So Trumps "Beautiful" tax reform will give the middle class a break? Double the standard deduction for married couples to roughly 25k. Then, take away personal exemptions. (Net effect is roughly 17k paired from your taxable income.

If you never itemize your deductions you may come out ahead, slightly. But what if you can only defer 2.4k into your 401k? What if your itemized deductions and personal exemptions exceeded 25k. When you add up state and local taxes, which you can't itemize in the beautiful plan, along with mortgage interest and charitable giving, exceeding 25k is not a long shot.

Don't just look at the new standard deduction. Look at what you have to give up to get there. Consider also that he wants to raise the lowest tax bracket.

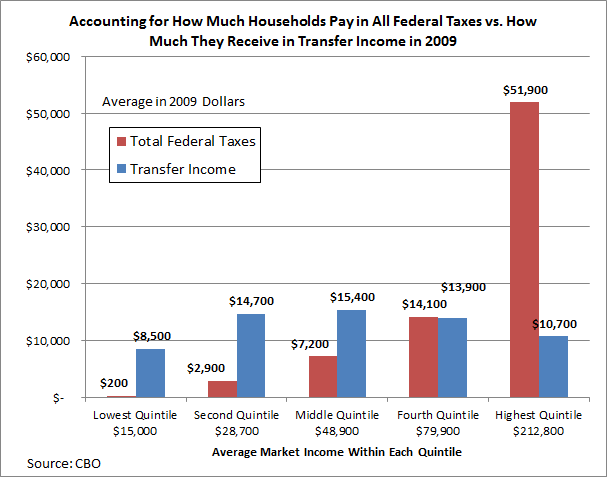

One thing you can be sure of. The middle class will pay for that increased standard deduction.

https://www.nytimes.com/2017/10/20/us/politics/republicans-tax-401-k.html

If you never itemize your deductions you may come out ahead, slightly. But what if you can only defer 2.4k into your 401k? What if your itemized deductions and personal exemptions exceeded 25k. When you add up state and local taxes, which you can't itemize in the beautiful plan, along with mortgage interest and charitable giving, exceeding 25k is not a long shot.

Don't just look at the new standard deduction. Look at what you have to give up to get there. Consider also that he wants to raise the lowest tax bracket.

One thing you can be sure of. The middle class will pay for that increased standard deduction.

https://www.nytimes.com/2017/10/20/us/politics/republicans-tax-401-k.html