I was reading an article in the USA Today about one the sharpest declines in wage growth history and one sentence stuck out to me as to why I can't stand reading bullet point main-stream-economist-media.

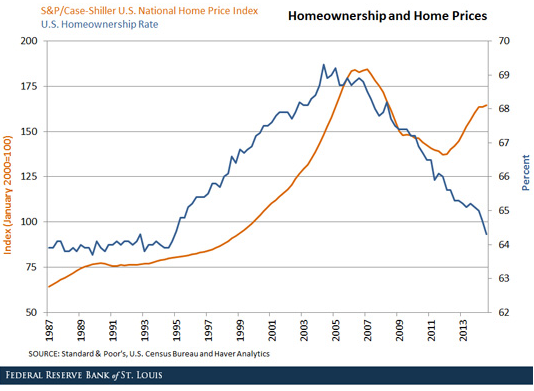

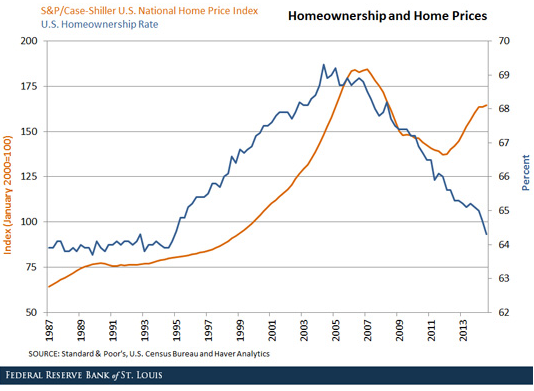

As bad economic indicators pile up, there are a few easy to understand measurables that show just howtUS homeownership has dropped to it's lowest levels since 1967. It's even worse for millenials, with an all-time record high of that generation living at home with their parents and a disproportionately higher unemployment rate.

Obviously during the housing boom, we over built or used up future housing growth, so the numbers needed to drop because there were people owning homes who couldn't afford them, it was an artificial market. And thus came a natural market correction. But with appropriate economic policy, by now the housing bust should have leveled off and prices should not be increasing. This also has the effect of increasing rents. No wonder millenials are living at home, they can't afford housing.

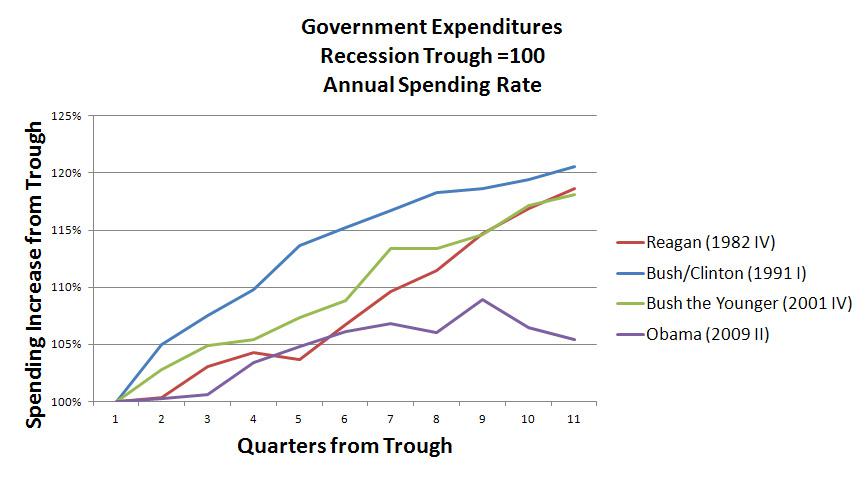

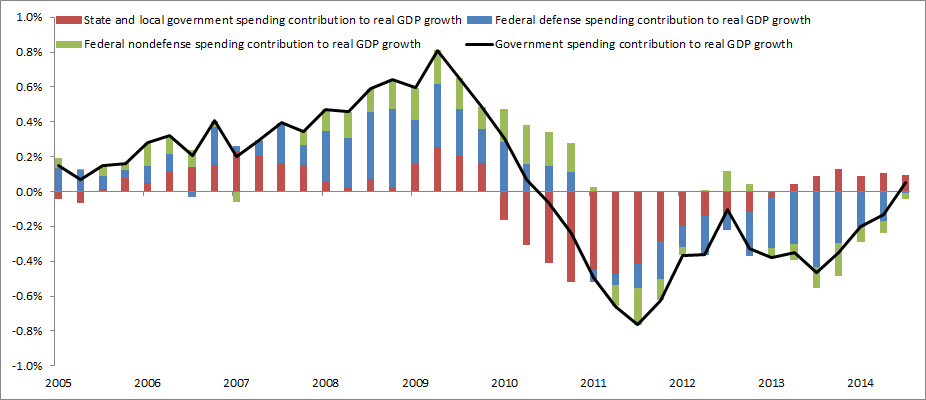

So 7 years into the Obama administration and 5 years into ZIRP and we've got no growth in housing but higher rents, falling wages, no middle class, and with that comes the obvious lack of consumer confidence.

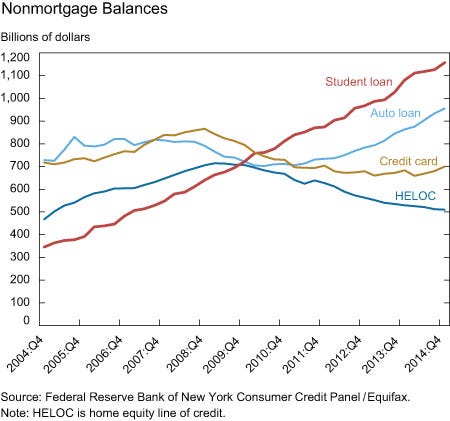

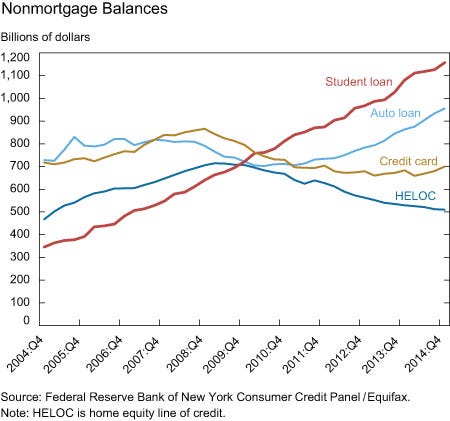

What's even scarier is the crushing $1.2T in student loan debt that will have to be repaid by millenials. Looking at this chart we see that student loan and auto loan debt is increasing and credit card is moving in that direction. The reality is we've still over borrowed as a consumer base and can't handle the debt service.

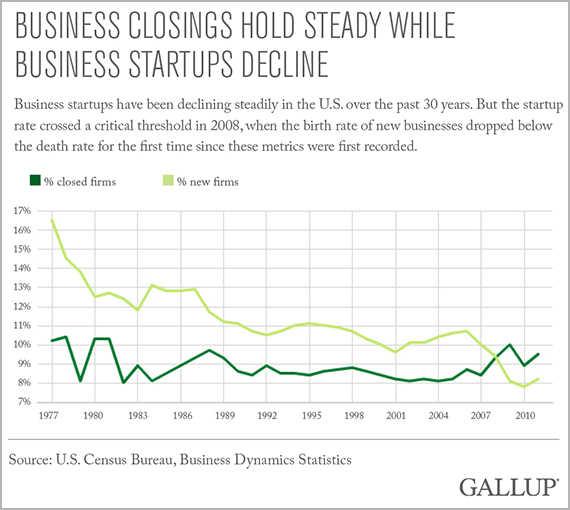

Naturally with no real long term well paying jobs with benefits being created there is nowhere for these new graduates to work and it won't be long before serious pressure is on Congress and a future President as to whether they should bailout these student loans and forgive them at taxpayer expense.

What's really troubling is the FED can't lower rates any more. They talk about a rate increase which is exactly what they should have done a while ago because ZIRP isn't working and it's punishing the savers and temporarily benefitting large corporations that inflate the stock market with stock buy backs. But there is no way the FED will increase rates anytime soon as they will come up with a multitude of excuses while also claiming the economy is in a recovery.

We should have had a lot more traction by now, instead we're coming down from a sugar high. This is going to be a lost decade if Congress doesn't get serious about job creation and small business and middle class friendly policies that create quality jobs. We also need a complete different course of direction from the FED. I can only hope our next President really understands how business works and how to create jobs.

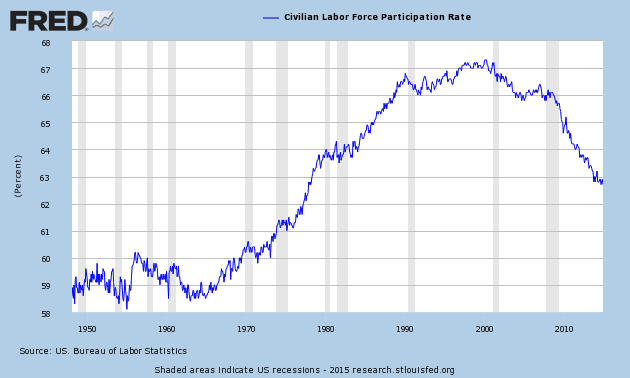

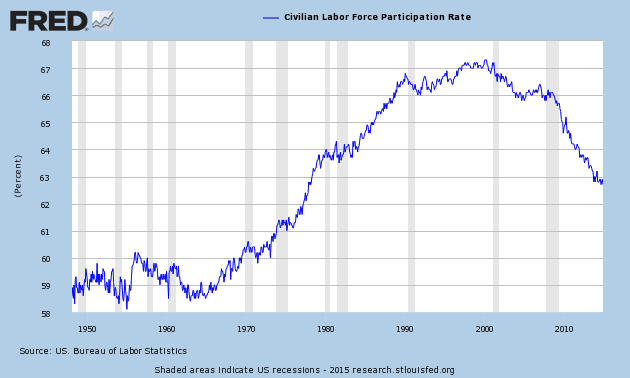

Economists have been puzzled by the failure of wages to rise at a faster pace despite a near-normal 5.3% unemployment rate and a shrinking pool of available workers.

A "near-normal 5.3% unemployment rate and a shrinking pool of available workers?" Are they kidding? We have 93,000,000 people out of the labor force, a number not seen since the Carter administration, making the unemployment rate number farcical.

As bad economic indicators pile up, there are a few easy to understand measurables that show just howtUS homeownership has dropped to it's lowest levels since 1967. It's even worse for millenials, with an all-time record high of that generation living at home with their parents and a disproportionately higher unemployment rate.

Obviously during the housing boom, we over built or used up future housing growth, so the numbers needed to drop because there were people owning homes who couldn't afford them, it was an artificial market. And thus came a natural market correction. But with appropriate economic policy, by now the housing bust should have leveled off and prices should not be increasing. This also has the effect of increasing rents. No wonder millenials are living at home, they can't afford housing.

So 7 years into the Obama administration and 5 years into ZIRP and we've got no growth in housing but higher rents, falling wages, no middle class, and with that comes the obvious lack of consumer confidence.

What's even scarier is the crushing $1.2T in student loan debt that will have to be repaid by millenials. Looking at this chart we see that student loan and auto loan debt is increasing and credit card is moving in that direction. The reality is we've still over borrowed as a consumer base and can't handle the debt service.

Naturally with no real long term well paying jobs with benefits being created there is nowhere for these new graduates to work and it won't be long before serious pressure is on Congress and a future President as to whether they should bailout these student loans and forgive them at taxpayer expense.

What's really troubling is the FED can't lower rates any more. They talk about a rate increase which is exactly what they should have done a while ago because ZIRP isn't working and it's punishing the savers and temporarily benefitting large corporations that inflate the stock market with stock buy backs. But there is no way the FED will increase rates anytime soon as they will come up with a multitude of excuses while also claiming the economy is in a recovery.

We should have had a lot more traction by now, instead we're coming down from a sugar high. This is going to be a lost decade if Congress doesn't get serious about job creation and small business and middle class friendly policies that create quality jobs. We also need a complete different course of direction from the FED. I can only hope our next President really understands how business works and how to create jobs.

Last edited: