If you read the explainer I linked you should be less concerned about government manipulation of CPI data, which you shouldn't have been concerned about in the first place.The cost of living and the cost of goods are two different things

So there is really nothing to agree or disagree about…

If we see the inflation rate as a basket of goods, then price variations can be more readily seen as the result of economics and the result of supply and demand. If we see inflation rate of the cost of living, then what we are really saying is that a decrease in the standard of living (e.g. buying ground chuck instead of ground sirloin) caused by economic conditions is of no concern to the fed or to those who must pay attention to inflation rates as part of their job description. So, for the social security recipient, having to buy different and cheaper goods is not part of the calculation of reasons for an inflationary increase in benefits.

Once again, my concern is that by introducing these factors into the inflation rate calculation enables the government to manipulate the rate. Some of that manipulation might be justified, as we both agree, but some of it might be calculated solely for budget purposes.

Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

It's disturbing that Bernie Sanders is actually receiving support for the Presidency

- Thread starter mjvcaj

- Start date

I'm not looking for an argument . . . I'm looking to see what you're really saying, as it wasn't all that clear from your post, and then to test my understanding of it in relation to what you intended to say to see whether we agree or have gaps in what we're each saying. If you interpret that as an argument, well, that's on you.

Regarding your comment about those at the bottom of the income ladder, I think their decision-making regarding cars mitigates the effect of technological advancements because - from my experience and observation anyway - the folks at the bottom of the income ladder buy older used cars, and the price premiums for the new technologies have generally been wrung out of the car's value by then, largely because of other newer technologies in newer cars that render the technologies in older cars relatively obsolete.

Regarding the cost of governmental regulation and whether norming hides that . . . I don't know. Do you have evidence that it occurs? I don't have evidence either way, and am not presuming a result on that question, so I don't have any analysis/policy change to offer on that point.

Well

If one must buy a used car instead of a new one, and if their income increase is tied to inflation, they are getting screwed, no? I think you and I agree about the cost of regulation being hidden*. The question is so what? I don't know tha answer to this which is why I started this discussion.

*The cost of airbags will not be considered an inflationary increase in the cost of a car.

No, he wasn't. You're being flatly dishonest about the content of that op-ed.

Who is being dishonest? I'm taking it straight from the horse's mouth and you are manipulating it into what you think he meant.

Weak? What's my point? Real median household income is the best single measure of economic well-being I can think of, and it still hasn't recovered.Yes, it's growing again, but even when it finally regains its prior level families will still be many years behind where they were and many years more from where they would have been. And that's the median household. Half of all households will do worse than that. That's very strong evidence that many won't ever recover.

No, it's not. I think it's pretty shortsighted to look at a 5-6 year period and claim that people will NEVER recover, especially since the last 3+ years have been moving in the right direction.

And your statement about families being behind where they "could" have been is equally pointless. You act like there should never be a down day on Wall Street. I mean damn, if I had just shorted the market on the down days I'd be way ahead of where I'm at now! Please. And where do you get away with talking about median household income and how half of them will do worse? This is exactly the type of spin you accuse Republicans with on a daily basis.

As for your last point, the market had mostly recovered by then. I wasn't referring to unemployment, but that's my fault as I wasn't clear on that. However, unemployment is better now as well. You are painting a darker picture than what actually exists. And since you're so sure what the future holds based on a 6 year stretch, please give me some lotto picks and stock tips. Thanks.

I don't know if that's true, but what's the basis for your suggestion that the requirement that cars have airbags increases the overall price level? It probably increased the price of a car in year one, but I'd bet that in years 2 through X the cost of an airbag went down, and in any event, the safety gain could have reduced other prices in the basket, like health care.The cost of airbags will not be considered an inflationary increase in the cost of a car.

For example, if the price of beef goes up 10% but consumers eat 10% less beef as a result, inflation would be seen as zero. Also if a price of a car goes up 10% but the car is better and has more safety features that are the reason for the 10% increase, then inflation is again seen as zero.

What are you even talking about here? This makes zero sense.

So, what lessons should we learn from what you call "the subprime meltdown"? (Hint: if they have anything to do with the CRA and GSEs, you've learned the wrong lessons.)

That market-placed barriers (to credit and otherwise) are there for a reason and we tinker with them at our peril. A whole, whole lot of people got mortgages they never should've gotten -- and never would've gotten except for the 100% LTV, No-Doc/Lo-Doc, Interest-Only, Option ARM, etc. etc. and various other ways to reduce the barriers to home lending.

Remember, Rock: you can't bundle and securitize a mortgage that never closed in the first place. The genesis of the crisis here was that so many mortgages that never should've been written were, indeed, written.

I'll repeat again: the ensuing meltdown was predicted in 1999 shortly after these mortgage lending standards were lowered. You can read about it all here....in a story written nearly a decade before the house of cards came tumbling down. Notice that I don't blame the GSEs themselves -- I'd say they were patsies in this debacle.

Again, SO WHAT?

Bernie wasn't genuinely asking why student loan rates are higher. He was suggesting that we shouldn't accept that they need to be. That it would be better for the country if they weren't.

Again, I'm sure you're smart enough to get that. That's why I called your criticism disingenuous.

I'll be watching to see if you're that generous the next time a Republican says something that stupid. Just in case you're not, I'll be around to interpret for you since there's apparently a new standard. It's not what someone says, but what some apologist says they actually meant. As the Church Lady would say:

Your post is full of this sort of nonsense, but by definition half of the median will do worse than the median, and half will do better. So no, Mike Dunning-Kruger, it's not "spin" to say that half will do worse.And where do you get away with talking about median household income and how half of them will do worse? This is exactly the type of spin you accuse Republicans with on a daily basis.

If you read the explainer I linked you should be less concerned about government manipulation of CPI data, which you shouldn't have been concerned about in the first place.

I did read that

With all due respect, I think that link contains a significant amount of bureaucratic mumbo jumbo.

For example: the link answers this question with a negative:

When the cost of food rises, does the CPI assume that consumers switch to less desired foods, such as substituting hamburger for steak?

But include this in the answer:

the CPI's objective is to calculate the change in the amount consumers need to spend to maintain a constant level of satisfaction.

"constant level of satisfaction" is a very squishy phrase. It would permit the substitution of hamburger for steak.

There is a lot of similar squishiness in the link that allows for pretty much any manipulation.

That's just a plain old lie on your part. Not once in that op-ed did he suggest we "force" banks to offer lower interest rates. I'm not the one doing the manipulating here.Who is being dishonest? I'm taking it straight from the horse's mouth and you are manipulating it into what you think he meant.

I'll be watching to see if you're that generous the next time a Republican says something that stupid. Just in case you're not, I'll be around to interpret for you since there's apparently a new standard. It's not what someone says, but what some apologist says they actually meant. As the Church Lady would say:

You'll be watching?

Then the double-standard will be all yours, RB. You're all about apologizing for your side, and nit-picking the other . . . you're incapable of applying any standard accurately.

Your post is full of this sort of nonsense, but by definition half of the median will do worse than the median, and half will do better. So no, Mike Dunning-Kruger, it's not "spin" to say that half will do worse.

It is intentionally deceptive(although not that bright) to phrase it that way when obviously half will do better. That was my point. Apparently the self-appointed genius of the board couldn't figure that out...

Mike Dunning-Kruger. You mad, Rock? You should look in the mirror...

The next time a Republican candidate says something as "stupid" as "student loan rates are too high" will be the first time one of them says something that smart.I'll be watching to see if you're that generous the next time a Republican says something that stupid. Just in case you're not, I'll be around to interpret for you since there's apparently a new standard. It's not what someone says, but what some apologist says they actually meant. As the Church Lady would say:

Your predictable response is limited to what conservative ideology will allow. In reality, the financial crisis was driven by the financial sector's greedy response to a global savings glut (which still exists, by the way), as best described by this splendid report from This American Life. Lending standards didn't become absurd until there weren't enough legitimate mortgages to fill the demand for mortgage-backed securities. The GSEs' market share was shrinking during the period when the bubble inflated, and the toxic stuff was all private label. But I'll let you explain how Fannie/Freddie/CRA caused real estate bubbles in (for example) Ireland. It was a global financial crisis, crazed. Your theory doesn't fit the facts.That market-placed barriers (to credit and otherwise) are there for a reason and we tinker with them at our peril. A whole, whole lot of people got mortgages they never should've gotten -- and never would've gotten except for the 100% LTV, No-Doc/Lo-Doc, Interest-Only, Option ARM, etc. etc. and various other ways to reduce the barriers to home lending.

Remember, Rock: you can't bundle and securitize a mortgage that never closed in the first place. The genesis of the crisis here was that so many mortgages that never should've been written were, indeed, written.

I'll repeat again: the ensuing meltdown was predicted in 1999 shortly after these mortgage lending standards were lowered. You can read about it all here....in a story written nearly a decade before the house of cards came tumbling down. Notice that I don't blame the GSEs themselves -- I'd say they were patsies in this debacle.

That market-placed barriers (to credit and otherwise) are there for a reason and we tinker with them at our peril. A whole, whole lot of people got mortgages they never should've gotten -- and never would've gotten except for the 100% LTV, No-Doc/Lo-Doc, Interest-Only, Option ARM, etc. etc. and various other ways to reduce the barriers to home lending.

Remember, Rock: you can't bundle and securitize a mortgage that never closed in the first place. The genesis of the crisis here was that so many mortgages that never should've been written were, indeed, written.

I'll repeat again: the ensuing meltdown was predicted in 1999 shortly after these mortgage lending standards were lowered. You can read about it all here....in a story written nearly a decade before the house of cards came tumbling down. Notice that I don't blame the GSEs themselves -- I'd say they were patsies in this debacle.

Sooo . . . I'm not clear on what you're saying about who is to blame . . . are you blaming the Clinton administration, which wanted loans to lower income folks, or Wall Street banks, who wanted to make more subprime loans?

And which of those sets of loans actually caused the Great Recession? Who made those loans?

You haven't tied the predictions in the article to the actual results of the Great Recession yet, crazed.

You'll be watching?

Then the double-standard will be all yours, RB. You're all about apologizing for your side, and nit-picking the other . . . you're incapable of applying any standard accurately.

Goat applied the double-standard. I just pointed it out.

That's just a plain old lie on your part. Not once in that op-ed did he suggest we "force" banks to offer lower interest rates. I'm not the one doing the manipulating here.

Who said anything about interest rates? We are talking about making riskier loans. Interest rates are only a component of lending. Apparently you skimmed over these:

The Fed must also make sure that financial institutions are investing in the productive economy by providing affordable loans to small businesses and consumers.

Third, as a condition of receiving financial assistance from the Fed, large banks must commit to increasing lending to creditworthy small businesses and consumers, reducing credit card interest rates and fees, and providing help to underwater and struggling homeowners.

The Fed must also make sure that financial institutions are investing in the productive economy by providing affordable loans to small businesses and consumers that create good jobs.

Pretty sure this was the line, Goat.

This is not something that the Fed needs to be doing, IMO. Bernie apparently thinks they should be.

The next time a Republican candidate says something as "stupid" as "student loan rates are too high" will be the first time one of them says something that smart.

Undergrad student loan rates are too low, if anything, relative to other loans out there. 4.29% isn't far from what I refi'd my mortgage at, with good collateral and land value.

If anything, the Government should allow the loan rates to float and underwrite based on a variety of factors, such as ability to payback, future earnings expectations, etc.

None of that involves forcing them to do anything. Everything he listed involved incentives or monetary policy. None of it involved any kind of regulatory control that could even be remotely described as "forcing" anything.Who said anything about interest rates? We are talking about making riskier loans. Interest rates are only a component of lending. Apparently you skimmed over these:

The Fed must also make sure that financial institutions are investing in the productive economy by providing affordable loans to small businesses and consumers.

Third, as a condition of receiving financial assistance from the Fed, large banks must commit to increasing lending to creditworthy small businesses and consumers, reducing credit card interest rates and fees, and providing help to underwater and struggling homeowners.

I'll get out the crayons:It is intentionally deceptive(although not that bright) to phrase it that way when obviously half will do better. That was my point. Apparently the self-appointed genius of the board couldn't figure that out...

(1) The median household is still worse off and will need dramatically faster growth to ever make up for the lost years, if they live long enough.

(2) By definition, half of all households are worse off than the median household. They're even less likely to fully recover.

(3) Add to this the fact that we have something like a million people who will never be employed again and the reality that many households will never regain the wealth they lost during the Great Recession, and there is strong evidence that "many of us will never recover" from the Great Recession. In response to my evidence, you have offered nothing.

I don't proclaim myself a genius, Mike. But in comparison I can look pretty good. My suggestion to you: Quit leading with your chin.

None of that involves forcing them to do anything. Everything he listed involved incentives or monetary policy. None of it involved any kind of regulatory control that could even be remotely described as "forcing" anything.

So extorting banks based on political beliefs isn't "forcing"? You should tell that to Chicago businesses that went against the Dem Machine.

"That shouldn't be the Fed's job" is a legitimate criticism of Bernie's suggestion, if you happen to think that.Pretty sure this was the line, Goat.

This is not something that the Fed needs to be doing, IMO. Bernie apparently thinks they should be.

"Bernie is suggesting we force banks to hand out bad loans" is a blatant misrepresentation of what he is suggesting, and has no place in reasonable discussion.

How is incentivizing public assistance extortion? I suppose you're equally appalled by welfare programs that require recipients to work, seek employment or job train?So extorting banks based on political beliefs isn't "forcing"? You should tell that to Chicago businesses that went against the Dem Machine.

Sooo . . . I'm not clear on what you're saying about who is to blame . . . are you blaming the Clinton administration, which wanted loans to lower income folks, or Wall Street banks, who wanted to make more subprime loans?

And which of those sets of loans actually caused the Great Recession? Who made those loans?

You haven't tied the predictions in the article to the actual results of the Great Recession yet, crazed.

Both, actually. Why must they be mutually exclusive?

Folks in the government (and I wouldn't say it was solely the Clinton Administration, either -- after all, the Bush Administration did nothing to reverse course) were motivated by expanding home ownership -- and saw these barriers I'm talking about as impediments to that. If you're interested in reading this from the horse's mouth, here's a link to HUD's Home Ownership Strategy parameters from 1995. You can also read about HUD's role here in this WaPo piece. That piece contains the following quote:

"We need to focus on putting families in homes they can truly afford, not just on getting a sale, packaging the loan into a sophisticated financial security and walking away to the next closing. Today, people are wondering, 'Why weren't the regulators and the industry probing these [loans] more deeply?' "

That quote was from Democratic Senator Jack Reed, and he was exactly right. However, he has to realize that they *intentionally* weren't probing loans more deeply -- because they wanted a certain end result: more people owning homes.

As for Wall Street, of course they got in on the act -- once they (wrongly) thought they had a way to mitigate the added risk. There were huge profits to be made on a hot mortgage market and they now had a way to hedge against the enhanced risk.

For anybody who wonders why the government didn't bring criminal charges against Wall Street over this debacle, the answer is obvious: because they were both in the same bed together.

Who said anything about interest rates? We are talking about making riskier loans. Interest rates are only a component of lending. Apparently you skimmed over these:

The Fed must also make sure that financial institutions are investing in the productive economy by providing affordable loans to small businesses and consumers.

Third, as a condition of receiving financial assistance from the Fed, large banks must commit to increasing lending to creditworthy small businesses and consumers.

What do you think the role of banks ought to be, if not making loans to creditworthy small businesses and consumers?

What's inherently "higher risk" about "creditworthy" small businesses and consumers?

Should loans to small businesses and consumers not be affordable?

Should banks only make loans to big businesses, creditworthy or not? Invest in treasuries only?

Regarding interest rates on student loans . . . do you think that interest rates should be higher for all student loans than all mortgage loans - presumably because of the availability of collateral securing the mortgage loans? Would you say that a student loan to a straight A, highly accomplished student has to be at a higher interest rate than a subprime mortgage loan at 100% LTV?

Isn't perceived risk what drives interest rates?

So far your generalities are rendering your posts to not saying anything . . . .

Both, actually. Why must they be mutually exclusive?

Folks in the government (and I wouldn't say it was solely the Clinton Administration, either -- after all, the Bush Administration did nothing to reverse course) were motivated by expanding home ownership -- and saw these barriers I'm talking about as impediments to that. If you're interested in reading this from the horse's mouth, here's a link to HUD's Home Ownership Strategy parameters from 1995. You can also read about HUD's role here in this WaPo piece. That piece contains the following quote:

"We need to focus on putting families in homes they can truly afford, not just on getting a sale, packaging the loan into a sophisticated financial security and walking away to the next closing. Today, people are wondering, 'Why weren't the regulators and the industry probing these [loans] more deeply?' "That quote was from Democratic Senator Jack Reed, and he was exactly right. However, he has to realize that they *intentionally* weren't probing loans more deeply -- because they wanted a certain end result: more people owning homes.

As for Wall Street, of course they got in on the act -- once they (wrongly) thought they had a way to mitigate the added risk. There were huge profits to be made on a hot mortgage market and they now had a way to hedge against the enhanced risk.

For anybody who wonders why the government didn't bring criminal charges against Wall Street over this debacle, the answer is obvious: because they were both in the same bed together.

IMO, you are missing where the real action took place . . . "they" were the folks generating the loans, i.e., the banks, and their interests had nothing to do with home ownership . . . it was all about being the middle men between the vast pool of over-savings that Rock mentioned earlier and securitized loans made with that vast pool of savings . . . and reaping the loan fees and yield-spread premiums that come with being the middle man in that market.

I don't know if that's true, but what's the basis for your suggestion that the requirement that cars have airbags increases the overall price level? It probably increased the price of a car in year one, but I'd bet that in years 2 through X the cost of an airbag went down, and in any event, the safety gain could have reduced other prices in the basket, like health care.

Heh

Airbags knocked the hell out of the practices of many personal injury and insurance defense lawyers. I guess that lowers inflation in some way.

It specifically says that they don't substitute hamburger for steak, so the "squishiness" lies elsewhere.I did read that

With all due respect, I think that link contains a significant amount of bureaucratic mumbo jumbo.

For example: the link answers this question with a negative:

When the cost of food rises, does the CPI assume that consumers switch to less desired foods, such as substituting hamburger for steak?But include this in the answer:

the CPI's objective is to calculate the change in the amount consumers need to spend to maintain a constant level of satisfaction."constant level of satisfaction" is a very squishy phrase. It would permit the substitution of hamburger for steak.

There is a lot of similar squishiness in the link that allows for pretty much any manipulation.

Heh

Airbags knocked the hell out of the practices of many personal injury and insurance defense lawyers. I guess that lowers inflation in some way.

Am I reading this correctly . . . did CoH just acknowledge that Rock might - kind of, sort of - maybe have a point?

GRIN

IMO, you are missing where the real action took place . . . "they" were the folks generating the loans, i.e., the banks, and their interests had nothing to do with home ownership . . . it was all about being the middle men between the vast pool of over-savings that Rock mentioned earlier and securitized loans made with that vast pool of savings . . . and reaping the loan fees and yield-spread premiums that come with being the middle man in that market.

I'm not missing it at all. The loan originators did precisely as they were given incentive to do, as enabled by the reduced underwriting standards. The problem had to do with the assumption of risk on the back end.

Read that 1999 NYT piece again. The retail banks were clearly behind these changes -- not only because they saw increased market opportunities, but because they were being pressured to expand lending and had nowhere to dump the risk. They were more than willing to write the loans and collect their fees, they just needed to have someplace to dump the notes. The fateful move that was made was to create the first such repository for loans that nobody wanted to underwrite on their own. Later, another one came along in the form of the hedge derivatives. Before 1998 or so, neither of these risk pools existed. By 2008, both of them were huge -- and economically unsustainable.

The point is: we never should've been tinkering with the risk related parameters of mortgage lending.....whether the interests of those behind doing it were increased profits or the perceived social good of expanding the horizons of home ownership.

I'm not saying this to get Wall Street off the hook for their role in what happened. They very much did play a critical role. I'm saying it because some people mistakenly believe that it was entirely the result of unchecked Wall Street greed. That's wrong -- and it's probably because it's wrong that nobody faced any criminal charges for what happened. I think the government had a keen interest in seeing to it that the whole episode was not litigated in the public spotlight.

I'll get out the crayons:

(1) The median household is still worse off and will need dramatically faster growth to ever make up for the lost years, if they live long enough.

(2) By definition, half of all households are worse off than the median household. They're even less likely to fully recover.

(3) Add to this the fact that we have something like a million people who will never be employed again and the reality that many households will never regain the wealth they lost during the Great Recession, and there is strong evidence that "many of us will never recover" from the Great Recession. In response to my evidence, you have offered nothing.

I don't proclaim myself a genius, Mike. But in comparison I can look pretty good. My suggestion to you: Quit leading with your chin.

1) The median household is better off since 2012.

2) Why are they less likely to succeed than the half below the median in any other year? I think your crayon broke while scribbling out #2.

3) Here you are being dramatic again. A million of anything sounds like a lot until you put it into perspective. This is less than 1% and is exactly why I labeled your statement as over dramatic in the first place. Because it is.

At this point with the evidence we have and the state of the economy, making a mountain out of this issue is absurd.

I'm saying it because some people mistakenly believe that it was entirely the result of unchecked Wall Street greed. That's wrong -- and it's probably because it's wrong that nobody faced any criminal charges for what happened.

Entirely? I don't know about "entirely" . . . but I can tell you that greed was the single most important, dominant, driving force behind the subprime crisis. Any reduced underwriting standards came in service to that greed, supported by the lie that securitizations would sufficiently mitigate the default risk.

BTW, as an historical aside, the company I worked for at the time securitized $50 million in what were considered subprime mortgages back in 1989 . . . or maybe 1990, I can't remember. They were, however, loans made with the intention of holding them in the company's investment portfolio, and only a cash crunch caused by the savings and loan slump in New England cause the holding company to consider the securitization . . . .

Entirely? I don't know about "entirely" . . . but I can tell you that greed was the single most important, dominant, driving force behind the subprime crisis. Any reduced underwriting standards came in service to that greed, supported by the lie that securitizations would sufficiently mitigate the default risk.

Well, first of all, securitizations of mortgages is a practice that goes way back. As far as I know, it was never a problem until this time. The problem was what was going into the securities and what was done, and not done, regarding the enhanced risk that was being assumed. At first it was pressuring the GSEs to underwrite these higher-risk notes -- which, from what I can tell, they were never all that keen about doing. Several years later, the advent of the deeply flawed hedge derivatives opened up a whole new universe of capital to the game -- which received yet more of a boost when the Fed put the pedal to the metal following the dot-bomb and 9/11.

But, if you read that 1995 HUD document I linked, along with the NYT story on the reengineering of the subprime mortgage markets, I'd say the historical record clearly shows that there was something other than just greed behind the reduced underwriting standards -- unless you're including in that the desire of many people to be able to buy houses they actually couldn't afford (which, BTW, included a lot of Alt-A -- ie, people who could afford to own a home, but were buying up the scale from where they could afford....this wasn't just people who were totally priced out of home ownership entirely).

What Sen. Sanders is talking about here regarding education lending is basically the same mindset that led to reduction of home lending standards. It's entirely possible that Wall Street types might see new profit opportunities working within the confines of such a directive, were it ever to come to pass. And, should that happen, and should the whole thing subsequently collapse like subprime mortgages did, it might again be convenient to blame the rent-seekers....but it would be just as incomplete an assessment of what got us there.

The road to hell is truly paved with good intentions.

Isn't Sanders really railing against Hillary for being in the pocket of Wall Street and the Big Banks while proposing stuff to prove the extremes he would go as compared to the lap dog Hillary or the Chuck Shumers of the world?

After watching Wall Street and the banking industry ward off serious reforms following the financial crisis, I wouldn't worry about the proposals of Sanders or any other Democrat if I were Crazed or mjvcaj.

After watching Wall Street and the banking industry ward off serious reforms following the financial crisis, I wouldn't worry about the proposals of Sanders or any other Democrat if I were Crazed or mjvcaj.

They were more than willing to write the loans and collect their fees, they just needed to have someplace to dump the notes

This business model is a particular problem for lenders and society. Banks have a finite amount of capital available to back the asset side of the balance sheets, so in order to continue to grow, banks have decided to try and push out the majority of mortgages originated and hold business loans on their balance sheet, since less capital is required in the typical comparison. Businesses also tend to be better customers than consumers, given their need for treasury services and stickier deposits.

The problem is, banks are not incentivized to prudently underwrite loans if they are able to offload the risk. Post-2008, I'm sure there are more clawback provisions in place, but the equity incentivize is not present. And it should be noted that when we say banks, I'm also including community and regional banks, of which many offload at least 50% of their mortgage originations.

Even worse are the mortgage originators, whom I despise (although I used one). Structured properly, the mortgage originator maintains limited assets available in the event of attempted clawbacks or legal action.

Conservative ideology insists that government must have pressured banks into the risky behavior that blew up the economy because such irresponsible behavior is unpossible in a free market. The problem is that this simply isn't what happened, as study after study has shown:Entirely? I don't know about "entirely" . . . but I can tell you that greed was the single most important, dominant, driving force behind the subprime crisis. Any reduced underwriting standards came in service to that greed, supported by the lie that securitizations would sufficiently mitigate the default risk.

BTW, as an historical aside, the company I worked for at the time securitized $50 million in what were considered subprime mortgages back in 1989 . . . or maybe 1990, I can't remember. They were, however, loans made with the intention of holding them in the company's investment portfolio, and only a cash crunch caused by the savings and loan slump in New England cause the holding company to consider the securitization . . . .

Did Fannie and Freddie buy high-risk mortgage-backed securities? Yes. But they did not buy enough of them to be blamed for the mortgage crisis. Highly respected analysts who have looked at these data..including the nonpartisan Government Accountability Office, the Harvard Joint Center for Housing Studies, the Financial Crisis Inquiry Commission majority, the Federal Housing Finance Agency, and virtually all academics, including the University of North Carolina, Glaeser et al at Harvard, and the St. Louis Federal Reserve [also here], have all rejected the Wallison/Pinto argument that federal affordable housing policies were responsible for the proliferation of actual high-risk mortgages over the past decade.

(To those studies I'd add this one, this one, this one, and this one, all done by analysts working at the Federal Reserve.)

It is very well understood -- except by conservative ideologues -- what caused the financial crisis. It had nothing to do with the US government pressuring banks to lend money to poor people. Banks made crazy loans here and elsewhere because the Giant Pool of Money's demand for mortgage-backed securities couldn't be satisfied with legitimate mortgages. Originators could sell obviously absurd loans to securitizers, who dumped them into investment trusts that compliant ratings agencies labeled AAA. Since everyone expected housing prices to keep rising forever, there was no apparent downside, so lending standards went to hell. Those seeking government villains should look to those who deregulated trading in commodities futures and in particular to these smug assholes.

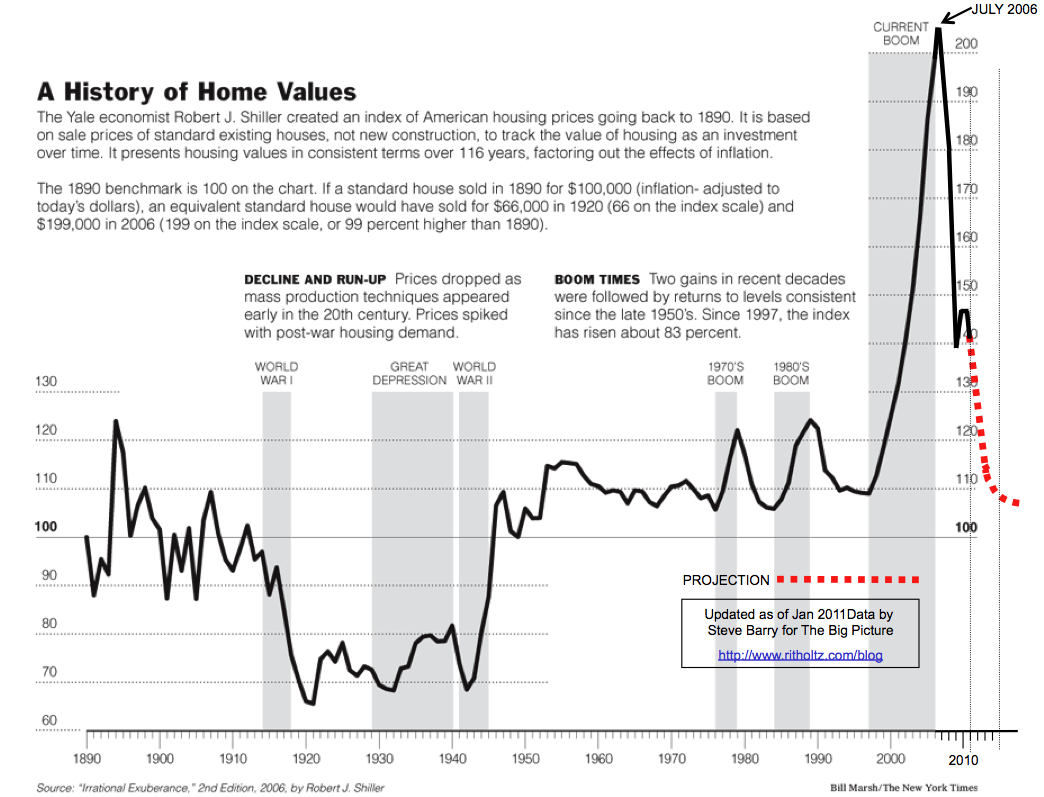

Here's what the historic 1997-2008 housing bubble looked like:Conservative ideology insists that government must have pressured banks into the risky behavior that blew up the economy because such irresponsible behavior is unpossible in a free market. The problem is that this simply isn't what happened, as study after study has shown:

Did Fannie and Freddie buy high-risk mortgage-backed securities? Yes. But they did not buy enough of them to be blamed for the mortgage crisis. Highly respected analysts who have looked at these data..including the nonpartisan Government Accountability Office, the Harvard Joint Center for Housing Studies, the Financial Crisis Inquiry Commission majority, the Federal Housing Finance Agency, and virtually all academics, including the University of North Carolina, Glaeser et al at Harvard, and the St. Louis Federal Reserve [also here], have all rejected the Wallison/Pinto argument that federal affordable housing policies were responsible for the proliferation of actual high-risk mortgages over the past decade.(To those studies I'd add this one, this one, this one, and this one, all done by analysts working at the Federal Reserve.)

It is very well understood -- except by conservative ideologues -- what caused the financial crisis. It had nothing to do with the US government pressuring banks to lend money to poor people. Banks made crazy loans here and elsewhere because the Giant Pool of Money's demand for mortgage-backed securities couldn't be satisfied with legitimate mortgages. Originators could sell obviously absurd loans to securitizers, who dumped them into investment trusts that compliant ratings agencies labeled AAA. Since everyone expected housing prices to keep rising forever, there was no apparent downside, so lending standards went to hell. Those seeking government villains should look to those who deregulated trading in commodities futures and in particular to these smug assholes.

Who can look at that ginormous spike and conclude it must have been government making banks loan money to poor people? When have we ever been so solicitous to poor people? It's astounding that the financial sector's rapacious greed could nearly bring down the global economy, and the conservative takeaway is that we should do less to help poor people.

This business model is a particular problem for lenders and society. Banks have a finite amount of capital available to back the asset side of the balance sheets, so in order to continue to grow, banks have decided to try and push out the majority of mortgages originated and hold business loans on their balance sheet, since less capital is required in the typical comparison. Businesses also tend to be better customers than consumers, given their need for treasury services and stickier deposits.

The problem is, banks are not incentivized to prudently underwrite loans if they are able to offload the risk. Post-2008, I'm sure there are more clawback provisions in place, but the equity incentivize is not present. And it should be noted that when we say banks, I'm also including community and regional banks, of which many offload at least 50% of their mortgage originations.

Even worse are the mortgage originators, whom I despise (although I used one). Structured properly, the mortgage originator maintains limited assets available in the event of attempted clawbacks or legal action.

But the banks only thought they were unloading the risk . . . in fact they were subject to the risk in the form of the warranties and repurchase obligations when individual loans went into default. The supposed spreading of risk by creating pools of loans was supposed to protect them, except that the statistical basis for calculating projected defaults and the risk of associated default losses didn't take into consideration the effect on real estate prices - and correspondingly the value of the entire pools' collateral. So when defaults came in droves, there wasn't enough of a real estate market to realize on the collateral - at all in many cases, much less in amounts sufficient to pay the securitization repurchase obligations - the banks went bust. That's what happened at Irwin Union, Washington Mutual, Countrywide, Wachovia, etc. . . .

As for capital requirements, this wikipedia article has a good explanation regarding the 2004 SEC net capital rule change was first thought to be a major contributing factor in the subprime collapse, but was later established not to have the effect that commenters first thought: https://en.wikipedia.org/wiki/Net_capital_rule

Mortgage brokers (so called "bird dogs") represent a significant problem . . . as do originators who don't hold their loans for any appreciable time.

Similar threads

- Replies

- 1

- Views

- 227

- Replies

- 2

- Views

- 129

- Replies

- 36

- Views

- 709

- Replies

- 11

- Views

- 373

ADVERTISEMENT

Latest posts

-

-

Report: Arizona transfer big man Oumar Ballo to visit Indiana

- Latest: Big Red Crimson Buffalo

-

-

-

Report: Transfer guards Tony Perkins, Connor Hickman on IU's radar

- Latest: Big Red Crimson Buffalo

ADVERTISEMENT