Another very smart guy.

I guess taxes are essentially penalties for the middle class.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Ask Al Sharpton

Another very smart guy.

I guess taxes are essentially penalties for the middle class.

Ask Al Sharpton

I guess taxes are essentially penalties for the middle class.

Another very smart guy.

I guess taxes are essentially penalties for the middle class.

Kyle obviously knows nothing about business.

Another very smart guy.

I guess taxes are essentially penalties for the middle class.

What a stupid tweet. What was his income?

You really believe that?

Another very smart guy.

I guess taxes are essentially penalties for the middle class.

Another very smart guy.

I guess taxes are essentially penalties for the middle class.

Depreciation of real estate property is the backbone of all real estate investing strategy....anywhere from a mom and pop with one rental house, to a huge developer.

If he ever sells any of those properties he's going to have to recapture all of those depreciation expenses, and be taxed on them.

Stupid story by NYT.

I believe the last half of your post.The NYT demonstrated its fundamental ignorance about the tax code with its Trump's dad story, and then it doubled down with this story. Or maybe the NYT understands taxes and is just publishing biased stories knowing that millions of people will buy it.

More likely they thought thousands of ignorant, emotional, spammers would pick it up and repost it everywhere. Extremely stupid tweet ....extremely.The NYT demonstrated its fundamental ignorance about the tax code with its Trump's dad story, and then it doubled down with this story. Or maybe the NYT understands taxes and is just publishing biased stories knowing that millions of people will buy it.

I am guessing that it's not $7.25 an hour when you are worth a few hundred million. And besides thats not the point.

Actually it's exactly the point. Wealth isn't taxed although that will probably change with the leftist attitudes

<showing ignorance>If he ever sells any of those properties he's going to have to recapture all of those depreciation expenses, and be taxed on them.

I sometimes wonder how democracy works in the US. It's amazing how people are so partisan and ignorant, and proud of it!Says the crowd that is spoon fed by Fox News and Rush L.

<showing ignorance>

So, they're in essence trading current income tax liability for future capital gains tax liability? Is that the gist of it?

</showing ignorance>

<showing ignorance>

So, they're in essence trading current income tax liability for future capital gains tax liability? Is that the gist of it?

</showing ignorance>

The NYT demonstrated its fundamental ignorance about the tax code with its Trump's dad story, and then it doubled down with this story. Or maybe the NYT understands taxes and is just publishing biased stories knowing that millions of people will buy it.

Deprecation recapture is taxed at at a higher rate than cap gains. For most things it's taxed at ordinary income tax rates. Real estate is at a 25% rate on recapture.

What's important to note....it is a legal requirement that you take the deprecation expense deduction....you cannot choose to just NOT depreciate property on your taxes.

https://www.kiplinger.com/article/i...on-tax-break-has-real-estate-consequence.html

You can now have cost segregation studies done to break down the cost of the components of buildings and write off 100% in year one.

https://costseg.com/cost-segregation/

Edit, there is a day of reckoning with depreciation. I have a client selling his timber and sawmill business this year. He’s screaming bloody murder because of the taxes. I warned him over the years that all the taxes he wasn’t paying because of depreciation would catch him when he sold the business. Most of his assets are fully depreciated and the sales proceeds from the assets being sold are pretty much 100% taxable. Depreciation isn’t a permanent tax savings. It only defers taxes.

You must have hots for Sen. Warren. Why else does her name appear on your unrelated post?Lizzy warren would find a way

Ask Al Sharpton

Ask Al Sharpton

Ask Al Sharpton

Coming from a person who supposes a person who is blatantly hiding his tax returns.

I’m pointing out that ALL rich people take advantage of every loophole in the book. ALL of them, regardless of their politics.

Its just not sustainable.

Its been lobbied and rigged. So middle-class folks of all political persuasions ought to get together and fix it. You are paying for the rich folks to enjoy the benefits of society.

And yet every other candidate for president was rich and showed their taxes. And with Trump! We are talking tax fraud, not loopholes.I’m pointing out that ALL rich people take advantage of every loophole in the book. ALL of them, regardless of their politics.

Its just not sustainable.

Its been lobbied and rigged. So middle-class folks of all political persuasions ought to get together and fix it. You are paying for the rich folks to enjoy the benefits of society.

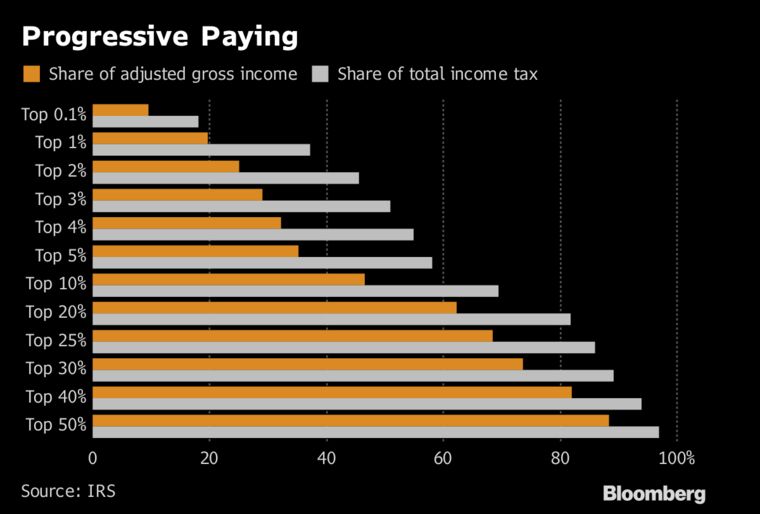

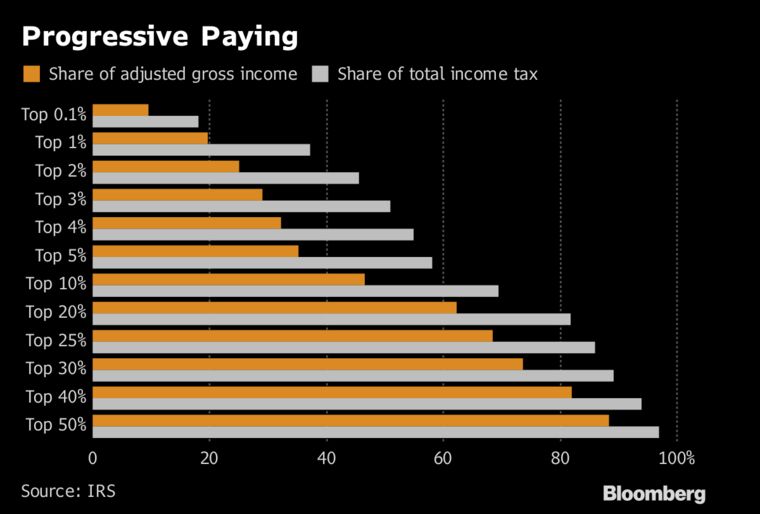

But that's the point -- people like Jared take advantage of the code to Adjust their Gross Income down to nothing.The top 3% of total AGI pays about 50% of the income tax. The top 50% of AGI pays almost 100% of the income tax. The top 1% of the AGI is pushing 40% by itself. How much more progressive do you want the tax code?

But that's the point -- people like Jared take advantage of the code to Adjust their Gross Income down to nothing.

Since you always complain about my charts, did you notice how your chart has .1%, 1%, and 10% breakdowns listed. I believe from previous discussions, that renders the chart invalid.Nope.

The top 3% of total AGI pays about 50% of the income tax. The top 50% of AGI pays almost 100% of the income tax. The top 1% of the AGI is pushing 40% by itself. How much more progressive do you want the tax code?

Since you always complain about my charts, did you notice how your chart has .1%, 1%, and 10% breakdowns listed. I believe from previous discussions, that renders the chart invalid.

But that's the point -- people like Jared take advantage of the code to Adjust their Gross Income down to nothing.

You very well may be correct. I will stand corrected, of course. As a lower class working class hero, I'm definitely out of my element.I believe AGI is taken BEFORE deductions are applied. Applying various deductions to AGI gives you Taxable Income.

As a lower class working class hero