist of the International Monetary Fund — said he was now more persuaded by the secular-stagnation story than he first had been. It is, Blanchard said, “more likely than not.”

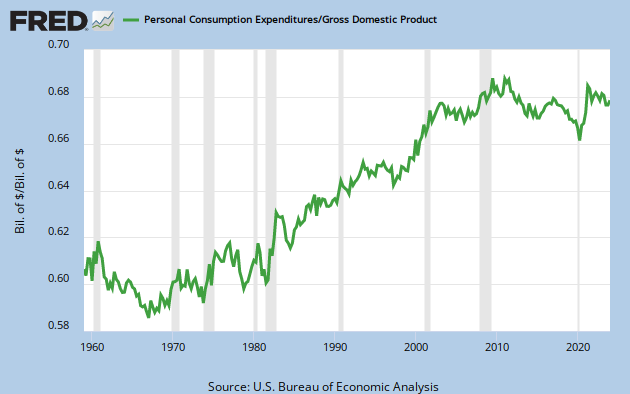

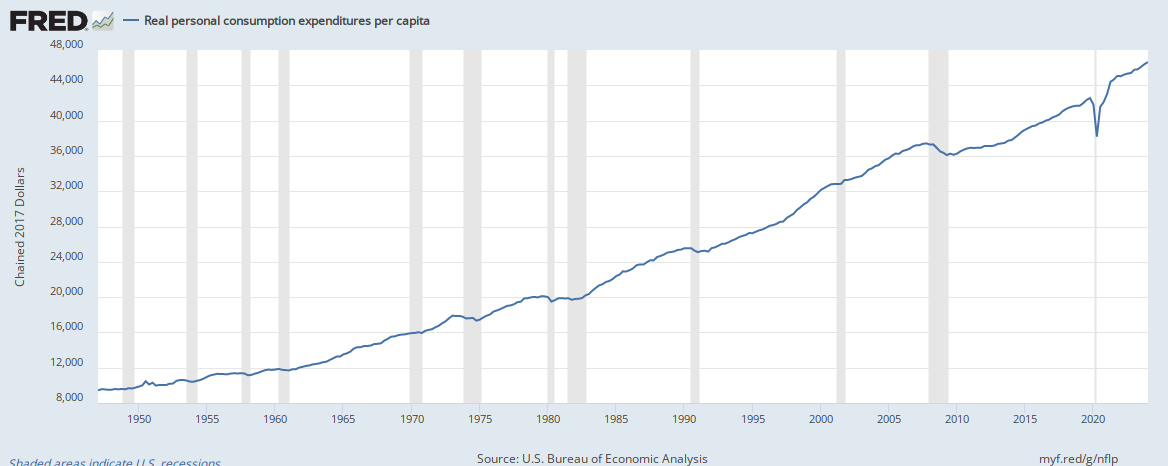

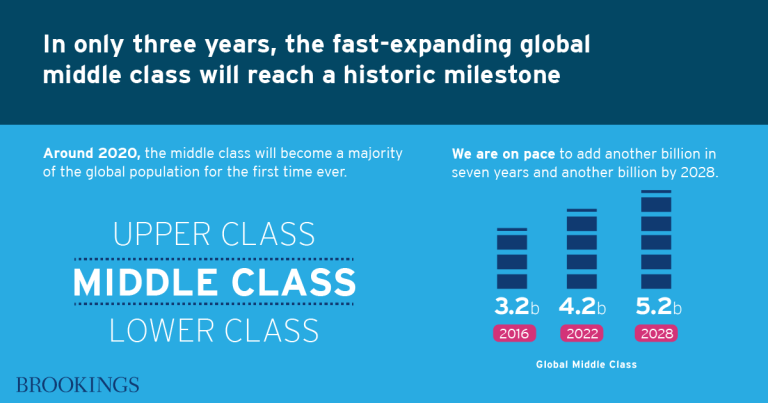

There are two main culprits. The first is a savings glut. Americans are saving more and spending less partly because the rich now take home so much of the economy’s income — and the rich don’t spend as large a share of their income as the poor and middle class. The aging of society plays a role too, because people are saving for retirement.

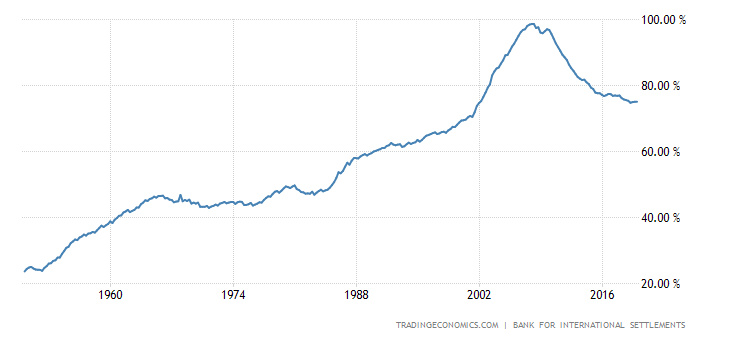

The second big cause is an investment slump. Despite all the savings available to be invested, companies are holding back. Some have grown so large and monopoly-like that they don’t need to invest in new projects to make profits. Think about your internet provider: It may have terrible customer service, but you don’t have a lot of alternatives. The company doesn’t need to invest in new technology or employees to keep you as a customer.

Beside a lack of competition, the investment slump stems from what Summers calls the de-massification of the economy. Developers aren’t building as many malls and stores, because goods now go straight from warehouses to homes. Offices don’t need as much storage space. Cellphones have replaced not just desktop computers but also cameras, stereos, books and more. Many young people have decided they’re happy living in small apartments, without cars.

For all of these economic problems, there are promising solutions. But the United States is not giving those solutions a try.

The 2017 Trump tax law is a useful case study. It is a dreadful piece of economic policy — essentially a giant effort to aggravate income inequality. Tax cuts that benefit the wealthy most are huge and permanent. Tax cuts focused on everyone else are smaller and temporary.

But the law still pumped money into the economy last year, thanks largely to those temporary tax cuts for the middle class and poor. And guess what? G.D.P. growth finally met some forecasters’ expectations, as you can see from the first chart above. The economy expanded 2.9 percent in 2018. Unfortunately, the boost seems to have been temporary. In the first quarter of this year, growth has slowed markedly, probably to about 0.5 percent. It will most likely grow faster over the rest of 2019, but not 3 percent. Once again, economists have started downgrading their expectations.

A better policy response would start with a tax cut focused on the majority of Americans, not the wealthy. And there are many other ways to take on secular stagnation. When I spoke to Summers last week, he rattled off a list:

Infrastructure projects, to jump-start investment. The retirement of coal-fired power plants, which would also lead to new investment. Stronger safety-net programs, including Social Security, to reduce the savings glut. More aggressive antitrust policies, to combat monopolies. And a Federal Reserve that, at long last, stopped making the same mistake — of overestimating both growth and inflation.

So, among many other things, we should (1) redistribute income away from the wealthy (who mostly don't spend it) to ordinary people who desperately need more money to spend; (2) protect and expand safety net spending; (3) invest in infrastructure; and (4) break up the huge corporations that are extracting rents from us. Not only would measures like these produce a more equitable distribution of income, they'd also make the economy grow faster.When Summers first made his case in 2013, some other economists criticized it as too pessimistic. But the repeated growth shortfalls of recent years suggest he was onto something. At last week’s conference, hosted by the Brookings Institution, Olivier Blanchard — the former chief economist of the International Monetary Fund — said he was now more persuaded by the secular-stagnation story than he first had been. It is, Blanchard said, “more likely than not.”

There are two main culprits. The first is a savings glut. Americans are saving more and spending less partly because the rich now take home so much of the economy’s income — and the rich don’t spend as large a share of their income as the poor and middle class. The aging of society plays a role too, because people are saving for retirement.

The second big cause is an investment slump. Despite all the savings available to be invested, companies are holding back. Some have grown so large and monopoly-like that they don’t need to invest in new projects to make profits. Think about your internet provider: It may have terrible customer service, but you don’t have a lot of alternatives. The company doesn’t need to invest in new technology or employees to keep you as a customer.

Beside a lack of competition, the investment slump stems from what Summers calls the de-massification of the economy. Developers aren’t building as many malls and stores, because goods now go straight from warehouses to homes. Offices don’t need as much storage space. Cellphones have replaced not just desktop computers but also cameras, stereos, books and more. Many young people have decided they’re happy living in small apartments, without cars.

For all of these economic problems, there are promising solutions. But the United States is not giving those solutions a try.

The 2017 Trump tax law is a useful case study. It is a dreadful piece of economic policy — essentially a giant effort to aggravate income inequality. Tax cuts that benefit the wealthy most are huge and permanent. Tax cuts focused on everyone else are smaller and temporary.

But the law still pumped money into the economy last year, thanks largely to those temporary tax cuts for the middle class and poor. And guess what? G.D.P. growth finally met some forecasters’ expectations, as you can see from the first chart above. The economy expanded 2.9 percent in 2018. Unfortunately, the boost seems to have been temporary. In the first quarter of this year, growth has slowed markedly, probably to about 0.5 percent. It will most likely grow faster over the rest of 2019, but not 3 percent. Once again, economists have started downgrading their expectations.

A better policy response would start with a tax cut focused on the majority of Americans, not the wealthy. And there are many other ways to take on secular stagnation. When I spoke to Summers last week, he rattled off a list:

Infrastructure projects, to jump-start investment. The retirement of coal-fired power plants, which would also lead to new investment. Stronger safety-net programs, including Social Security, to reduce the savings glut. More aggressive antitrust policies, to combat monopolies. And a Federal Reserve that, at long last, stopped making the same mistake — of overestimating both growth and inflation.

Needless to say, none of this will happen if we elect Republicans. And all the Very Serious People ridicule the loony Democrats who are proposing action in all of these areas. We really just aren't very bright, it seems.